Berkshire Hathaway 1999 Annual Report Download

Download and view the complete annual report

Please find the complete 1999 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BERKSHIRE HATHAWAY INC.

1999 ANNUAL REPORT

TABLE OF CONTENTS

Business Activities ...........................Inside Front Cover

Corporate Performance vs. the S&P 500 ...................... 2

Chairman's Letter* ....................................... 3

Selected Financial Data For The

Past Five Years ......................................20

Acquisition Criteria ......................................21

Independent Auditors' Report ...............................21

Consolidated Financial Statements ...........................22

Management's Discussion .................................43

Owner's Manual .........................................55

Combined Financial Statements — Unaudited —

for Berkshire Business Groups ............................63

Shareholder-Designated Contributions ........................70

Common Stock Data .....................................72

Directors and Officers of the Company ............Inside Back Cover

*Copyright © 2000 By Warren E. Buffett

All Rights Reserved

Table of contents

-

Page 1

...' Report ...21 Consolidated Financial Statements ...22 Management's Discussion ...43 Owner's Manual ...55 Combined Financial Statements - Unaudited - for Berkshire Business Groups ...63 Shareholder-Designated Contributions ...70 Common Stock Data ...72 Directors and Officers of the Company ...Inside... -

Page 2

... equity ownership percentages of other publicly traded companies. Investments with a market value in excess of $750 million at the end of 1999 include approximately 11% of the outstanding capital stock of American Express Company, approximately 8% of the capital stock of The Coca-Cola Company... -

Page 3

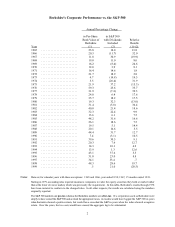

... they hold at market rather than at the lower of cost or market, which was previously the requirement. In this table, Berkshire's results through 1978 have been restated to conform to the changed rules. In all other respects, the results are calculated using the numbers originally reported. The... -

Page 4

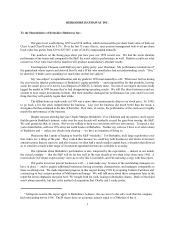

... INC. To the Shareholders of Berkshire Hathaway Inc.: Our gain in net worth during 1999 was $358 million, which increased the per-share book value of both our Class A and Class B stock by 0.5%. Over the last 35 years (that is, since present management took over) per-share book value has grown from... -

Page 5

..., measurement we utilize in our acquisitions of businesses and common stocks. (For an extensive discussion of this, and other investment and accounting terms and concepts, please refer to our Owner's Manual on pages 55 - 62. Intrinsic value is discussed on page 60.) In our last four reports, we have... -

Page 6

... for your country." Here's a remarkable story from last year: It's about R. C. Willey, Utah's dominant home furnishing business, which Berkshire purchased from Bill Child and his family in 1995. Bill and most of his managers are Mormons, and for this reason R. C. Willey's stores have neve r operated... -

Page 7

... takes in usually do not cover the losses and expenses it eventually must pay. That leaves it running an "underwriting loss," which is the cost of float. An insurance business has value if its cost of float over time is less than the cost the company would otherwise incur to obtain funds. But the... -

Page 8

...plans for GEICO, which we will discuss later. There are a number of people who deserve credit for manufacturing so much "no-cost" float over the years. Foremost is Ajit Jain. It's simply impossible to overstate Ajit's value to Berkshire: He has from scratch built a n outstanding reinsurance business... -

Page 9

... are pleased with our prices and service. An article published last year by Kiplinger's Personal Finance Magazine gives a good picture of where we stand in customer satisfaction: The magazine's survey of 20 state insurance departments showed that GEICO's complaint ratio was well below the ratio for... -

Page 10

... services companies - FlightSafety International ("FSI") and Executive Jet Aviation ("EJA") - are both runaway leaders in their field. EJA, which sells and manages the fractional ownership of jet aircraft, through its NetJets® program, is larger than its next two competitors combined. FSI trains... -

Page 11

... to the value of the EJA service. Give us a call at 1-800-848-6436 and ask for our "white paper" on fractional ownership. Acquisitions of 1999 At both GEICO and Executive Jet, our best source of new customers is the happy ones we already have. Indeed, about 65% of our new owners of aircraft come as... -

Page 12

...of Level 3 Communications and a director of Berkshire. Walter has many other business connections as well, and one of them is with MidAmerican Energy, a utility company in which he has substantial holdings and on whose board he sits. At a conference in California that we both attended last September... -

Page 13

...in the appendix to our 1983 annual report, which is available on our website, and in the Owner's Manual on pages 55 - 62. For accounting rules to mandate amortization that will, in the usual case, conflict with reality is deeply troublesome: Most accounting charges relate to what's going on, even if... -

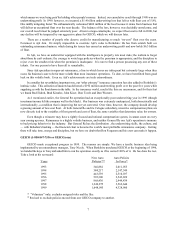

Page 14

... and Financial Products Businesses ...125 205 (1) 86 133 (1) Flight Services ...225 (2) 181 132 (2) 110 Home Furnishings ...79 72 46 41 International Dairy Queen ...56 58 35 35 Jewelry ...51 39 31 23 Scott Fetzer (excluding finance operation) ...147 137 92 85 See's Candies ...74 62 46 40 Shoe Group... -

Page 15

...I put him in charge the day of our purchase, and his fanatical insistence on both product quality and friendly service has rewarded customers, employees and owners. Chuck gets better every year. When he took charge of See's at age 46, the company's pre-tax profit, expressed in millions, was about 10... -

Page 16

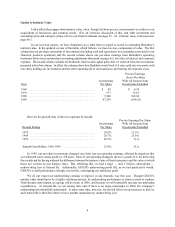

...average ownership for the year (3) The tax rate used is 14%, which is the rate Berkshire pays on the dividends it receives Investments Below we present our common stock investments. Those that had a market value of more than $750 million at the end of 1999 are itemized. 12/31/99 Shares Company Cost... -

Page 17

... those kinds, a company with a growth-oriented shareholder population can buy new businesses or repurchase shares. If a company's stock is selling well below intrinsic value, repurchases usually make the most sense. In the mid-1970s, the wisdom of making these was virtually screaming at managements... -

Page 18

...is selling well below intrinsic value, conservatively calculated. Nor will we attempt to talk the stock up or down. (Neither publicly or privately have I ever told anyone to buy or sell Berkshire shares.) Instead we will give all shareholders - and potential shareholders - the same valuation-related... -

Page 19

..., we have again signed up American Express (800-799-6634) to give you special help. In our normal fashion, we will run buses from the larger hotels to the meeting. After the meeting, the buses will make trips back to the hotels and to Nebraska Furniture Mart, Borsheim's and the airport. Even so, you... -

Page 20

... to employees. We have offered this break to shareholders the last couple of years, and sales have been amazing. In last year's five-day "Berkshire Weekend," NFM's volume was $7.98 million, an increase of 26% from 1998 and 51% from 1997. Borsheim's - the largest jewelry store in the country except... -

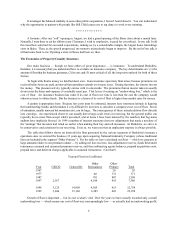

Page 21

BERKSHIRE HATHAWAY INC. Selected Financial Data for the Past Five Years (dollars in millions, except per share data) 1999 Revenues: Insurance premiums earned ...Sales and service revenues ...Interest, dividend and other investment income ...Income from finance and financial products businesses ...... -

Page 22

... hoping to sell you their cocker spaniels. A line from a country song expresses our feeling about new ventures, turnarounds, or auction-like sales: "When the phone don't ring, you'll know it's me." _____ INDEPENDENT AUDITORS' REPORT To the Board of Directors and Shareholders Berkshire Hathaway Inc... -

Page 23

... AND SHAREHOLDERS' EQUITY Losses and loss adjustment expenses ...Unearned premiums ...Accounts payable, accruals and other liabilities ...Income taxes, principally deferred ...Borrowings under investment agreements and other debt ...Liabilities of finance and financial products businesses ...$ 13... -

Page 24

... CONSOLIDATED STATEMENTS OF EARNINGS (dollars in millions except per share amounts) Year Ended December 31, 1999 1998 1997 Revenues: Insurance premiums earned ...Sales and service revenues ...Interest, dividend and other investment income ...Income from finance and financial products businesses... -

Page 25

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS (dollars in millions) Year Ended December 31, 1999 1998 1997 Cash flows from operating activities: Net earnings ...Adjustments to reconcile net earnings to cash flows from operating activities: Realized investment gain ... -

Page 26

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY (dollars in millions) Class A & B Capital in Common Excess of Par Value Stock $ 7 $ 2,274 Balance December 31, 1996 ...Common stock issued in connection with acquisitions of businesses ...- 73 Net ... -

Page 27

... Berkshire Hathaway Inc. ("Berkshire" or "Company") is a holding company owning subsidiaries engaged in a number of diverse business activities. The most important of these are property and casualty insurance businesses conducted on both a direct and reinsurance basis. Further information... -

Page 28

...) reports of losses from ceding insurers. The estimated liabilities of certain workers' compensation claims assumed under reinsurance contracts and liabilities assumed under structured settlement reinsurance contracts are carried in the Consolidated Balance Sheets at discounted amounts. Discounted... -

Page 29

... in shares of Class A and Class B Common Stock. Executive Jet is the world's leading p rovider of fractional ownership programs for general aviation aircraft. Executive Jet currently operates its NetJets® fractional ownership programs in the United States and Europe. In addition, Executive Jet is... -

Page 30

... consolidated earnings data for the years ended December 31, 1998 and 1997 as if the Dairy Queen, Executive Jet and General Re acquisitions had been consummated on the same terms at the beginning of 1997. Dollars in millions except per share amounts. Insurance premiums earned ...Sales and service... -

Page 31

...$21,246 (1) (2) Amounts above exclude securities with fixed maturities held by finance and financial products businesses. See Note 7. In connection with the acquisition of General Re on December 21, 1998, fixed maturity securities with a then fair value of $17.6 billion were acquired. Such amount... -

Page 32

... securities and other investments Data with respect to the consolidated investment in equity securities and other investments are shown below. Amounts are in millions. December 31, 1999 Cost Common stock of: American Express Company * ...The Coca-Cola Company ...The Gillette Company ...Other equity... -

Page 33

... General Re, the consumer finance business of Scott Fetzer Financial Group, the real estate finance business of Berkshire Hathaway Credit Corporation, the financial instrument trading business of BH Finance and a life insurance subsidiary in the business of selling annuities. General Re's financial... -

Page 34

... underlying m arket interest rate exceeds the fixed cap or falls below the fixed floor, applied to a notional amount. Futures contracts are commitments to either purchase or sell a financial instrument at a future date for a specified price and are generally settled in cash. Forward-rate agreements... -

Page 35

... from finance and financial products businesses. Investments in securities with fixed maturities held by Berkshire's life insurance business are classified as held-tomaturity. Investments classified as held-to-maturity are carried at amortized cost reflecting the Company's ability and intent to hold... -

Page 36

... loss development estimate. The Company has also established a liability for litigation costs associated with coverage disputes arising out of direct insurance policies. The liabilities for environmental and latent injury claims and claim expenses net of related reinsurance recoverables were $3,211... -

Page 37

... tax benefit ...Foreign tax rate differential ...Other differences, net ... Borrowings under investment agreements ...1% Senior Exchangeable Notes Due 2001 ("Exchange Notes") ...GEICO Corporation 7.5% debentures due 2005* ...General Re Corporation 8.85% debentures due 2009* ...General Re Corporation... -

Page 38

...Class A Common Stock. Class A and Class B common shares vote together as a single class. In connection with the General Re merger, all shares of Class A and Class B Common Stock of the Company outstanding immediately prior to the effective date of the merger were canceled and replaced with new Class... -

Page 39

...under investment agreements and other debt ...Liabilities of finance and financial products businesses ...(14) Litigation During 1999, GEICO was named as a defendant in a number of class action lawsuits related to the use of repair parts not produced by original equipment manufacturers in connection... -

Page 40

... g segments is shown below. Business Identity GEICO General Re Berkshire Hathaway Reinsurance Group Berkshire Hathaway Direct Insurance Group Buffalo News FlightSafety and Executive Jet ("Flight Services") Nebraska Furniture Mart, R.C. Willey Home Furnishings, Star Furniture Company and Jordan... -

Page 41

......General Re * ...Berkshire Hathaway Reinsurance Group * ...Berkshire Hathaway Direct Insurance Group * ...Interest, dividend and other investment income ...Total insurance group operating profit ...Buffalo News ...Flight services ...Home furnishings ...International Dairy Queen ...Jewelry ...Scott... -

Page 42

...: Insurance group: GEICO ...General Re ...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Direct Insurance Group ...Total insurance group ...Buffalo News ...Flight services ...Home furnishings ...International Dairy Queen ...Jewelry ...Scott Fetzer Companies ...See's Candies ...Shoe group... -

Page 43

Notes to Consolidated Financial Statements (Continued) (17) Quarterly data A summary of revenues and earnings by quarter for each of the last two years is presented in the following table. This information is unaudited. Dollars are in millions, except per share amounts. 1999 Revenues ...Earnings: ... -

Page 44

... reinsurers in the world, (3) Berkshire Hathaway Reinsurance Group ("BHRG") and (4) Berkshire Hathaway Direct Insurance Group. See Note 2 to the Consolidated Financial Statements for information regarding the General Re acquisition. A significant marketing strategy followed by all these businesses... -

Page 45

... in a number of class action lawsuits related to the use of repair parts not produced by original equipment manufacturers in connection with settlement of collision damage claims. Similar lawsuits have been filed against several other major private-passenger auto insurers. Management intends to... -

Page 46

...) - pre-tax ... General Re's North American property/casualty operations underwrite predominantly excess reinsuranc e across multiple lines of business. North American property/casualty premiums earned grew 4.8% in 1999. Premiums earned in 1999 included $154 million related to a single new stop-loss... -

Page 47

... related to higher premiums earned in connection with the run off of health lines written by a former London agent of Cologne Re's U.S. subsidiar y ("GCL" formerly "CLR") and growth from several new contracts written in the U.S. individual and group health markets. The Global life/health net... -

Page 48

...loss includes $126 million of net losses on reinsurance assumed from General Re's North American property/casualty businesses. As with retroactiv e reinsurance contracts, the premiums established for non-catastrophe reinsurance contracts are based on time-value-ofmoney concepts because loss payments... -

Page 49

... commercial coverages to insureds in an increasing number of states; Cypress Insurance Company, a provider of workers' compensation insurance in California and other states; Central States Indemnity Company, a provider of credit card credit insurance to individuals nationwide through financial... -

Page 50

...Segment Buffalo News ...Flight Services ...Home Furnishings ...International Dairy Queen Jewelry ...Scott Fetzer Companies ...See's Candies ...Shoe Group ... 1999 $ 157 1,856 917 460 486 1,021 306 498 $5,701 1999 compared to 1998 Revenues from the eight identifiable non-insurance business segments... -

Page 51

Management's Discussion (Continued) Non-Insurance Business Segments (continued) Home Furnishings This segment is comprised of four separately managed but similar retail home furnishing businesses: Nebraska Furniture Mart ("NFM"), based in Omaha, Nebraska; R.C. Willey Home Furnishings ("Willey"), ... -

Page 52

... Consolidated Statements of Earnings, such gains often produce a minimal impact on Berkshire's total shareholders' equity. This is due to the fact that Berkshire's investments are carried in prior periods' consolidated financial statements at market value with unrealized gains, net of tax, reported... -

Page 53

... Notes are subject to equity price risks. See Note 10 to the Consolidated Financial Statements for information regarding the Exchange Notes. Given the current market price of the underlying stock into which Exchange Notes may be converted, the fair values of the Exchange Notes are primarily subject... -

Page 54

... tests to assess its exposure to extreme movements in various market risk factors. The table below shows the highest, lowest and average value at risk, as calculated using the above methodology, by broad category of market risk to which GRFP is exposed. Dollars are in millions. 1999 Foreign Exchange... -

Page 55

... testing of Year 2000 issues. Year 2000 related costs are expensed as incurred. Berkshire management does not believe that any significant IT projects were delayed due to Year 2000 efforts. Forward-Looking Statements Investors are cautioned that certain statements contained in this document, as well... -

Page 56

... excluded from the calculation. In effect, our shareholders behave in respect to their Berkshire stock much as Berkshire itself behaves in respect to companies in which it has an investment. As owners of, say, Coca-Cola or Gillette shares, we think of Berkshire as being a non-managing partner in two... -

Page 57

... goal by directly owning a diversified group of businesses that generate cash and consistently earn above-average returns on capital. Our second choice is to own parts of similar businesses, attained primarily through purchases of marketable common stocks by our insurance subsidiaries. The price and... -

Page 58

... individual businesses, should generally aid you in making judgments about them. To state things simply, we try to give you in the annual report the numbers and other information that really matter. Charlie and I pay a great deal of attention to how well our businesses are doing, and we also work to... -

Page 59

... your own portfolios through direct purchases in the stock market. Charlie and I are interested only in acquisitions that we believe will raise the per-share intrinsic value of Berkshire's stock. The size of our paychecks or our offices will never be related to the size of Berkshire's balance sheet... -

Page 60

... our business and investment philosophy. I benefitted enormously from the intellectual generosity of Ben Graham, the greatest teacher in the history of finance, and I believe it appropriate to pass along what I learned from him, even if that creates new and able investment competitors for Berkshire... -

Page 61

... regularly report our per-share book value, an easily calculable number, though one of limited use. The limitations do not arise from our holdings of marketable securities, which are carried on our books at their current prices. Rather the inadequacies of book value have to do with the companies we... -

Page 62

... think earnings of that description have far more economic meaning than the earnings produced by GAAP. When Berkshire buys a business for a premium over the GAAP net worth of the acquiree - as will usually be the case, since most companies we'd want to buy don't come at a discount - that premium has... -

Page 63

...the date of my death. But I can anticipate what the management structure will be: Essentially my job will be split into two parts, with one executive becoming responsible for investments and another for operations. If the acquisition of new businesses is in prospect, the two will cooperate in making... -

Page 64

BERKSHIRE HATHAWAY INC. COMBINED FINANCIAL STATEMENTS BUSINESS GROUPS Berkshire's consolidated data is rearranged in the presentations on the following six pages into four categories, corresponding to the way Mr. Buffett and Mr. Munger think about Berkshire's businesses. The presentations may be ... -

Page 65

... Group" companies underwrite various commercial coverages for risks in an increasing number of selected states. Cypress Insurance Company provides workers' compensation insurance to employers in California and other states. Central States Indemnity Company issues credit insurance distributed... -

Page 66

BERKSHIRE HATHAWAY INC. INSURANCE GROUP Balance Sheets (dollars in millions) December 31, 1999 1998 Assets Investments: Fixed maturities at market ...Equity securities and other investments at market: American Express Company ...The Coca-Cola Company ...Freddie Mac ...The Gillette Company ...Wells ... -

Page 67

... training to operators of aircraft and ships Ignition and sign transformers and components Work shoes, boots and casual footwear Zinc die cast conduit fittings and other electrical construction materials Retailing fine jewelry Licensing and servicing Dairy Queen Stores Retailing home furnishings... -

Page 68

...Statements of Earnings (dollars in millions) 1999 Revenues: Sales and service revenues ...Interest income ...Cost and expenses: Cost of products and services sold ...Selling, general and administrative expenses ...Interest on debt ...Earnings from operations before income taxes ...Income tax expense... -

Page 69

BERKSHIRE HATHAWAY INC. FINANCE AND FINANCIAL PRODUCTS BUSINESSES Scott Fetzer Financial Group, Inc., Berkshire Hathaway Life Insurance Co. of Nebraska, Berkshire Hathaway Credit Corporation, BH Finance and General Re Financial Products make up Berkshire's finance and financial products businesses. ... -

Page 70

... the consolidated financial statement values for assets, liabilities, shareholders' equity, revenues and expenses that were not assigned to any Berkshire operating group in the unaudited, and not fully GAAP adjusted group financial statements heretofore presented (pages 63 to 68). Statements of Net... -

Page 71

...such circumstances, I believe Berkshire should imitate more closely-held companies, not larger public companies. If you and I each own 50% of a corporation, our charitable decision making would be simple. Charities very directly related to the operations of the business would have first claim on our... -

Page 72

... breed. As I mentioned in the 1979 annual report, at the end of each year more than 98% of our shares are owned by people who were shareholders at the beginning of the year. This long-term commitment to the business reflects an owner mentality which, as your manager, I intend to acknowledge in all... -

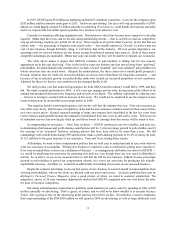

Page 73

... owners. Price Range of Common Stock Berkshire's Class A and Class B Common Stock are listed for trading on the New York Stock Exchange, trading symbol: BRK.A and BRK.B. The following table sets forth the high and low sales prices per share, as reported on the New York Stock Exchange Composite List... -

Page 74

...MILLARD, Director of Financial Assets Letters from Annual Reports (1977 through 1999), quarterly reports, press releases and other information about Berkshire may be obtained on the Internet at www.berkshirehathaway.com. Berkshire's 2000 quarterly reports are scheduled to b e posted on the Internet...