BMW 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Management Report 8

A review of the Financial Year 8

Outlook 29

Financial Analysis 30

--Earnings performance 30

--Financial position 33

--Net assets position 34

--Events after the

Balance Sheet date 37

--Value added statement 37

--Key performance figures 39

--Comments on the financial

statements of BMW AG 40

Risk Management 44

BMW Stock in 2004 48

34

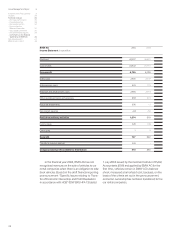

Net interest-bearing assets (cash and cash

equivalents and marketable securities less debt) re-

lating to industrial operations increased by euro 547

million to euro 2,363 million.

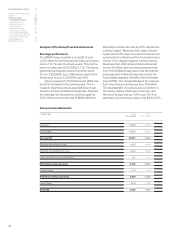

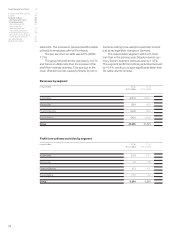

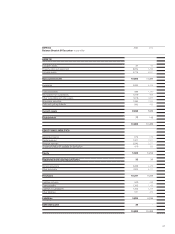

Net assets position

The balance sheet total of the BMW Group increased

by euro 5,940 million or 9.7% to euro 67,415 million.

The main factors behind this increase on the assets

side of the balance sheet were the increased level of

receivables from sales financing (+14.1%), property,

plant and equipment (+10.5%), leased products

(+12.0%), inventories (+13.6%) and intangible assets

(+17.4%). On the equity and liabilities side of the

balance sheet, the main changes occurred in equity

(+8.5%), debt (+11.1%) and deferred income

(+86.1%). Currency factors, mainly in connection

with the low exchange rate of the US dollar reduced

the balance sheet total by euro1,322 million.Adjusted

for changes in exchange rates, the balance sheet

total would have risen by 12.1%.

Intangible assets increased by 17.4% to euro

3,758 million. Within intangible assets, capitalised

development costs increased by 16.1% to euro

3,495 million. Development costs recognised as

assets during the financial year 2004 amounted to

euro1,121 million (+12.6 %), equivalent to a capitali-

sation ratio of 39.8 % (2003: 38.9%). Depreciation

and disposals amounted to euro 637 million (+9.3%).

The total carrying amount of property, plant and

equipment increased by 10.5% to euro 10,724 mil-

lion. The bulk of capital expenditure related to new

construction for and expansion of production plants.

In total, euro 3,079 million was invested in property,

plant and equipment (–2.3%). Total depreciation

and disposals, including currency impact, amounted

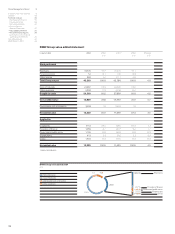

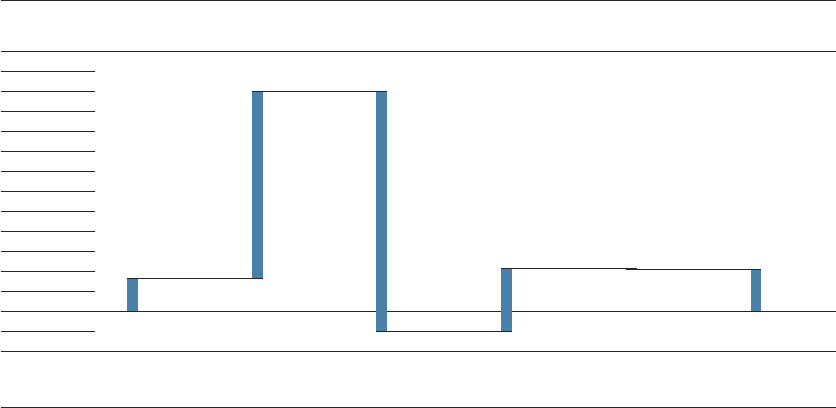

Change in cash and cash equivalents

in euro million

12,000

11,000

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

–1,000

Cash and cash

equivalents

31.12. 2003

Cash inflow from

operating activities

Cash outflow from

investing activities

Cash inflow from

financing activities

Currency trans-

lation, changes in

group composition

Cash and cash

equivalents

31.12.2004

1,659

+9,311 – 11,957

+3,137 –22 2,128