BMW 2004 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Financial Statements 50

Income Statements 51

Balance Sheets 52

Cash Flow Statements 54

Group Statement of

Changes in Equity 56

Notes 57

--Accounting Principles

and Policies 57

--Notes to the Income Statement 66

--Notes to the balance sheet 74

--Other Disclosures 93

--Segment Information 100

--Disclosures pursuant to

§292a HGB

104

Auditors’ Report 107

96

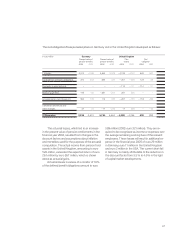

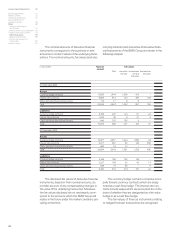

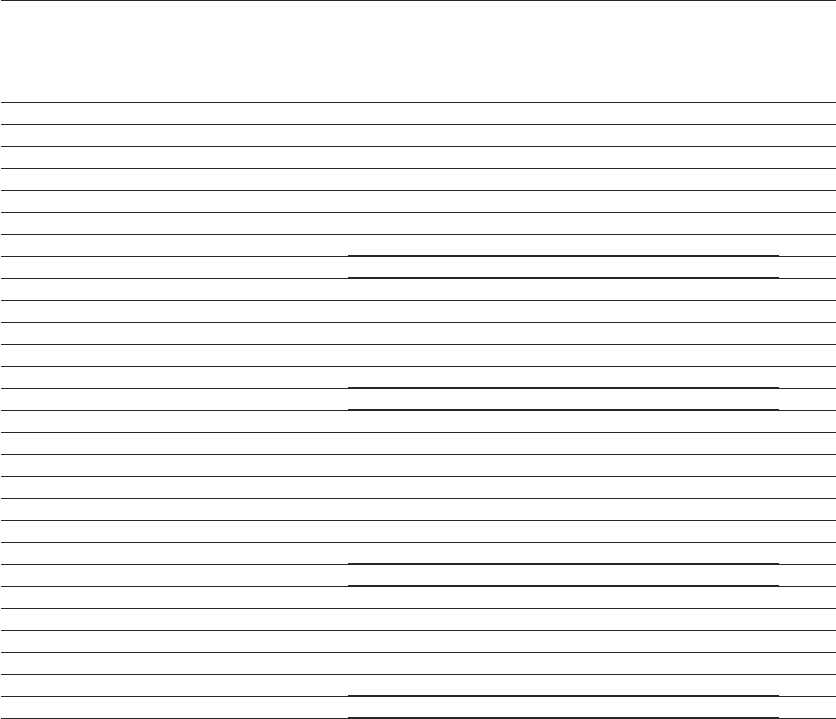

The nominal amounts of derivative financial

instruments correspond to the purchase or sale

amounts or contract values of the underlying trans-

actions.The nominal amounts, fair values (and also

The disclosed fair values of derivative financial

instruments, based on their nominal amounts, do

not take account of any compensating changes in

the value of the underlying transaction. Moreover,

the fair values disclosed do not necessarily corre-

spond to the amounts which the BMW Group will

realise in the future under the market conditions pre-

vailing at that time.

carrying amounts) and maturities of derivative finan-

cial instruments of the BMW Group are shown in the

following analysis:

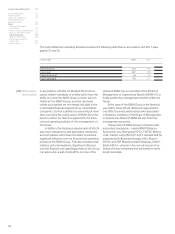

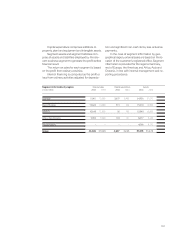

The currency hedge contracts comprise princi-

pally forward currency contracts which are desig-

nated as a cash flow hedge. The interest rate con-

tracts include swaps which are accounted for on the

basis of whether they are designated as a fair value

hedge or as a cash flow hedge.

The fair values of financial instruments relating

to hedged forecast transactions are recognised

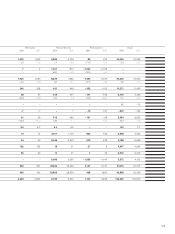

in euro million Nominal Fair values

amount

To t a l

due within due between due later than

one year one and five years

five years

31 December 2004

Assets

Currency hedge contracts 13,833 1,844 1,390 453 1

Interest rate contracts 9,608 813 124 495 194

Other derivative financial instruments 114 17 8 9 –

Total 23,555 2,674 1,522 957 195

Liabilities

Currency hedge contracts 3,189 237 124 91 22

Interest rate contracts 7,043 38 8 27 3

Other derivative financial instruments 646 107 105 2 –

Total 10,878 382 237 120 25

31 December 2003

Assets

Currency hedge contracts 16,877 2,957 1,824 1,090 43

Interest rate contracts 9,217 567 65 146 356

Other derivative financial instruments 600 19 12 – 7

Total 26,694 3,543 1,901 1,236 406

Liabilities

Currency hedge contracts 3,169 190 102 88 –

Interest rate contracts 5,527 108 52 43 13

Other derivative financial instruments 639 74 65 – 9

Total 9,335 372 219 131 22