Berkshire Hathaway 1999 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

*All figures used in this report apply to Berkshire's A shares, the successor to the only stock that the company

had outstanding before 1996. The B shares have an economic interest equal to 1/30th that of the A.

3

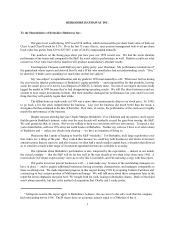

BERKSHIRE HATHAWAY INC.

To the Shareholders of Berkshire Hathaway Inc.:

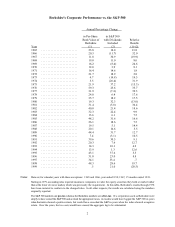

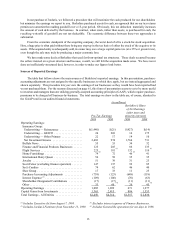

Our gain in net worth during 1999 was $358 million, which increased the per-share book value of both our

Class A and Class B stock by 0.5%. Over the last 35 years (that is, since present management took over) per-share

book value has grown from $19 to $37,987, a rate of 24.0% compounded annually.*

The numbers on the facing page show just how poor our 1999 record was. We had the worst absolute

performance of my tenure and, compared to the S&P, the worst relative performance as well. Relative results are what

concern us: Over time, bad relative numbers will produce unsatisfactory absolute results.

Even Inspector Clouseau could find last year’s guilty party: your Chairman. My performance reminds me of

the quarterback whose report card showed four Fs and a D but who nonetheless had an understanding coach. “Son,”

he drawled, “I think you’re spending too much time on that one subject.”

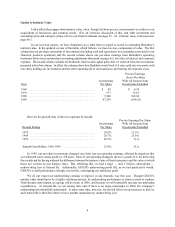

My “one subject” is capital allocation, and my grade for 1999 most assuredly is a D. What most hurt us during

the year was the inferior performance of Berkshire’s equity portfolio — and responsibility for that portfolio, leaving

aside the small piece of it run by Lou Simpson of GEICO, is entirely mine. Several of our largest investees badly

lagged the market in 1999 because they’ve had disappointing operating results. We still like these businesses and are

content to have major investments in them. But their stumbles damaged our performance last year, and it’s no sure

thing that they will quickly regain their stride.

The fallout from our weak results in 1999 was a more-than-commensurate drop in our stock price. In 1998,

to go back a bit, the stock outperformed the business. Last year the business did much better than the stock, a

divergence that has continued to the date of this letter. Over time, of course, the performance of the stock must roughly

match the performance of the business.

Despite our poor showing last year, Charlie Munger, Berkshire’s Vice Chairman and my partner, and I expect

that the gain in Berkshire’s intrinsic value over the next decade will modestly exceed the gain from owning the S&P.

We can’t guaran tee that, of course. But we are willing to back our conviction with our own money. To repeat a fact

you’ve heard before, well over 99% of my net worth reside s in Berkshire. Neither my wife nor I have ever sold a share

of Berkshire and — unless our checks stop clearing — we have no intention of doing so.

Please note that I spoke of hoping to beat the S&P “modestly.” For Berkshire, truly large superiorities over

that index are a thing of the past. They existed then because we could buy both businesses and stocks at far more

attractive prices than we can now, and also because we then had a much smaller capital base, a situation that allowed

us to consider a much wider range of investment opportunities than are available to us today.

Our optimism about Berkshire’s performance is also tempered by the expectation — indeed, in our minds,

the virtual certainty — that the S&P will do far less well in the next decade or two than it has done since 1982. A

recent article in Fortune expressed my views as to why this is inevitable, and I’m enclosing a copy with this report.

Our goal is to run our present businesses well — a task made easy because of the outstanding managers we

have in place — and to acquire additional businesses having economic characteristics and managers comparable to

those we already own. We made important progress in this respect during 1999 by acquiring Jordan’s Furniture and

contracting to buy a major portion of MidAmerican Energy. We will talk more about these companies later in the

report but let me emphasize one point here: We bought both for cash, issuing no Berkshire shares. Deals of that kind

aren’t always possible, but that is the method of acquisition that Charlie and I vastly prefer.