Berkshire Hathaway 1999 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

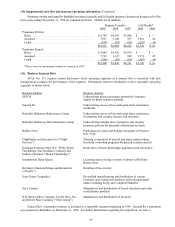

Insurance Segments - Underwriting (continued)

Berkshire Hathaway Reinsurance Group

The Berkshire Hathaway Reinsurance Group (“BHRG”) underwrites principally excess-of-loss reinsurance

coverages for insurers and reinsurers. BHRG is believed to be one of the world leaders in providing catastrophe excess-

of-loss reinsurance. In recent years, BHRG has generated significant premium volume from a few very sizable

retroactive reinsurance contracts.

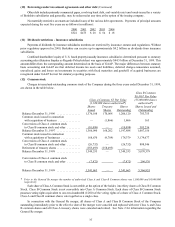

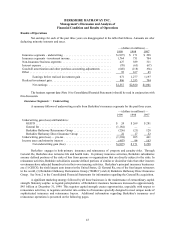

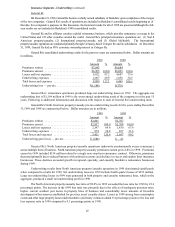

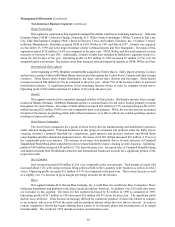

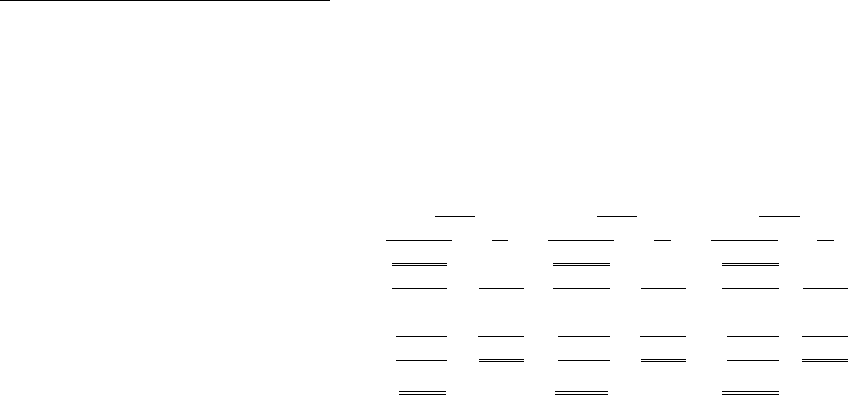

Underwriting results for the past three years are summarized in the following table. Dollar amounts are in

millions.

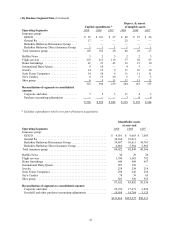

1999 1998 1997

Amount %Amount %Amount %

Premiums written ........................ $2,410 $ 986 $ 955

Premiums earned ......................... $2,382 100.0 $ 939 100.0 $ 967 100.0

Losses and loss expenses ................... 2,573 108.0 765 81.5 676 69.9

Underwriting expenses .................... 65 2.7 195 20.7 163 16.9

Total losses and expenses .................. 2,638 110.7 960 102.2 839 86.8

Underwriting gain (loss) — pre-tax ........... $(256)$ (21)$ 128

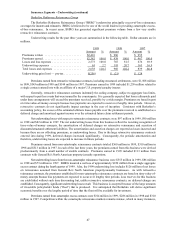

Premiums earned from retroactive reinsurance contracts, including structured settlements, were $1,508 million

in 1999, $343 million in 1998 and $144 million in 1997. Premiums earned in 1999 included $1,250 million related to

a single contact entered into with an affiliate of a major U.S. property/casualty insurer.

Generally, retroactive reinsurance contracts indemnify the ceding company, subject to aggregate loss limits,

with respect to past loss events that were insured by the counterparty. It is generally expected that losses ultimately paid

under these arrangements will exceed the premiums received, possibly by a wide margin. Premiums are based in part

on time-value-of-money concepts because loss payments are expected to occur over lengthy time periods. However,

retroactive contracts do not significantly impact earnings in the year of inception. Consistent with Berkshire’ s

accounting policy, the excess of the estimated ultimate losses payable over the premiums received is established as a

deferred charge and amortized against income over the estimated future claim settlement periods.

Net underwriting losses with respect to retroactive reinsurance contracts were $97 million in 1999, $90 million

in 1998 and $82 million in 1997. The net underwriting losses from this business reflect the recurring recognition of

time-value-of-money concepts, the amortization of deferred charges on retroactive reinsurance and accretion of

discounted structured settlement liabilities. The amortization and accretion charges are reported as losses incurred and

because there are no offsetting premiums, as underwriting losses. Due to the large retroactive reinsurance contracts

entered into during 1999, deferred charges increased significantly. Consequently, the periodic amortization and

therefore, underwriting losses are expected to increase in future periods.

Premiums earned from non-catastrophe reinsurance contracts totaled $560 million in 1999, $310 million in

1998 and $513 million in 1997. In each of the last three years, the premiums earned from this business were derived

predominantly from a small number of sizable contracts. Premiums earned in 1999 included $113 million from

contracts with General Re’s North American property/casualty operations.

Net underwriting losses from the non-catastrophe reinsurance business were $355 million in 1999, $86 million

in 1998 and $73 million in 1997. BHRG incurred a net loss of approximately $220 million from a single aggregate

excess contract during the fourth quarter of 1999. Also, the 1999 underwriting loss includes $126 million of net losses

on reinsurance assumed from General Re’s North American property/casualty businesses. As with retroactiv e

reinsurance contracts, the premiums established for non-catastrophe reinsurance contracts are based on time-value-of-

money concepts because loss payments are expected to occur over lengthy time periods. Loss reserves for this business

are established without such time discounting but, unlike retroactive reinsurance contracts, no deferred charges are

established. Consequently, significant underwriting losses result. This business is accepted because of the large amounts

of investable policyholder funds (“float”) that is produced. It is anticipated that Berkshire will derive significant

economic benefits over the lengthy period of time that the float will be available for investment.

Premiums earned from catastrophe excess contracts were $314 million in 1999, $286 million in 1998 and $310

million in 1997. Competition within the catastrophe reinsurance markets remains intense, which in many instances,