Berkshire Hathaway 1999 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.11

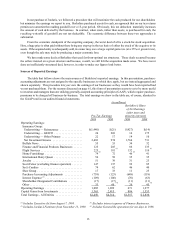

Which brings us to the furniture business. Two years ago I recounted how the acquisition of Nebraska Furniture

Mart in 1983 and my subsequent association with the Blumkin family led to follow-on transactions with R. C. Willey

(1995) and Star Furniture (1997). For me, these relationships have all been terrific. Not only did Berkshire acquire

three outstanding retailers; these deals also allowed me to become friends with some of the finest people you will ever

meet.

Naturally, I have persistently asked the Blumkins, Bill Child and Melvyn Wolff whether there are any more out

there like you. Their invariable answer was the Tatelman brothers of New England and their remarkable furniture

business, Jordan’s.

I met Barry and Eliot Tatelman last year and we soon signed an agreement for Berkshire to acquire the company.

Like our three previous furniture acquisitions, this business had long been in the family — in this case since 1927, when

Barry and Eliot’s grandfather began operations in a Boston suburb. Under the brothers’ management, Jordan’s ha s

grown ever more dominant in its region, becoming the largest furniture retailer in New Hampshire as well as

Massachusetts.

The Tatelmans don’t just sell furniture or manage stores. They also present customers with a dazzlin g

entertainment experience called “shoppertainment.” A family visiting a store can have a terrific time, while

concurrently viewing an extraordinary selection of merchandise. The business results are also extraordinary: Jordan’s

has the highest sales per square foot of any major furniture operation in the country. I urge you to visit one of their

stores if you are in the Boston area — particularly the one at Natick, which is Jordan’s newest. Bring money.

Barry and Eliot are classy people — just like their counterparts at Berkshire’s three other furniture operations.

When they sold to us, they elected to give each of their employees at least 50¢ for every hour that he or she had worked

for Jordan’s. This payment added up to $9 million, which came from the Tate lmans’ own pockets, not from Berkshire’s.

And Barry and Eliot were thrilled to write the checks.

Each of our furniture operations is number one in its territory. We now sell more furniture than anyone else in

Massachusetts, New Hampshire, Texas, Nebraska, Utah and Idaho. Last year Star’s Melvyn Wolff and his sister, Shirley

Toomim, scored two major successes: a move into San Antonio and a significant enlargement of Star’s store in Austin.

There’s no operation in the furniture retail ing business remotely like the one assembled by Berkshire. It’s fun for

me and profitable for you. W. C. Fields once said, “It was a woman who drove me to drink, but unfortunately I never

had the chance to thank her.” I don’t want to make that mistake. My thanks go to Louie, Ron and Irv Blumkin for

getting me started in the furniture business and for unerringly guiding me as we have assembled the group we now have.

* * * * * * * * * * * *

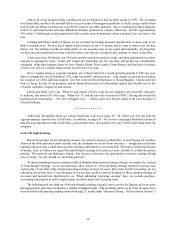

Now, for our second acquisition deal: It came to us through my good friend, Walter Scott, Jr., chairman of Level

3 Communications and a director of Berkshire. Walter has many other business connections as well, and one of them

is with MidAmerican Energy, a utility company in which he has substantial holdings and on whose board he sits. At

a conference in California that we both attended last September, Walter casually asked me whether Berkshire might be

interested in making a large investment in MidAmerican, and from the start the idea of being in partnership with Walter

struck me as a good one. Upon returning to Omaha, I read some of MidAmerican’s public reports and had two short

meetings with Walter and David Sokol, MidAmerican’s talented and entrepreneurial CEO. I then said that, at a n

appropriate price, we would indeed like to make a deal.

Acquisitions in the electric utility industry are complicated by a variety of regulations including the Public Utility

Holding Company Act of 1935. Therefore, we had to structure a transaction that would avoid Berkshire gaining voting

control. Instead we are purchasing an 11% fixed-income security, along with a combination of common stock and

exchangeable preferred that will give Berkshire just under 10% of the voting power of MidAmerican but about 76% of

the equity interest. All told, our investment will be about $2 billion.

Walter characteristically backed up his convictions with real money: He and his family will buy more

MidAmerican stock for cash when the transaction closes, bringing their total investment to about $280 million. Walter

will also be the controlling shareholder of the company, and I can’t think of a better person to hold that post.

Though there are many regulatory constraints in the utility industry, it’s possible that we will make additiona l

commitments in the field. If we do, the amounts involved could be large.