Berkshire Hathaway 1999 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Management's Discussion (continued)

Insurance Segments - Underwriting (continued)

GEICO

GEICO provides primarily private passenger automobile coverages to insureds in 48 states and the District

of Columbia. GEICO policies are marketed mainly by direct response methods in which customers apply for coverage

directly to the company over the telephone, through the mail or via the Internet. This is a significant element in

GEICO’s strategy to be a low cost insurer and, yet, provide high value to policyholders.

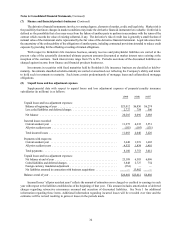

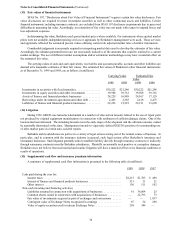

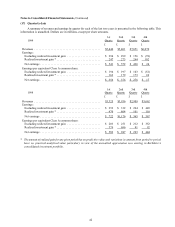

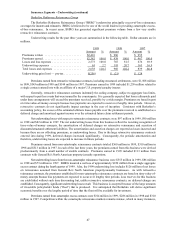

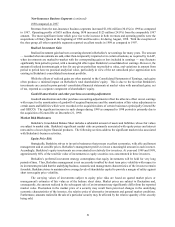

GEICO's underwriting results for the past three years are summarized below.

— (dollars are in millions) —

1999 1998 1997

Amount %Amount %Amount %

Premiums written ......................... $4,953 $4,182 $3,588

Premiums earned .......................... $4,757 100.0 $4,033 100.0 $3,482 100.0

Losses and loss expenses .................... 3,815 80.2 2,978 73.8 2,630 75.5

Underwriting expenses ..................... 918 19.3 786 19.5 571 16.4

Total losses and expenses ................... 4,733 99.5 3,764 93.3 3,201 91.9

Underwriting gain — pre-tax ................ $ 24 $ 269 $ 281

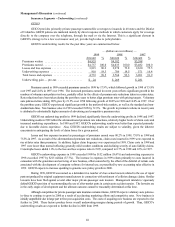

Premiums earned in 1999 exceeded premiums earned in 1998 by 17.9%, which followed growth in 1998 of 15.8%

over 1997 and 12.6% in 1997 over 1996. The increased premiums earned in recent years reflects significant growth in the

numbers of voluntary auto policies-in-force, partially offset by the effects of premium rate reductions taken in certain states.

Rate reductions have been taken during the past three years to better align premium rates with pricing targets. Voluntary

auto policies-in-force during 1999 grew by 21.5% over 1998 following growth of 20.8% in 1998 and 16.0% in 1997. Over

the past three years, GEICO experienced significant growth in the preferred-risk markets, as well as the standard and non-

standard auto lines. New business sales in 1999 exceeded 1998 by 31.9%. The growth in premium volume in recent years

is attributed to substantially higher amounts of advertising and competitive premium rates.

GEICO’s net underwri ting profits in 1999 declined significantly from the underwriting profits in 1998 and 1997.

Underwriting results in 1999 reflect the aforementioned premium rate reductions, relatively higher levels of claim costs and

increased marketing expenditures. In 1998 and 1997, GEICO’s underwriting results were better than expected primarily

due to favorable claims experience. Also, GEICO’s underwriting results are subject to volatility, given the inheren t

uncertainty in anticipating the levels of claim losses for a given period.

Losses and loss expenses incurred as percentages of premiums earned were 80.2% in 1999, 73.8% in 1998 and

75.5% in 1997. As a result of the aforementioned premium rate reductions, claim costs incurred in 1999 were expected to

rise at faster rates than premiums. In addition, higher claim frequency was experienced in 1999. Claim costs in 1998 and

1997 were lower than normal reflecting generally mild weather conditions and declining severity of auto liability claims.

Catastrophe losses added 1.0% to the loss and loss expense ratio in 1999, compared to 0.7% in 1998 and 0.3% in 1997.

GEICO’s underwriting expenses in 1999 exceeded 1998 by $132 million (16.8%) and underwriting expenses in

1998 exceeded 1997 by $215 million (37.7%). The increase in expenses in 1999 relates primarily to costs incurred in

connection with the generation and servicing of new business, offset somewhat by the effect of the deferral of certain costs

associated with the development of computer software for internal use, as prescribed by new accounting rules effective in

1999. GEICO expects to increase spending to generate new policy growth in 2000.

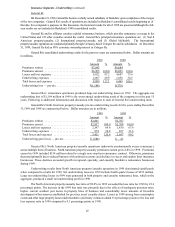

During 1999, GEICO was named as a defendant in a number of class action lawsuits related to the use of repair

parts not produced by original equipment manufacturers in connection with settlement of collision damage claims. Similar

lawsuits have been filed against several other major private-passenger auto insurers. Management intends to vigorously

defend GEICO’s pos ition of recommending the use of after-market parts in certain auto accident repairs. The lawsuits are

in the early stages of development and the ultimate outcome cannot be reasonably determined at this time.

Although competition for private passenger auto insurance remains intense, GEICO expects voluntary auto policies-

in-force to continue to grow in 2000 as a result of accelerating marketing efforts and competitive rates. New business is

initially unprofitable due in large part to first year acquisition costs. The costs of acquiring new business are expected to rise

further in 2000. These factors produce lower overall underwriting margins during periods of growth. Thus, GEICO’ s

underwriting results are expected to further decline in 2000 from 1999.