Berkshire Hathaway 1999 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Notes to Consolidated Financial Statements (Continued)

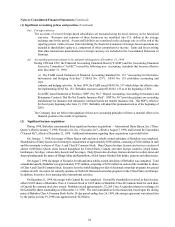

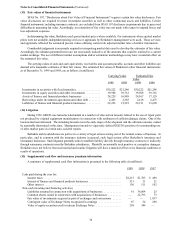

(13) Fair values of financial instruments

SFAS No. 107, "Disclosures about Fair Value of Financial Instruments" requires certain fair value disclosures. Fair

value disclosures are required for most investment securities as well as other contractual assets and liabilities. Certain

financial instruments, including insurance contracts, are excluded from SFAS 107 disclosure requirements due to perceived

difficulties in measuring fair value. Accordingly, an estimation of fair value was not made with respect to unpaid losses and

loss adjustment expenses.

In determining fair value, Berkshire used quoted market prices when available. For instruments where quoted market

prices were not available, independent pricing services or appraisals by Berkshire’s management were used. Those services

and appraisals reflected the estimated present values utilizing current risk adjusted market rates of similar instruments.

Considerable judgement is necessarily required in interpreting market data used to develop the estimates of fair value.

Accordingly, the estimates presented herein are not necessarily indicative of the amounts that could be realized in a current

market exchange. The use of different market assumptions and/or estimation methodologies may have a material effect on

the estimated fair value.

The carrying values of cash and cash equivalents, receivables and accounts payable, accruals and other liabilities are

deemed to be reasonable estimates of their fair values. The estimated fair values of Berkshire’s other financial instruments

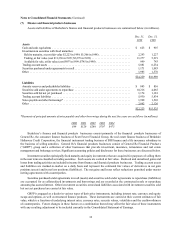

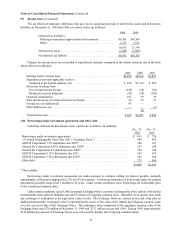

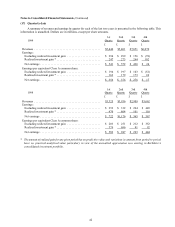

as of December 31, 1999 and 1998, are as follows (in millions):

Carrying Value Estimated Fair

Value

1999 1998 1999 1998

Investments in securities with fixed maturities ................ $30,222 $21,246 $30,222 $21,246

Investments in equity securities and other investments ......... 39,508 39,761 39,508 39,761

Assets of finance and financial products businesses ............ 24,229 16,989 24,167 17,129

Borrowings under investment agreements and other debt ........ 2,465 2,385 2,418 2,475

Liabilities of finance and financial products businesses ......... 22,223 15,525 22,151 15,698

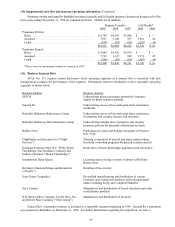

(14) Litigation

During 1999, GEICO was named as a defendant in a number of class action lawsuits related to the use of repair parts

not produced by original equipment manufacturers in connection with settlement of collision damage claims. One of the

lawsuits has been dismissed. The remaining lawsuits are in the early stages of development and the ultimate outcome cannot

be reasonably determined at this time. Management intends to vigorously defend GEICO’s position of recommending use

of after-market parts in certain auto accident repairs.

Berkshire and its subsidiaries are parties in a variety of legal actions arising out of the normal course of business. In

particular, and in common with the insurance industry in general, such legal actions affect Berkshire’s insurance an d

reinsurance businesses. Such litigation generally seeks to establish liability directly through insurance contracts or indirectly

through reinsurance contracts issued by Berkshire subsidiaries. Plaintiffs occasionally seek punitive or exemplary damages.

Berkshire does not believe that such normal and routine litigation will have a material effect on its financial condition or

results of operations.

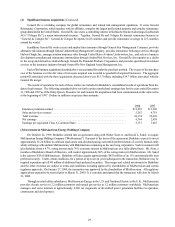

(15) Supplemental cash flow and insurance premium information

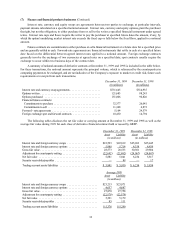

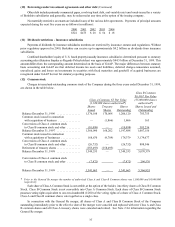

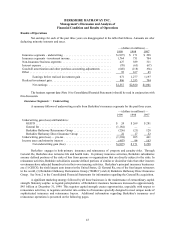

A summary of supplemental cash flow information is presented in the following table (in millions):

1999 1998 1997

Cash paid during the year for:

Income taxes ................................................... $2,215 $1,703 $ 498

Interest of finance and financial products businesses ...................... 513 21 21

Other interest ................................................... 136 111 102

Non-cash investing and financing activities:

Liabilities assumed in connection with acquisitions of businesses ............ 61 36,064 25

Common shares issued in connection with acquisitions of businesses ......... —22,795 73

Fair value of investments acquired as part of exchanges and conversions ...... — — 1,837

Contingent value of Exchange Notes recognized in earnings ............... 87 54 298

Value of equity securities used to redeem Exchange Notes ................. 298 344 —