BP 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Information about this report

This document constitutes the Annual Report and Accounts in accordance

with UK requirements and the Annual Report on Form 20-F in accordance

with the US Securities Exchange Act of 1934, for BP p.l.c. for the year

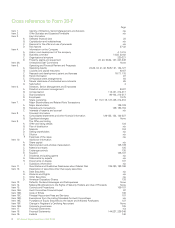

ended 31 December 2010. A cross reference to Form 20-F requirements is

on page 2.

This document contains the Directors’ Report, including the

Business Review and Management Report, on pages 5-109 and 123-140,

142 and PC1. The Directors’ Remuneration Report is on pages 111-121. The

consolidated financial statements of the group are on pages 141-248 and

the corresponding reports of the auditor are on pages 143-145. The parent

company financial statements of BP p.l.c. and corresponding auditor’s

report are on pages PC1-PC16 and page PC2 respectively.

The statement of directors’ responsibilities in respect of the

consolidated financial statements, the independent auditor’s report on the

annual report and accounts to the members of BP p.l.c. and the parent

company financial statements of BP p.l.c. and corresponding auditor’s

report do not form part of BP’s Annual Report on Form 20-F as filed with

the SEC.

BP Annual Report and Form 20-F 2010 and BP Summary Review

2010 may be downloaded from www.bp.com/annualreport. No material

on the BP website, other than the items identified as BP Annual Report

and Form 20-F 2010 or BP Summary Review 2010, forms any part of

those documents.

BP p.l.c. is the parent company of the BP group of companies.

Unless otherwise stated, the text does not distinguish between

the activities and operations of the parent company and those of

its subsidiaries.

The term ‘shareholder’ in this report means, unless the context

otherwise requires, investors in the equity capital of BP p.l.c., both direct

and indirect. As BP shares, in the form of ADSs, are listed on the New York

Stock Exchange (NYSE), an Annual Report on Form 20-F is filed with the US

Securities and Exchange Commission (SEC).

Cautionary statement

BP Annual Report and Form 20-F 2010 contains certain forward-looking

statements within the meaning of the US Private Securities Litigation

Reform Act of 1995 with respect to the financial condition, results of

operations and businesses of BP and certain of the plans and objectives of

BP with respect to these items.

In order to utilize the ‘Safe Harbor’ provisions of the United States

Private Securities Litigation Reform Act of 1995, BP is providing the

following cautionary statement. This document contains certain forward-

looking statements with respect to the financial condition, results of

operations and businesses of BP and certain of the plans and objectives of

BP with respect to these items. These statements may generally, but not

always, be identified by the use of words such as ‘will’, ‘expects’, ‘is

expected to’, ‘aims’, ‘should’, ‘may’, ‘objective’, ‘is likely to’, ‘intends’,

‘believes’, ‘plans’, ‘we see’ or similar expressions. In particular, among other

statements, (i) certain statements in the Business review (pages 6-82),

including under the heading ‘Outlook’, with regard to strategy, management

aims and objectives, future capital expenditure, the completion of planned

and announced divestments and disposals, acquisitions and other

transactions, future hydrocarbon production volume and the group’s ability

to satisfy its long-term sales commitments from future supplies available to

the group, date(s) or period(s) in which production is scheduled or expected

to come onstream or a project or action is scheduled or expected to begin

or be completed, capacity of planned plants or facilities and impact of

health, safety and environmental regulations; (ii) the statements in the

Business review (pages 6-63 and 68-81) with regard to anticipated energy

demand and consumption, global economic recovery, oil and gas prices,

global reserves, refining capacity, expected future energy mix and the

potential for cleaner and more efficient sources of energy, management

aims and objectives, strategy, production, petrochemical and refining

margins, anticipated investment in Alternative Energy, anticipated future

project developments, growth of the international businesses, Refining and

Marketing investments, reserves increases through technological

developments, with regard to planned investment or other projects, timing

and ability to complete announced transactions and future regulatory

actions; (iii) the statements in the Business review (pages 23-26, 63-67

and 73) with regard to the plans of the group, the cost of and provision for

future remediation programmes and environmental operating and capital

expenditures, taxation, liquidity and costs for providing pension and other

post-retirement benefits; and including under ‘Liquidity and capital

resources – Trend Information’, with regard to global economic recovery, oil

and gas prices, petrochemical and refining margins, production, demand for

petrochemicals, production and production growth, depreciation, underlying

average quarterly charge from Other businesses and corporate, costs,

foreign exchange and energy costs, capital expenditure, timing and

proceeds of divestments, balance of cash inflows and outflows, dividend

and optional scrip dividend, cash flows, shareholder distributions, gearing,

working capital, guarantees, expected payments under contractual and

commercial commitments and purchase obligations; and (iv) certain

statements in Chairman’s letter (pages 6-7) and Business review (pages 10-

11) in relation to an anticipated increase in the level of the dividend; are all

forward-looking in nature.

By their nature, forward-looking statements involve risk and

uncertainty because they relate to events and depend on circumstances

that will or may occur in the future and are outside the control of BP. Actual

results may differ materially from those expressed in such statements,

depending on a variety of factors, including the specific factors identified in

the discussions accompanying such forward-looking statements; the timing

of bringing new fields onstream; future levels of industry product supply,

demand and pricing; operational problems; general economic conditions;

political stability and economic growth in relevant areas of the world;

changes in laws and governmental regulations; actions by regulators;

exchange rate fluctuations; development and use of new technology; the

success or otherwise of partnering; the actions of competitors; natural

disasters and adverse weather conditions; changes in public expectations

and other changes to business conditions; wars and acts of terrorism or

sabotage; and other factors discussed elsewhere in this report including

under ‘Risk factors’ (pages 27-32). In addition to factors set forth elsewhere

in this report, those set out above are important factors, although not

exhaustive, that may cause actual results and developments to differ

materially from those expressed or implied by these forward-looking

statements.

Statements regarding competitive position

Statements referring to BP’s competitive position are based on the

company’s belief and, in some cases, rely on a range of sources, including

investment analysts’ reports, independent market studies and BP’s internal

assessments of market share based on publicly available information about

the financial results and performance of market participants.

Unless otherwise indicated, information in this document reflects 100% of the assets and

operations of the company and its subsidiaries that were consolidated at the date or for

the periods indicated, including minority interests. The company was incorporated in 1909

in England and Wales and changed its name to BP p.l.c. in 2001. BP’s primary share listing

is the London Stock Exchange. Ordinary shares are also traded on the Frankfurt Stock Exchange

in Germany and, in the US, the company’s securities are traded in the form of ADSs.

(See page 134 for more details.)

The registered office of BP p.l.c., and our worldwide headquarters, is:

1 St James’s Square,

London SW1Y 4PD, UK.

Tel +44 (0)20 7496 4000.

Registered in England and Wales No. 102498. Stock exchange symbol ‘BP’.

Our agent in the US is BP America Inc.,

501 Westlake Park Boulevard, Houston, Texas 77079.

Tel +1 281 366 2000.

4 BP Annual Report and Form 20-F 2010