Berkshire Hathaway 1999 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

Notes to Consolidated Financial Statements (Continued)

(1) Significant accounting polices and practices (Continued)

(m) Foreign currency

The accounts of several foreign-based subsidiaries are measured using the local currency as the functional

currency. Revenues and expenses of these businesses are translated into U.S. dollars at the average

exchange rate for the period. Assets and liabilities are translated at the exchange rate as of the end of the

reporting period. Gains or losses from translating the financial statements of foreign-based operations are

included in shareholders’ equity as a component of other comprehensive income. Gains and losses arising

from other transactions denominated in a foreign currency are included in the Consolidated Statement of

Earnings.

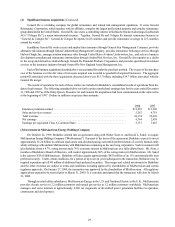

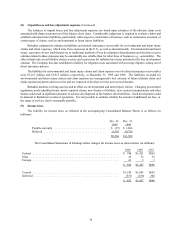

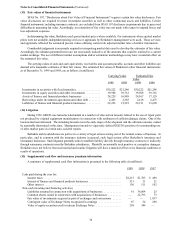

(n) Accounting pronouncements to be adopted subsequent to December 31, 1999

During 1998 and 1999, the Financial Accounting Standards Board (“FASB”) and the Accounting Standards

Executive Committee (“AcSEC”) issued the following new accounting standards that become effective

after December 31, 1999:

(i) The FASB issued Statement of Financial Accounting Standard No. 133 “Accounting for Derivative

Instruments and Hedging Activities” (“SFAS No. 133"). SFAS No. 133 establishes accounting and

rep

ort

contracts, and hedging activities. In June 1999, the FASB issued SFAS No. 137 which delays the effective date

for implementing SFAS No. 133. Berkshire expects to adopt SFAS No. 133 as of the beginning of 2001.

(ii) AcSEC issued Statement of Position (“SOP”) No. 98-7 “Deposit Accounting: Accounting for Insurance and

Reinsurance Contracts That Do Not Transfer Insurance Risk”. SOP No. 98-7 provides guidance on accounting

and disclosure for insurance and reinsurance contracts that do not transfer insurance risk. This SOP is effective

for fiscal years beginning after June 15, 1999. Berkshire will adopt this pronouncement as of the beginning of

2000.

The Company does not believe that adoption of these new accounting principles will have a material effect on its

financial position or the results of operations.

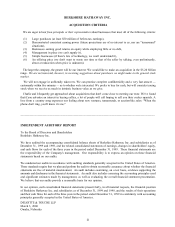

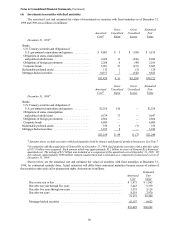

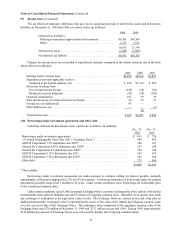

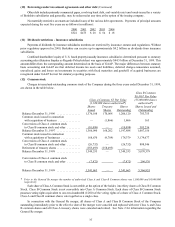

(2) Significant business acquisitions

During 1998, Berkshire consummated three significant business acquisitions — International Dairy Queen, Inc. (“Dairy

Queen”), effective January 7, 1998; Executive Jet, Inc. (“Executive Jet”), effective August 7, 1998; and General Re Corporation

(“General Re”), effective December 21, 1998. Additional information regarding these acquisitions is provided below.

On January 7, 1998, the merger of Dairy Queen with and into a wholly owned subsidiary of Berkshire was completed.

Shareholders of Dairy Queen received merger consideration of approximately $590 million, consisting of $265 million in cash

and the remainder in shares of Class A and Class B Common Stock. Dairy Queen develops, licenses and services a system of

almost 6,000 Dairy Queen stores located throughout the United States, Canada, and other foreign countries, which feature

hamburgers, hot dogs, various dairy desserts and beverages. Dairy Queen also develops, licenses and services other stores and

shops operating under the names of Orange Julius and Karmelkorn, which feature blended fruit drinks, popcorn and other snacks.

On August 7, 1998, the merger of Executive Jet with and into a wholly owned subsidiary of Berkshire was completed. Total

consideration paid by Berkshire was approximately $725 million, consisting of $350 million in cash and the remainder in shares

of Class A and Class B Common Stock. Executive Jet is the world’s leading p rovider of fractional ownership programs for general

aviation aircraft. Executive Jet currently operates its NetJets® fractional ownership programs in the United States and Europe.

In addition, Executive Jet is pursuing other international activities.

On December 21, 1998, the merger with General Re was completed. General Re shareholders received, at their election,

either 0.0035 shares of Berkshire Class A Common Stock or 0.105 shares of Berkshire Class B Common Stock for each share

of General Re common stock they owned. Berkshire issued approximately 272,200 Class A equivalent shares in exchange for

the General Re shares outstanding as of December 21, 1998. The total consideration for the transaction, based upon the closing

prices of Berkshire Class A Common Stock for the 10-day period ending June 26, 1998, (the merger agreement was entered into

by the parties on June 19, 1998) was approximately $22 billion.