BMW 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.82

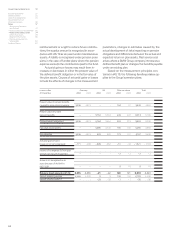

The Group Statement of Changes in Equity is shown

on page 56.

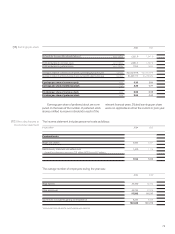

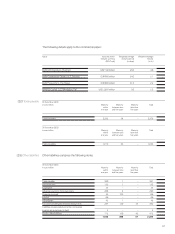

Number of shares issued

At 31 December 2004, issued BMW AG common

stock was divided, as in the previous year, into

622,227,918 shares with a par-value of one euro.

Issued BMW AG preferred stock was divided into

52,196,162 non-voting shares, unchanged from

the previous year, each with a par-value of one euro.

All of the company’s stock is issued in the form of

bearer shares. Preferred stock bears an advance

profit (additional dividend) of euro 0.02 per share.

895,045 of the shares of preferred stock are only

entitled to receive dividends with effect from the be-

ginning of the financial year 2005.

In the period from February to November 2004,

BMW Group acquired 895,045 of its own (treasury)

preferred stock shares at an average price of euro

24.16 per share; these shares were sold to employees

at a reduced price of euro 14.26 per share in con-

junction with an employee share scheme. As a

result of the repurchase of treasury shares and their

subsequent issue, the company’s share capital re-

mained unchanged at euro 674 million during 2004

(2003: increase of euro 0.7 million in conjunction with

the issue of new shares out of authorised capital).

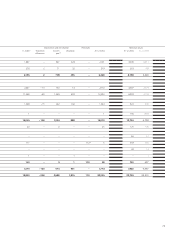

Capital reserves

The capital reserves comprise additional paid in capi-

tal on the issue of shares and remained unchanged

at euro 1,971 million.

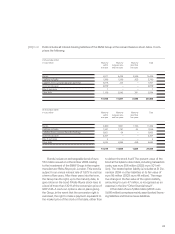

Revenue reserves

Revenue reserves are disclosed in accordance with

the disclosure requirements contained in German

commercial law. They comprise the post-acquisition

and non-distributed earnings of consolidated group

companies. In addition, revenue reserves include both

positive and negative goodwill arising on the

consoli-

dation of group companies prior to 31December1994.

Revenue reserves increased during the year by

14.4% to euro 14,501 million. They were increased

in 2004 by the amount of the net profit for the year

of euro 2,222 million und were reduced by the pay-

ment of the dividend for 2003 amounting to euro

392 million.

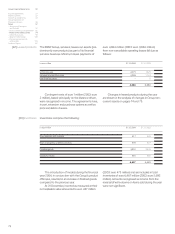

The unappropriated profit of BMW AG of euro

419 million will be proposed to the Annual General

Meeting for distribution. As in the previous year, the

proposed dividend will not give rise to a tax credit

relating to the corporation tax system applicable until

2001, since, following the enactment of the Tax

Preference Reduction Act on 16 May 2003, the tax

benefit on distributed profits was suspended until

the end of 2005.The tax reduction benefits of euro

133 million, resulting from the previous corporation

tax system, can be realised in specific annual amounts

during the period from 2006 to 2019. As a result of

the maximum amount regulations which apply for

each dividend year, the total amount will not be fully

utilised before 2019.

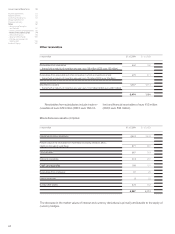

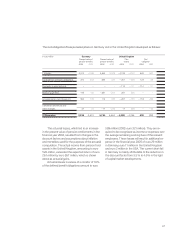

Accumulated other equity

Accumulated other equity consists of all amounts

recognised directly in equity resulting from the

translation of the financial statements of foreign

subsidiaries. It also includes the effects (net of de-

ferred tax) of recognising changes in the fair value

of financial instruments directly in equity. Accumu-

lated other equity includes deferred tax liabilities

of euro 704 million (2003: euro 1,102 million) which

have been recognised directly in equity.

Minority interest

As a result of the insignificance of the minority share-

holders’ interest in the equity of the group’s sub-

sidiaries, minority interest is not reported separately.

Minority interest in the share capital of sub-

sidiaries amounts to euro 0.312 million (2003: euro

0.297 million). Of this amount, euro 0.311 million

(2003: euro 0.286 million) relates to the minority

shareholder Euro Lloyd Reisebüro GmbH& Co.KG,

Cologne, and euro 0.001 million (2003: euro 0.011

million) to the minority shareholder Norddeutsche

Landesbank Girozentrale, Braunschweig.

Group Financial Statements 50

Income Statements 51

Balance Sheets 52

Cash Flow Statements 54

Group Statement of

Changes in Equity 56

Notes 57

--Accounting Principles

and Policies 57

--Notes to the Income Statement 66

--Notes to the balance sheet 74

--Other Disclosures 93

--Segment Information 100

--Disclosures pursuant to

§292a HGB

104

Auditors’ Report 107

[28]Equity