Berkshire Hathaway 1999 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.9

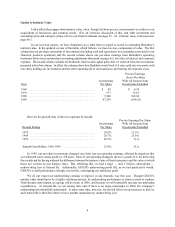

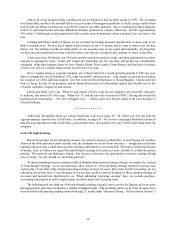

we will incur for sales counselors, communications and facilities, are optional outlays we choose to make so that we

can both achieve significant growth and extend and solidify the promise of the GEICO brand in the minds of Americans.

Personally, I think these expenditures are the best investment Berkshire can make. Through its advertising,

GEICO is acquiring a direct relationship with a huge number of households that, on average, will send us $1,100 year

after year. That makes us — among all companies, selling whatever kind of product — one of the country’s leading

direct merchandisers. Also, as we build our long-term relationships with more and more families, cash is pouring in

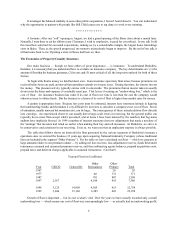

rather than going out (no Internet economics here). Last year, as GEICO increased its customer base by 766,256, it

gained $590 million of cash from operating earnings and the increase in float.

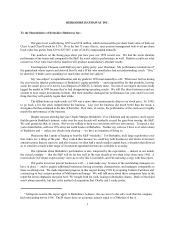

In the past three years, we have increased our market share in personal auto insurance from 2.7% to 4.1%. But

we rightfully belong in many more households — maybe even yours. Give us a call and find out. About 40% of those

people checking our rates find that they can save money by doing business with us. The proportion is not 100% because

insurers differ in their underwriting judgments, with some giving more credit than we do to drivers who live in certain

geographic areas or work at certain occupations. Our closure rate indicates, however, that we more frequently offer the

low price than does any other national carrier selling insurance to all comers. Furthermore, in 40 states we can offer

a special discount — usually 8% — to our shareholders. Just be sure to identify yourself as a Berkshire owner so that

our sales counselor can make the appropriate adjustment.

* * * * * * * * * * * *

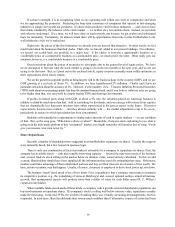

It’s with sadness t hat I report to you that Lorimer Davidson, GEICO’s former Chairman, died last November, a

few days after his 97 birthday. For GEICO, Davy was a business giant who moved the company up to the big leagues.

th

For me, he was a friend, teacher and hero. I have told you of his lifelong kindnesses to me in past reports. Clearly, my

life would have developed far differently had he not been a part of it. Tony, Lou Simpson and I visited Davy in August

and marveled at his mental alertness — particularly in all matters regarding GEICO. He was the company’s number

one supporter right up to the end, and we will forever miss him.

Aviation Services

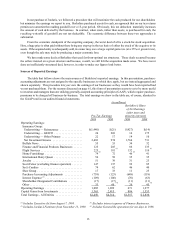

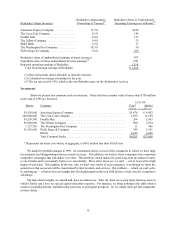

Our two aviation services companies — FlightSafety International (“FSI”) and Executive Jet Aviation (“EJA”)

— are both runaway leaders in their field. EJA, which sells and manages the fractional ownership of jet aircraft,

through its NetJets® program, is larger than its next two competitors combined. FSI trains pilots (as well as other

transportation professionals) and is five times or so the size of its nearest competitor.

Another common characteristic of the companies is that they are still managed by their founding entrepreneurs.

Al Ueltschi started FSI in 1951 with $10,000, and Rich Santulli invented the fractional-ownership industry in 1986.

These men are both remarkable managers who have no financial need to work but thrive on helping their companies

grow and excel.

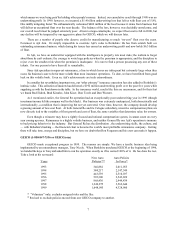

Though these two businesses have leadership positions that are similar, they differ in their economic

characteristics. FSI must lay out huge amounts of capital. A single flight simulator can cost as much as $15 million

— and we have 222. Only one person at a time, furthermore, can be trained in a simulator, which means that the capital

investment per dollar of revenue at FSI is exceptionally high. Operating margins must therefore also be high, if we are

to earn a reasonable return on capital. Last year we made capital expenditures of $215 million at FSI and FlightSafety

Boeing, its 50%-owned affiliate.

At EJA, in contrast, the customer owns the equipment, though we, of course, must invest in a core fleet of our own

planes to ensure outstanding service. For example, the Sunday after Thanksgiving, EJA’s busiest day of the year, strains

our resources since fractions of 169 planes are owned by 1,412 customers, many of whom are bent on flying home

between 3 and 6 p.m. On that day, and certain others, we need a supply of company-owned aircraft to make sure all

parties get where they want, when they want.

Still, most of the planes we fly are owned by customers, which means that modest pre-tax margins in this business

can produce good returns on equity. Currently, our customers own planes worth over $2 billion, and in addition we have

$4.2 billion of planes on order. Indeed, the limiting factor in our business right now is the availability of planes. We