Berkshire Hathaway 1999 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

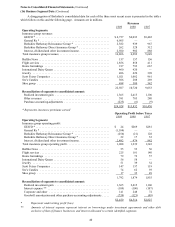

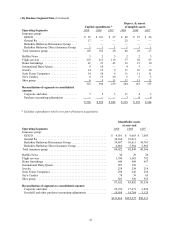

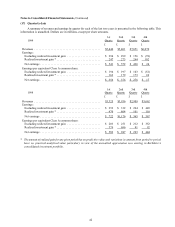

Management's Discussion (Continued)

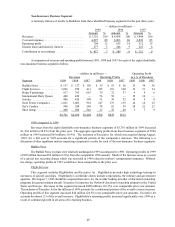

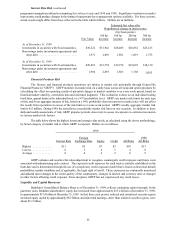

Non-Insurance Business Segments (continued)

Home Furnishings

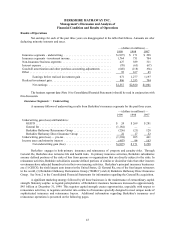

This segment is comprised of four separately managed but similar retail home furnishing businesses: Nebraska

Furniture Mart (“NFM”), based in Omaha, Nebraska; R.C. Willey Home Furnishings (“Willey”), based in Salt Lake

City, Utah; Star Furniture Company (“Star”), based in Houston, Texas; and Jordan’s Furniture, Inc. (“Jordan’s”), based

in Boston, Massachusetts. Berkshire acquired NFM in 1983, Willey in 1995 and Star in 1997. Jordan’s was acquired

on November 13, 1999 and is the largest furniture retailer in Massachusetts and New Hampshire. Revenues of this

segment increased $124 million (15.6%) as compared to the prior year. NFM, Willey and Star each reported revenue

increases of between 8% and 10%. Additionally, Jordan’s results were included in Berkshire’s segments results fo r

about the last 45 days of the year. Operating profits of $79 million in 1999 increased $7 million (9.7%) over the

comparable prior year amount. The increase arose from increased sales and improved margins at NFM, Willey and Star.

International Dairy Queen

At the beginning of 1998, Berkshire completed the acquisition of Dairy Queen. Dairy Queen develops, licenses

and services a system of about 6,000 Dairy Queen stores located throughout the United States, Canada and other foreign

countries. Dairy Queen stores feature hamburgers, hot dogs, various dairy desserts and beverages. Dairy Queen

revenues increased $40 million (9.5%) as compared to the prior year. About 75% of the increase relates to increased

distribution business. A significant portion of the remaining increase relates to sales by company-owned stores.

Operating profit of $56 million declined $2 million (3.4%) from the prior year.

Jewelry

This segment consists of two separately managed retailers of fine jewelry. Borsheim’s operates from a single

location in Omaha, Nebraska. Helzberg’s Diamonds operate s a national chain of retail stores located primarily in malls

throughout the United States. Revenues of $486 million increased $66 million (15.7%) and operating profits of $51

million increased $12 million (30.8%) over the comparable prior year amounts. While the revenue increase accounted

for much of the increase in operating profits, both of these businesses were able to effectively control operating expenses

resulting in improved results.

Scott Fetzer Companies

The Scott Fetzer companies are a group of about twenty diverse manufacturing and distribution businesses

under common management. Principal businesses in this group of companies sell products under the Kirby (home

cleaning systems), Campbell Hausfeld (air compressors, paint sprayers and pressure washers) and World Book

(encyclopedias and other educational products) names. Revenues of $1,021 million increased $19 million (1.9%) over

the comparable prior year amount. The increase in revenues was primarily due to revenue increases at Campbell

Hausfeld and World Book offset somewhat by lower revenues from Kirby’s home cleaning system’s business. Operating

profits of $147 million increased $10 million (7.3%) from the prior year. Increased sales at Campbell Hausfeld along

with improved results from World Book’s domest ic and international businesses account for a significant portion of the

improved results.

See’s Candies

See’s revenues increased $18 million (6.2%) over comparable prior year amounts. Total pounds of candy sold

increased about 7.2% with strong increases being achieved both in See’s quantity order business as well as its retai l

stores. Operating profits increased $12 million (19.3%) as compared to the prior year. The revenue increase as well

as a slightly over 1% increase in gross margin percentage accounts for the increase.

Shoes

This segment includes H. H. Brown Shoe Company, Inc., Lowell Shoe, Inc. and Dexter Shoe Companies. These

businesses manufacture and distribute work, dress, casual and athletic footwear. In addition, over 100 retail shoe stores

are included in this segment. Revenues for this segment decreased by $2 million in 1999 as compared to 1998.

Operating profits of $17 million in 1999 decreased $16 million (48.5%) from the prior year. The significant profit

decline arose at Dexter. It has become increasingly difficult for a domestic producer of shoes like Dexter to compete

in an industry where over 90% of the items sold are produced abroad, where low-cost labor is the rule. In order to

remain competitive, Dexter has begun shutting down certain of its domestic plants and sourcing more of its output

internationally. The results for 1999 include severance and relocation costs.