CVS 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

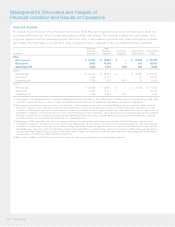

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

• The Federal Government’s Medicare Part D benefit is

increasing prescription utilization. However, it is also

decreasing our pharmacy gross profit rates as our higher

gross profit business (e.g., cash customers) continued to

migrate to Part D coverage during 2009.

• In 2005, the Deficit Reduction Act of 2005 (the “DRA”) was

signed into law by the President. The DRA sought to reduce

federal spending by altering the Medicaid reimbursement

formula for multi-source (i.e., generic) drugs. These changes

were expected to result in reduced Medicaid reimbursement

rates for retail pharmacies. During 2007, CMS issued a final

rule implementing provisions under the DRA regarding

prescription drugs under the Medicaid program. Among

other things, the rule defines Average Manufacturer Price

(“AMP”) and “best price,” and specifies the items that must

be included and excluded in the calculation of each (the

“AMP Rule”). In October 2008, approximately ten months

after the U.S. District Court for the District of Columbia

preliminarily enjoined CMS from implementing relevant

portions of the AMP Rule, CMS issued a rule, subject to

comment, which modified the definition of multiple source

drugs, a component of the AMP calculation. The proposed

rule seeks to address one of the legal challenges on which

the injunction was issued. However, opponents of this new

rule have asserted that the revised definition continues to be

inconsistent with the DRA. In the event health care reform

legislation is adopted, such legislation will likely include a

provision to correct the definitional issues with the AMP. As a

result of the previously mentioned, we cannot predict the

extent or timing of implementation of the AMP Rule, its effect

on Medicaid reimbursement or its impact on the Company.

• In conjunction with a recently approved class action settlement

with two entities that publish the AWP of pharmaceuticals, the

AWP for many brand-name and some generic prescription

drugs were reduced effective September 26, 2009. We have

reached understandings with most of our commercial third-

party payors where we participate as pharmacy providers to

adjust reimbursements to account for this change in methodol-

ogy, but most state Medicaid programs that utilize AWP as a

pricing reference have not taken action to make similar

adjustments. As a result, we expect reduced Medicaid reim-

bursement levels in fiscal 2010.

• Our pharmacy gross profit rates have been adversely

affected by the efforts of managed care organizations,

pharmacy benefit managers and governmental and other

third-party payors to reduce their prescription drug costs.

In the event this trend continues, we may not be able

to sustain our current rate of revenue growth and gross

profit dollars could be adversely impacted.

Gross profit, which includes net revenues less the cost of

merchandise sold during the reporting period and the related

purchasing costs, warehousing costs, delivery costs and actual

and estimated inventory losses, as a percentage of net revenues

was 30.0% in 2009. This compares to 30.1% in 2008 and 29.1%

in 2007.

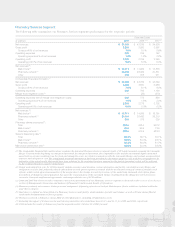

As you review our Retail Pharmacy segment’s performance

in this area, we believe you should consider the following

important information:

• Three fewer days in the 2009 fiscal year negatively impacted

gross profit by $123 million, compared to 2008.

• During 2009, our front-store revenues were 32.5% of total

revenues, compared to 32.5% and 32.2% in 2008 and 2007,

respectively. On average, our gross profit on front-store

revenues is higher than our average gross profit on phar-

macy revenues.

• During 2009, our front-store gross profit rate was negatively

impacted by increased sales of promotional related items,

which were partially offset by increases in private label

and proprietary brand product sales, which normally yield

a higher gross profit rate than other front-store products.

• During 2009 and 2008, our pharmacy gross profit rate

continued to benefit from an increase in generic drug

revenues, which normally yield a higher gross profit rate

than equivalent brand name drug revenues. However, the

increased use of generic drugs has augmented the efforts

of third-party payors to reduce reimbursement payments

to retail pharmacies for prescriptions. This trend, which

we expect to continue, reduces the benefit we realize

from brand to generic product conversions.

• Sales to customers covered by third-party insurance programs

have continued to increase and, thus, have become a larger

component of our total pharmacy business. On average, our

gross profit on third-party pharmacy revenues is lower than

our gross profit on cash pharmacy revenues. Third-party

pharmacy revenues were 96.9% of pharmacy revenues in 2009,

compared to 96.1% and 95.3% of pharmacy revenues in 2008

and 2007, respectively. We expect this trend to continue.

• Four additional days in the 2008 fiscal year increased gross

profit by $190 million, compared to 2007.

• During 2008, our front-store gross profit rate benefited from

improved product mix (including increases in private label

and proprietary brand product sales, which normally yield a

higher gross profit rate than other front-store products) and

benefits derived from our ExtraCare loyalty program.

• During 2008, our pharmacy gross profit rate continued to

benefit from a portion of the purchasing synergies resulting

from the Caremark Merger.

CVS Caremark

32