Berkshire Hathaway 1999 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Management's Discussion (continued)

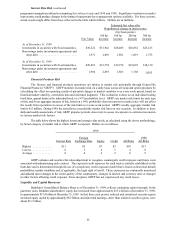

Insurance Segments - Underwriting (continued)

General Re (Continued)

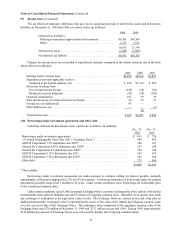

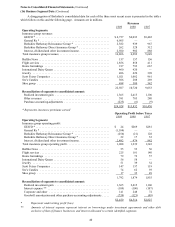

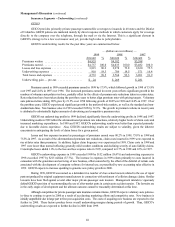

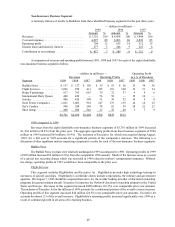

General Re’s International property/casualty underwriting results for years ending December 31,1999 and

1998 are summarized below. Dollar amounts are in millions.

1999 1998

Amount %Amount %

Premiums written ........................... $2,506 $2,072

Premiums earned ............................ $2,343 100.0 $2,095 100.0

Losses and loss expenses ...................... 2,041 87.1 1,514 72.3

Underwriting expenses ....................... 775 33.1 682 32.5

Total losses and expenses ..................... 2,816 120.2 2,196 104.8

Underwriting loss — pre-tax ................... $ (473)$ (101)

The International property/casualty operations write quota-share and excess reinsurance on risks around the world.

Earned premiums in 1999 exceeded premiums earned in 1998 by 11.8%. The increase was primarily due to business

produced by DP Mann, reduced levels of premiums ceded, including amounts ceded to General Re’s North America n

reinsurance operations and a large new contract involving motor business in Argentina. DP Mann is a Lloyd’s underwriting

manager that was acquired by General Re at the end of 1998.

General Re’s International property/casualty un derwriting results for 1999 were poor. Loss and loss expense ratios

for 1999 were 87.1% as compared to 72.3% for 1998. The increase in the 1999 loss ratio was mainly due to inadequate

premium rates, higher catastrophe losses and deteriorating results in the excess liability, motor and the Australian

professional indemnity lines of businesses. In addition, the motion picture film finance business experienced significant losses

in the fourth quarter of 1999. Losses from catastrophic events, including fourth quarter 1999 European winter storms,

earthquakes in Taiwan and Turkey and an Australian hailstorm, aggregated $126 million in 1999 or 5.4 loss ratio points,

compared to $28 million of catastrophic losses or 1.3 loss ratio points in 1998.

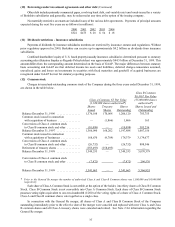

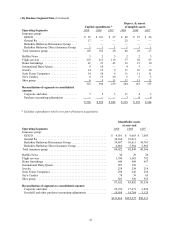

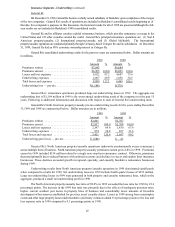

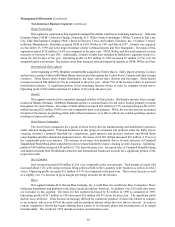

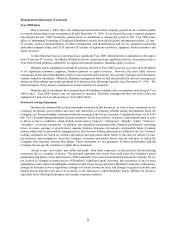

General Re’s Global life/health underwriting results for the years ending December 31,1999 and 1998 ar e

summarized below. Dollar amounts are in millions.

1999 1998

Amount %Amount %

Premiums written ............................ $1,736 $1,305

Premiums earned ............................. $1,725 100.0 $1,292 100.0

Losses and loss expenses ....................... 1,434 83.2 1,263 97.8

Underwriting expenses ........................ 418 24.2 319 24.6

Total losses and expenses ...................... 1,852 107.4 1,582 122.4

Underwriting loss — pre-tax .................... $ (127)$ (290)

General Re’s Global life/health affiliates reinsure such risks worldwide. The life business represente d

approximately 52% of the total life/health premiums in 1999 compared to about 63% in 1998. Global life/health

premiums earned increased 33.6% in 1999 over 1998. The increase was principally related to higher premiums earned

in connection with the run off of health lines written by a former London agent of Cologne Re’s U.S. subsidiar y

(“GCL” formerly “CLR”) and growth from several new contracts written in the U.S. individual and group health

markets.

The Global life/health net underwriting losses in 1999 and 1998 were principally attributed to the health

business. In both 1999 and 1998, the life business produced modest underwriting profits although mortality experience

in the individual life business worsened in 1999. The unsatisfactory underwriting experience in the group health

business in 1999 reflected increases in GCL’s health claim reserves that resulted from a comprehensive revie w

conducted during the first half of 1999. Prior to the merger with Berkshire in 1998, a loss provision of $275 million

was established on GCL’s portion of a pool of workers’ compensation carve-o ut business written by the former London-

based managing underwriter. After considering settlements negotiated by other parties involved in this business and

actuarial reviews of other available loss information, management concluded that no change to the reserve was

warranted for 1999.