Berkshire Hathaway 1999 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

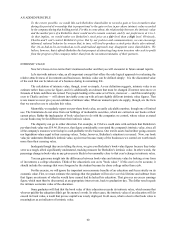

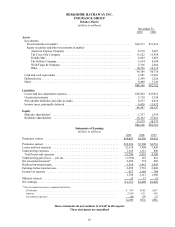

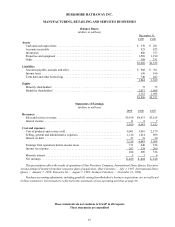

BERKSHIRE HATHAWAY INC.

FINANCE AND FINANCIAL PRODUCTS BUSINESSES

Scott Fetzer Financial Group, Inc., Berkshire Hathaway Life Insurance Co. of Nebraska, Berkshire Hathaway Credit

Corporation, BH Finance and General Re Financial Products make up Berkshire's finance and financial products

businesses.

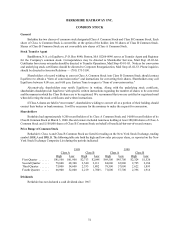

Balance Sheets

(dollars in millions)

1999 1998

Assets

Cash and cash equivalents .................................................. $ 623 $ 907

Investment in securities with fixed maturities:

Held to maturity, at cost (fair value $2,223 in 1999; $1,366 in 1998) ................ 2,293 1,227

Trading, at fair value (cost $11,330 in 1999; $5,279 in 1998) ...................... 11,277 5,219

Available for sale, at fair value (cost $997 in 1999; $745 in 1998) .................. 999 743

Trading account assets ..................................................... 5,881 6,234

Securities purchased under agreements to resell .................................. 1,171 1,083

Other .................................................................. 1,985 1,576

$24,229 $16,989

Liabilities

Annuity reserves and policyholder liabilities .................................... $ 843 $ 816

Securities sold under agreements to repurchase .................................. 10,216 4,065

Securities sold but not yet purchased .......................................... 1,174 1,181

Trading account liabilities .................................................. 5,931 5,834

Notes payable and other borrowings .......................................... 1,998 1,503

Other .................................................................. 2,303 2,428

22,465 15,827

Equity

Berkshire shareholders’ ................................................... 1,764 1,162

$24,229 $16,989

Statements of Earnings

(dollars in millions)

1999 1998 1997

Revenues:

Annuity premiums earned ............................................. $ — $ 95 $ 248

Other revenues ..................................................... 846 293 112

846 388 360

Expenses:

Interest expense .................................................... 596 27 24

Annuity benefits and underwriting expenses ............................... 54 146 287

General and administrative ............................................ 87 16 21

737 189 332

Earnings from operations before income taxes .............................. 109 199 28

Income tax expense .................................................. 32 70 10

Net earnings ....................................................... $ 77 $ 129 $ 18

General Re Financial Products, (“GRFP”) was acquired in connection with the acquisition of General Re Corporation

on December 21, 1998. This statement reflects GRFP’s operating results for the year ended December 31, 1999.

These statements do not conform to GAAP in all respects

These statements are unaudited