Berkshire Hathaway 1999 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

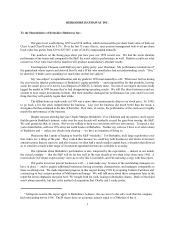

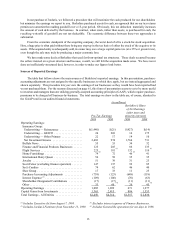

which means we were being paid for holding other people’s money. Indeed, our cumulative result through 1998 was an

underwriting profit. In 1999, however, we incurred a $1.4 billion underwriting loss that left us with float cost of 5.8%.

One mildly mitigating factor: We enthusiastically welcomed $400 million of the loss because it stems from business that

will deliver us exceptional float over the next decade. The balance of the loss, however, was decidedly unwelcome, and

our overall result must be judged extremely poor. Absent a mega-catastrophe, we expect float cost to fall in 2000, but

any decline will be tempered by our aggressive plans for GEICO, which we will discuss later.

There are a number of people who deserve credit for manufacturing so much “no-cost” float over the years.

Foremost is Ajit Jain. It’s simply impossible to overstate Ajit’s value to Berkshire: He has from scratch built a n

outstanding reinsurance business, which during his tenure has earned an underwriting profit and now holds $6.3 billion

of float.

In Ajit, we have an underwriter equipped with the intelligence to properly rate most risks; the realism to forget

about those he can’t evaluate; the courage to write huge policies when the premium is appropriate; and the discipline to

reject even the smallest risk when the premium is inadequate. It is rare to find a person possessing any one of these

talents. For one person to have them all is remarkable.

Since Ajit specializes in super-cat reinsurance, a line in which losses are infrequent but extremely large when they

occur, his business is sure to be far more volatile than most insurance operations. To date, we have benefitted from good

luck on this volatile book. Even so, Ajit’s achievements are truly extraordinary.

In a smaller but nevertheless important way, our “other primary” insurance operation has also added to Berkshire’s

intrinsic value. This collection of insurers has delivered a $192 million underwriting profit over the past five years while

supplying us with the float shown in the table. In the insurance world, results like this are uncommon, and for their feat

we thank Rod Eldred, Brad Kinstler, John Kizer, Don Towle and Don Wurster.

As I mentioned earlier, the General Re operation had an exceptionally poor underwriting year in 1999 (though

investment income left the company well in the black). Our business was extremely underpriced, both domestically and

internationally, a condition that is improving but not yet corrected. Over time, however, the company should develop

a growing amount of low-cost float. At both General Re and its Cologne subsidiary, incentive compensation plans are

now directly tied to the variables of float growth and cost of float, the same variables that determine value for owners.

Even though a reinsurer may have a tightly focused and rational compensation system, it cannot count on every

year coming up roses. Reinsurance is a highly volatile business, and neither General Re nor Ajit’s operation is immune

to bad pricing behavior in the industry. But General Re has the distribution , the underwriting skills, the culture, and

— with Berkshire’s backing — the fina ncial clout to become the world’s most profitable reinsurance company. Getting

there will take time, energy and discipline, but we have no doubt that Ron Ferguson and his crew can make it happen.

GEICO (1-800-847-7536 or GEICO.com)

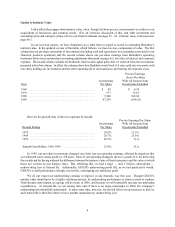

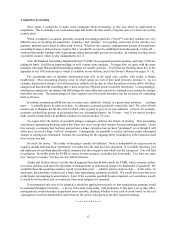

GEICO made exceptional progress in 1999. The reasons are simple: We have a terrific business idea being

implemented by an extraordinary manager, Tony Nicely. When Berkshire purchased GEICO at the beginning of 1996,

we handed the keys to Tony and asked him to run the operation exactly as if he owned 100% of it. He has done the rest.

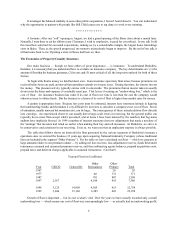

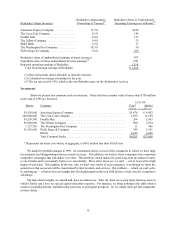

Take a look at his scorecard:

New Auto Auto Policies

Years Policies In-Force

(1)(2) (1)

1993 346,882 2,011,055

1994 384,217 2,147,549

1995 443,539 2,310,037

1996 592,300 2,543,699

1997 868,430 2,949,439

1998 1,249,875 3,562,644

1999 1,648,095 4,328,900

“Voluntary” only; excludes assigned risks and the like.

(1)

Revised to exclude policies moved from one GEICO company to another.

(2)