BMW 2004 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.124

Other Information 116

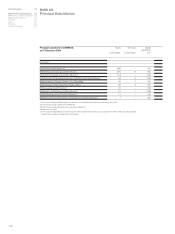

BMW AG

Principal Subsidiaries

116

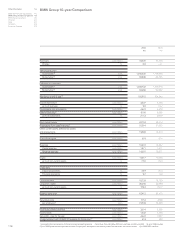

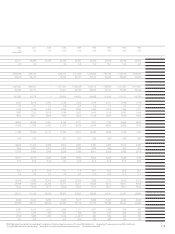

BMW

Group10-year Comparison

118

BMW Group Locations 120

Glossary 122

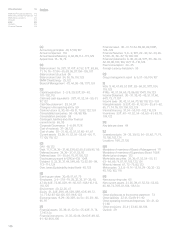

Index 126

Contacts 128

Financial Calendar 129

[Internal financing]

Internal financing is defined by the BMW Group as

profit from ordinary activities less actual tax pay-

ments and adjusted for depreciation and amortisa-

tion and significant non-cash items.

[Multi-stage charging process]

See Variable Twin Turbo Technology.

[Non-current assets]

Intangible assets: expenses for formation and expan-

sion of business operations, concessions, patents,

licences, design patents, trade marks, goodwill, de-

velopment costs, know-how, etc.

Property, plant and equipment: land and buildings,

plant and machinery, other facilities, factory and office

equipment and construction in progress.

Financial assets: investments in subsidiaries, invest-

ments

in associated companies,

loans

(with a maturity

of more than five years) to subsidiaries and to other

companies in which shares are held, investments

in other companies, long-term marketable securities,

other loans.

Leased products: from operating leases.

[Preferred stock]

Stock which receives a higher dividend than com-

mon stock, but without voting rights.

[Principal subsidiaries]

Subsidiaries are those enterprises which, either

directly or indirectly, are under the uniform control of

the management of BMW AG or in which BMW AG,

either directly or indirectly

– holds the majority of the voting rights

– has the right to appoint or remove the majority of

the members of the Board of Management or

equivalent governing body, and in which BMW AG

is at the same time (directly or indirectly) a share-

holder

– has control (directly or indirectly) over another

enterprise on the basis of a control agreement or

a provision in the statutes of that enterprise.

[Production network]

The BMW Group production network consists

worldwide of 16 plants, five assembly plants and one

contract production plant. Within this network, the

plants supply one another with systems and com-

ponents and are all characterised by a high level of

productivity, agility and flexibility.

[Rating]

Standardised evaluation of a company’s credit

standing which is widely accepted on the global

capital markets. Ratings are published by inde-

pendent rating agencies e.g. Standard& Poor’s or

Moody’s based on their analysis of a company.

[Return on sales]

The ratio of the profit from ordinary activities to

Group revenues. For segment reporting purposes,

the computation is based on the profit before finan-

cial result.

[Risk management]

An integral component of all business processes.

Following enactment of the Law on Control and

Transparency within Businesses (KonTraG), all

companies listed on a stock exchange in Germany

are required to set up a risk management system.

The purpose of this system is to identify risks at an

early stage which could have a significant adverse

effect on the assets, liabilities, financial position and

results of operations and which could endanger the

continued existence of the company. This applies

in particular to transactions involving risk, errors in

accounting or financial reporting and violations of

legal requirements. The Board of Management is

required to set up an appropriate system, to docu-

ment

that system and monitor it regularly with the

aid of the internal audit department.