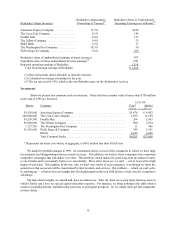

Berkshire Hathaway 1999 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17

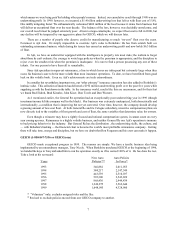

pursued. Indeed, during the 1970s (and, spasmodically, for some years thereafter) we searched for companies that were

large repurchasers of their shares. This often was a tipoff that the company was both undervalued and run by a

shareholder-oriented management.

That day is past. Now, repurchases are all the rage, but are all too often made for an unstated and, in our view,

ignoble reason: to pump or support the stock price. The shareholder who chooses to sell today, of course, is benefitted

by any buyer, whatever his origin or motives. But the continuing shareholder is penalized by repurchases above intrinsic

value. Buying dollar bills for $1.10 is not good business for those who stick around.

Charlie and I admit that we feel confident in estimating intrinsic value for only a portion of traded equities and

then only when we employ a range of values, rather than some pseudo-precise figure. Nevertheless, it appears to us that

many companies now making repurchases are overpaying departing shareholders at the expense of those who stay. In

defense of those companies, I would say that it is natural for CEOs to be optimistic about their own businesses. They

also know a whole lot more about them than I do. However, I can’t help but feel that too often today’s repurchases are

dictated by management’s desire to “show confidence” or be in fashion rather than by a desire to enhance per-shar e

value.

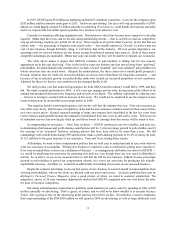

Sometimes, too, companies say they are repurchasing shares to offset the shares issued when stock options granted

at much lower prices are exercised. This “buy high, sell low” strategy is one many unfortunate investors have employed

— but never intentionally! Managements, however, seem to follow this perverse activity very cheerfully.

Of course, both option grants and repurchases may make sense — but if that’s the case, it’s not because the two

activities are logically related. Rationally, a company’s decision to repurchase shares or to issue them should stand on

its own feet. Just because stock has been issued to satisfy options — or for any other reason — does not mean that stock

should be repurchased at a price above intrinsic value. Correspondingly, a stock that sells well below intrinsic value

should be repurchased whether or not stock has previously been issued (or may be because of outstanding options).

You should be aware that, at certain times in the past, I have erred in not making repurchases. My appraisal of

Berkshire’s value was then too conservative or I was too enthused about some alternative use of funds. We have

therefore missed some opportunities — though Berkshire’s trading volume at these points was too light for us to have

done much buying, which means that the gain in our per-share value would have been minimal. (A repurchase of, say,

2% of a company’s shares at a 25% discount from per-share intrinsic value produces only a ½% gain in that value at

most — and even less if the funds could alternatively have been deployed in value-building moves.)

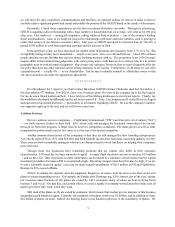

Some of the letters we’ve received clearly imply that the writ er is unconcerned about intrinsic value considerations

but instead wants us to trumpet an intention to repurchase so that the stock will rise (or quit going down). If the writer

wants to sell tomorrow, his thinking makes sense — for him! — but if he intends to hold, he should instead hope the

stock falls and trades in enough volume for us to buy a lot of it. That’s the only way a repurchase program can have

any real benefit for a continuing shareholder.

We will not repurchase shares unless we believe Berkshire stock is selling well below intrinsic value,

conservatively calculated. Nor will we attempt to talk the stock up or down. (Neither publicly or privately have I ever

told anyone to buy or sell Berkshire shares.) Instead we will give all shareholders — and potential shareholders — the

same valuation-related information we would wish to have if our positions were reversed.

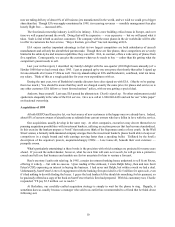

Recently, when the A shares fell below $45,000, we considered making repurchases. We decided, however, to

delay buying, if indeed we elect to do any, until shareholders have had the chance to review this report. If we do find

that repurchases make sense, we will only rarely place bids on the New York Stock Exchange (“NYSE”). Instead, we

will respond to offers made directly to us at or below the NYSE bid. If you wish to offer stock, have your broker call

Mark Millard at 402-346-1400. When a trade occurs, the broker can either record it in the “third market” or on the

NYSE. We will favor purchase of the B shares if they are selling at more than a 2% discount to the A. We will not

engage in transactions involving fewer than 10 shares of A or 50 shares of B.

Please be clear about one point: We will never make purchases with the intention of stemming a decline in

Berkshire’s price. Rather we will make them if and when we believe that they represent an attractive use of the

Company’s money. At best, repurchases are likely to have only a very minor effect on the future rate of gain in our

stock’s intrinsic value.