Berkshire Hathaway 1999 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

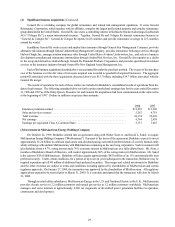

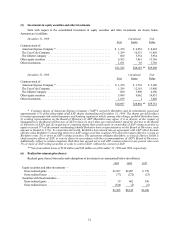

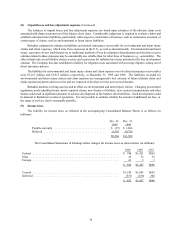

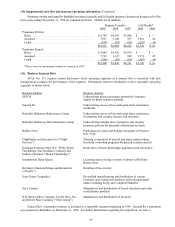

(10) Borrowings under investment agreements and other debt (Continued)

Other debt includes primarily commercial paper, revolving bank debt, and variable rate term bonds issued by a variety

of Berkshire subsidiaries and generally, may be redeemed at any time at the option of the issuing company.

No materially restrictive covenants are included in any of the various debt agreements. Payments of principal amounts

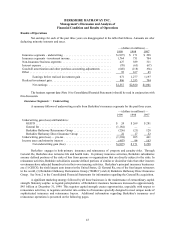

expected during the next five years are as follows (in millions):

2000 2001 2002 2003 2004

$522 $473 $ 28 $ 54 $ 18

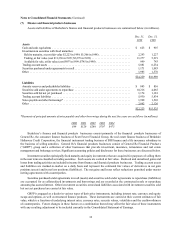

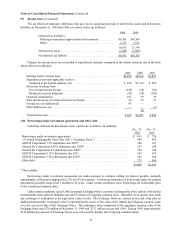

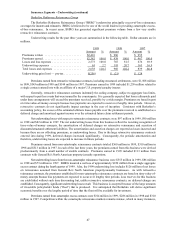

(11) Dividend restrictions - Insurance subsidiaries

Payments of dividends by insurance subsidiaries members are restricted by insurance statutes and regulations. Without

prior regulatory approval in 2000, Berkshire can receive up to approximately $4.2 billion as dividends from insurance

subsidiaries.

Combined shareholders' equity of U.S. based property/casualty insurance subsidiaries determined pursuant to statutory

accounting rules (Statutory Surplus as Regards Policyholders) was approximately $44.5 billion at December 31, 1999. This

amount differs from the corresponding amount determined on the basis of GAAP. The major differences between statutory

basis accounting and GAAP are that deferred income tax assets and liabilities, deferred charges-reinsurance assumed,

unrealized gains and losses on investments in securities with fixed maturities and goodwill of acquired businesses are

recognized under GAAP but not for statutory reporting purposes.

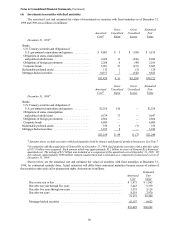

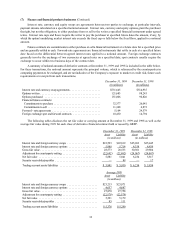

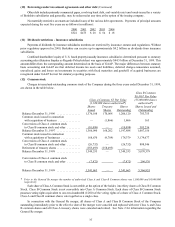

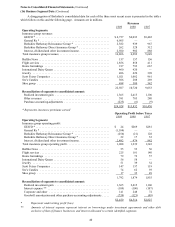

(12) Common stock

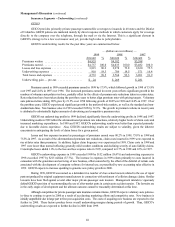

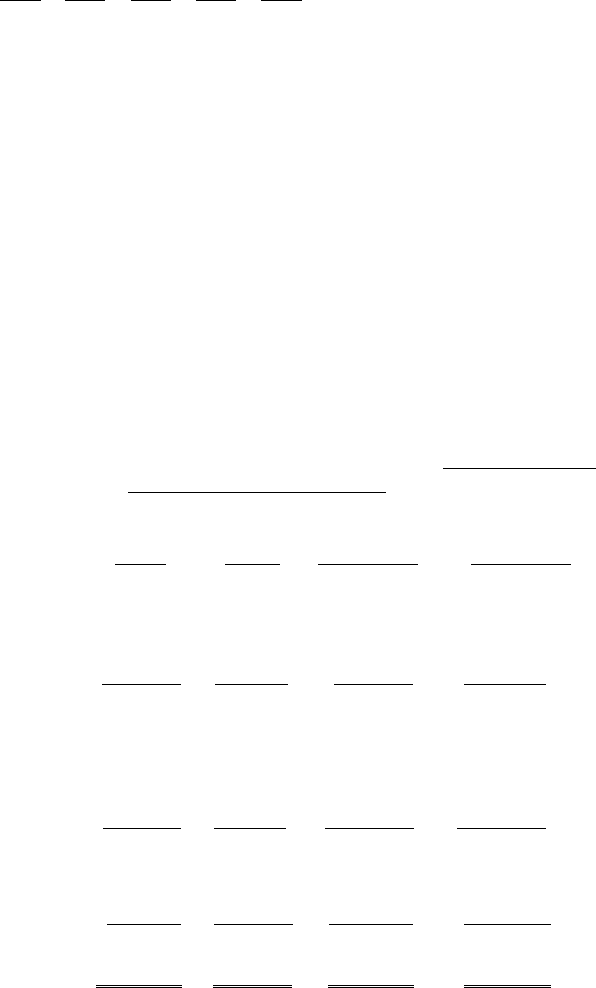

Changes in issued and outstanding common stock of the Company during the three years ended December 31, 1999,

are shown in the table below.

Class B Common

$0.1667 Par Value

Class A Common, $5 Par Value (55,000,000 shares

(1,650,000 shares authorized*) authorized*)

Shares Treasury Shares Shares Issued and

Issued Shares Outstanding Outstanding

Balance December 31, 1996 ................ 1,376,188 170,068 1,206,120 783,755

Common stock issued in connection

with acquisition of business ............... —(1,866) 1,866 165

Conversions of Class A common stock

to Class B common stock and other ......... (10,098) — (10,098) 303,236

Balance December 31, 1997 ................ 1,366,090 168,202 1,197,888 1,087,156

Common stock issued in connection

with acquisitions of businesses ............. 168,670 (9,709) 178,379 3,174,677

Conversions of Class A common stock

to Class B common stock and other ......... (26,732) —(26,732) 808,546

Retirement of treasury shares ................ (158,493)(158,493) — —

Balance December 31, 1998 ................ 1,349,535 — 1,349,535 5,070,379

Conversions of Class A common stock

to Class B common stock and other ......... (7,872) (7,872) 296,576

Balance December 31, 1999 ................ 1,341,663 — 1,341,663 5,366,955

*Prior to the General Re merger the number of authorized Class A and Class B Common shares was 1,500,000 and 50,000,000

respectively.

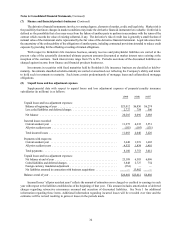

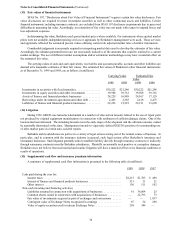

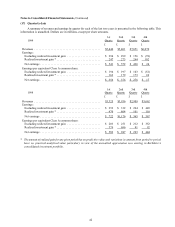

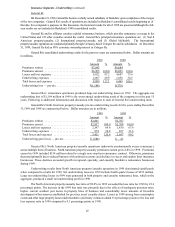

Each share of Class A Common Stock is convertible, at the option of the holder, into thirty shares of Class B Common

Stock. Class B Common Stock is not convertible into Class A Common Stock. Each share of Class B Common Stock

possesses voting rights equivalent to one-two-hundredth (1/200) of the voting rights of a share of Class A Common Stock.

Class A and Class B common shares vote together as a single class.

In connection with the General Re merger, all shares of Class A and Class B Common Stock of the Company

outstanding immediately prior to the effective date of the merger were canceled and replaced with new Class A and Class

B common shares and all Class A treasury shares were canceled and retired. See Note 2 for information regarding the

General Re merger.