Berkshire Hathaway 1999 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

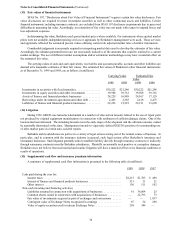

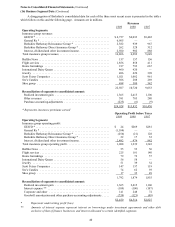

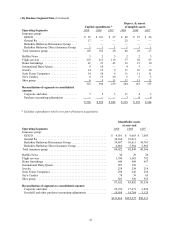

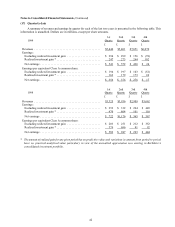

Notes to Consolidated Financial Statements (Continued)

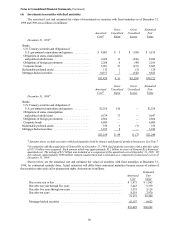

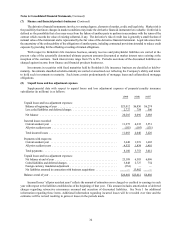

(16) Business Segment Data (Continued)

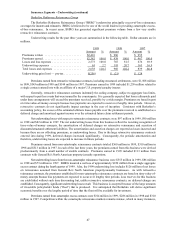

A disaggregation of Berkshire’s consolidated data for each of the three most recent years is presented in the table s

which follow on this and the following page. Amounts are in millions.

Revenues

1999 1998 1997

Operating Segments:

Insurance group revenues:

GEICO * ................................................. $ 4,757 $4,033 $3,482

General Re * .............................................. 6,905 — —

Berkshire Hathaway Reinsurance Group * ....................... 2,382 939 967

Berkshire Hathaway Direct Insurance Group * .................... 262 328 312

Interest, dividend and other investment income .................... 2,500 982 888

Total insurance group revenues ................................. 16,806 6,282 5,649

Buffalo News ............................................... 157 157 156

Flight services .............................................. 1,856 858 411

Home furnishings ........................................... 917 793 667

International Dairy Queen ..................................... 460 420 —

Jewelry ................................................... 486 420 398

Scott Fetzer Companies ....................................... 1,021 1,002 961

See’s Candies .............................................. 306 288 269

Shoe group ................................................ 498 500 542

22,507 10,720 9,053

Reconciliation of segments to consolidated amount:

Realized investment gain .................................... 1,365 2,415 1,106

Other revenues ............................................ 381 703 280

Purchase-accounting-adjustments .............................. (225) (6) (9)

$24,028 $13,832 $10,430

* Represents insurance premiums earned

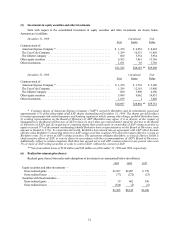

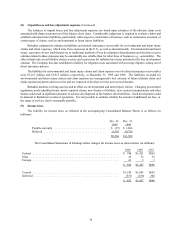

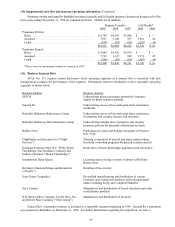

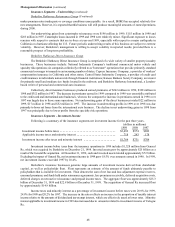

Operating Profit before Taxes

1999 1998 1997

Operating Segments:

Insurance group operating profit:

GEICO * ................................................. $ 24 $269 $281

General Re * .............................................. (1,184) — —

Berkshire Hathaway Reinsurance Group * ....................... (256) (21) 128

Berkshire Hathaway Direct Insurance Group * .................... 22 17 52

Interest, dividend and other investment income .................... 2,482 974 882

Total insurance group operating profit ............................ 1,088 1,239 1,343

Buffalo News ............................................... 55 53 56

Flight services .............................................. 225 181 140

Home furnishings ........................................... 79 72 57

International Dairy Queen ..................................... 56 58 —

Jewelry ................................................... 51 39 32

Scott Fetzer Companies ....................................... 147 137 119

See’s Candies .............................................. 74 62 59

Shoe group ................................................ 17 33 49

1,792 1,874 1,855

Reconciliation of segments to consolidated amount:

Realized investment gain .................................... 1,365 2,415 1,106

Interest expense ** ......................................... (109) (100) (107)

Corporate and other ........................................ 141 248 72

Goodwill amortization and other purchase-accounting-adjustments ..... (739) (123) (99)

$2,450 $4,314 $2,827

*Represents underwriting profit (loss)

** Amounts of interest expense represent interest on borrowings under investment agreements and other debt

exclusive of that of finance businesses and interest allocated to certain identified segments.