Berkshire Hathaway 1999 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

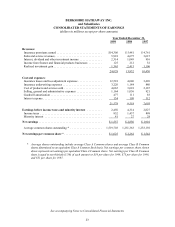

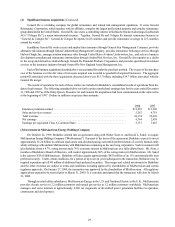

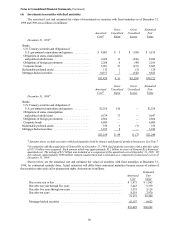

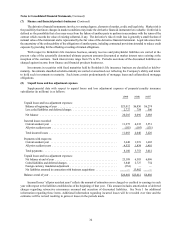

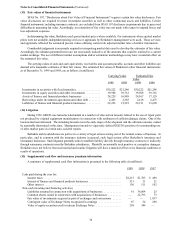

(5) Investments in equity securities and other investments

Data with respect to the consolidated investment in equity securities and other investments are shown below.

Amounts are in millions.

December 31, 1999 Unrealized Fair

Cost Gains Value

Common stock of:

American Express Company * .................................... $ 1,470 $ 6,932 $ 8,402

The Coca-Cola Company ........................................ 1,299 10,351 11,650

The Gillette Company .......................................... 600 3,354 3,954

Other equity securities ........................................... 6,305 7,461 13,766

Other investments .............................................. 1,651 85 1,736

$11,325 $28,183 ** $39,508

December 31, 1998 Unrealized Fair

Cost Gains Value

Common stock of:

American Express Company * .................................... $ 1,470 $ 3,710 $ 5,180

The Coca-Cola Company ........................................ 1,299 12,101 13,400

The Gillette Company .......................................... 600 3,990 4,590

Other equity securities ........................................... 5,889 9,062 14,951

Other investments .............................................. 1,639 1 1,640

$10,897 $28,864 ** $39,761

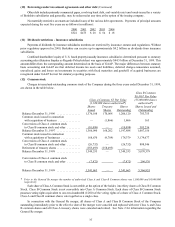

* Common shares of American Express Company ("AXP") owned by Berkshire and its subsidiaries possessed

approximately 11% of the voting rights of all AXP shares outstanding at December 31, 1999. The shares are held subject

to various agreements with certain insurance and banking regulators which, among other things, prohibit Berkshire from

(i) seeking representation on the Board of Directors of AXP (Berkshire may agree, if it so desires, at the request of

management or the Board of Directors of AXP to have no more than one representative stand for election to the Board

of Directors of AXP) and (ii) acquiring or retaining shares that would cause its ownership of AXP voting securities to

equal or exceed 17% of the amount outstanding (should Berkshire have a representative on the Board of Directors, such

amount is limited to 15%). In connection therewith, Berkshire has entered into an agreement with AXP which became

effective when Berkshire's ownership interest in AXP voting securities reached 10% and will remain effective so long as

Berkshire owns 5% or more of AXP's voting securities. The agreement obligates Berkshire, so long as Harvey Golub is

chief executive officer of AXP, to vote its shares in accordance with the recommendations of AXP's Board of Directors.

Additionally, subject to certain exceptions, Berkshire has agreed not to sell AXP common shares to any person who owns

5% or more of AXP voting securities or seeks to control AXP, without the consent of AXP.

** Net of unrealized losses of $149 million and $38 million as of December 31, 1999 and 1998, respectively.

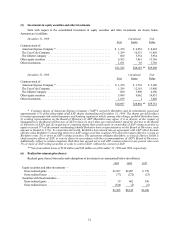

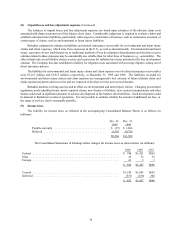

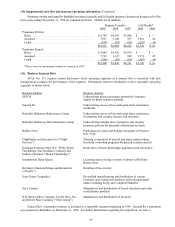

(6) Realized investment gains (losses)

Realized gains (losses) from sales and redemptions of investments are summarized below (in millions):

1999 1998 1997

Equity securities and other investments —

Gross realized gains ....................................... $1,507 $2,087 $ 739

Gross realized losses ....................................... (77) (272) (23)

Securities with fixed maturities —

Gross realized gains ....................................... 39 602 396

Gross realized losses ....................................... (104) (2) (6)

$1,365 $2,415 $1,106