Berkshire Hathaway 1999 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

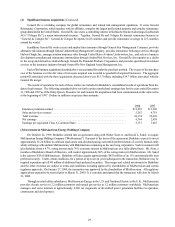

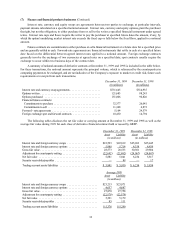

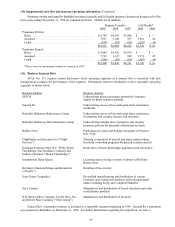

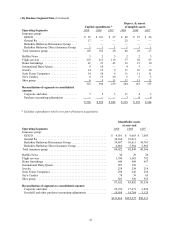

(15) Supplemental cash flow and insurance premium information (Continued)

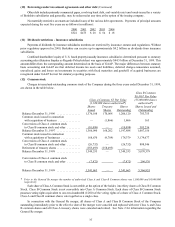

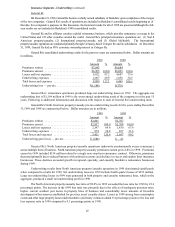

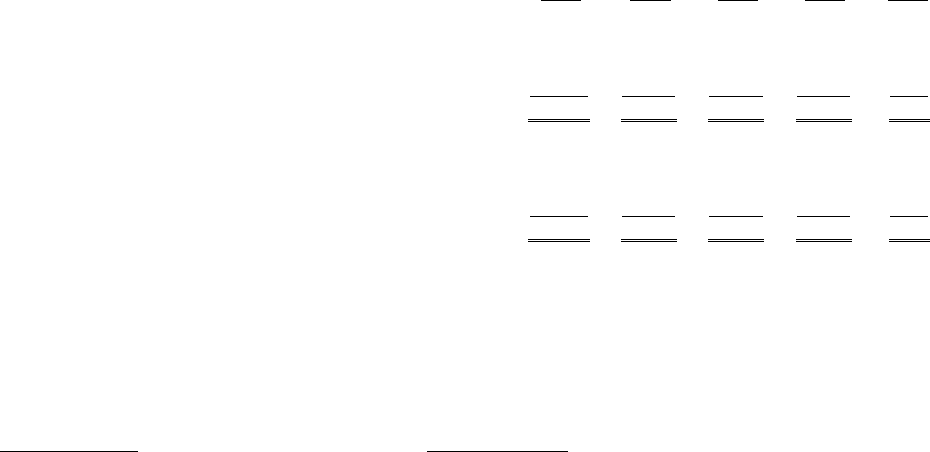

Premiums written and earned by Berkshire’s pr operty/casualty and life/health insurance businesses during each of the

three years ending December 31, 1999 are summarized below. Dollars are in millions.

Property/Casualty Life/Health*

1999 1998 1997 1999 1998

Premiums Written:

Direct ........................................ $ 5,798 $4,503 $3,980 $ — $ —

Assumed ...................................... 7,951 1,184 957 1,981 46

Ceded ........................................ (818) (83) (85) (245) (5)

$12,931 $5,604 $4,852 $1,736 $ 41

Premiums Earned:

Direct ........................................ $ 5,606 $4,382 $3,879 $ — $ —

Assumed ...................................... 7,762 1,147 968 1,971 45

Ceded ........................................ (788) (89) (86) (245) (4)

$12,580 $5,440 $4,761 $1,726 $ 41

*There were no premiums written or earned in 1997.

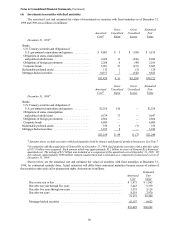

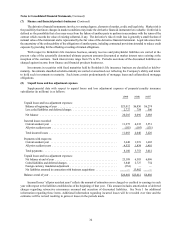

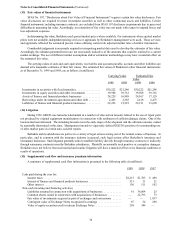

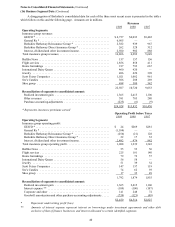

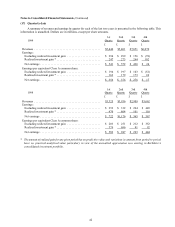

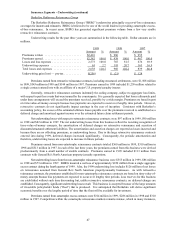

(16) Business Segment Data

SFAS No. 131 requires certain disclosures about operating segments in a manner that is consistent with how

management evaluates the performance of the segment. Information related to Berkshire’s twelve reportable operatin g

segments is shown below.

Business Identity Business Activity

GEICO Underwriting private passenger automobile insurance

mainly by direct response methods

General Re Underwriting excess-of-loss and quota-share reinsurance

worldwide

Berkshire Hathaway Reinsurance Group Underwriting excess-of-loss and quota-share reinsurance

for property and casualty insurers and reinsurers

Berkshire Hathaway Direct Insurance Group Underwriting multiple lines of property and casualty

insurance policies for primarily commercial accounts

Buffalo News Publication of a daily and Sunday newspaper in Western

New York

FlightSafety and Executive Jet (“Flight Training to operators of aircraft and ships and providing

Services”) fractional ownership programs for general aviation aircraft

Nebraska Furniture Mart, R.C. Willey Home Retail sales of home furnishings, appliances and electronics

Furnishings, Star Furniture Company and

Jordan’s Furniture (“Home Furnishings”)

International Dairy Queen Licensing and servicing a system of almost 6,000 Dairy

Queen stores

Helzberg’s Diamond Shops and Borsheim’s Retailing of fine jewelry

(“Jewelry”)

Scott Fetzer Companies Diversified manufacturing and distribution of various

consumer and commercial products with principal brand

names including Kirby and Campbell Hausfeld

See’s Candies Manufacture and distribution of boxed chocolates and other

confectionery products

H.H. Brown Shoe Company, Lowell Shoe, Inc. Manufacture and distribution of footwear

and Dexter Shoe Company (“Shoe Group”)

General Re’s reinsurance business is included as a reportable segment beginning in 1999. General Re Corporation

was acquired by Berkshire on December 21, 1998. For further information regarding the acquisition, see Note 2.