BMW 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other provisions are recognised when the

Group has an obligation to a third party, an outflow of

resources is probable and a reliable estimate can be

made of the amount of the obligation. Measurement

is computed on the basis of fully attributable costs.

Non-current provisions with a remaining period of

more than one year are discounted to the present

value of the expenditures expected to settle the obli-

gation at the balance sheet date.

Financial liabilities are measured on first-time

recognition at cost, which is equivalent to the fair

value of the consideration given. Transaction costs

are included in this initial measurement. Subsequent

to initial recognition, liabilities are, with the exception

of derivative financial instruments, measured at

amortised cost. The BMW Group has no liabilities

which are held for trading. Liabilities from finance

leases are stated at the present value of the future

lease payments and disclosed under debt.

The preparation of the Group financial state-

ments in accordance with standards issued by the

IASB requires management to make certain assump-

tions and estimates that affect the reported amounts

of assets and liabilities, revenues and expenses and

contingent liabilities. The assumptions and esti-

mates relate principally to the group-wide determi-

nation of economic useful lives, the recognition and

measurement of provisions and the recoverability

of future tax benefits. Actual amounts could in certain

cases differ from those assumptions and estimates.

Where new information becomes available, dif-

ferences

are reflected in the income statement.

65

[7]New accounting

rules

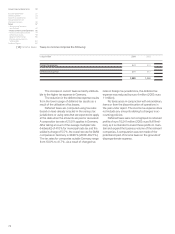

The IASB has issued ten new or revised Standards or

amendments to existing Standards in 2004, as follows:

–IFRS 2 (Share-based Payment)

–IFRS 3 (Business Combinations)

–IFRS 4 (Insurance Contracts)

–IFRS 5 (Non-current Assets Held for Sale and

Discontinued Operations)

–IFRS 6 (Exploration for and Evaluation of Mineral

Resources)

–IAS 36 (Impairment of Assets)

–IAS 38 (Intangible Assets)

– Amendment to IAS 19 (Employee Benefits:

Actuarial Gains and Losses, Group Plans and

Disclosure)

– Amendment to IAS 39 (Financial Instruments:

Recognition and Measurement on Fair Value

Hedge Accounting for a Portfolio Hedge of

Interest Rate Risk)

– Amendment to IAS 39 (Financial Instruments:

Transition and Initial Recognition of Financial

Assets and Financial Liabilities)

IFRS 3 is required to be applied (in conjunction

with the relevant provisions of IAS 36 and IAS 38) for

all business combinations for which the agreement

date is 31 March 2004 or later.The effect of applying

this Standard in the BMW Group financial state-

ments at 31 December 2004 was not significant.

IFRS 3, IAS 36 und IAS 38 must be applied prospec-

tively by the BMW Group, from 1 January 2005 on-

wards, for goodwill and intangible assets arising from

earlier business combinations and for investments

accounted for using the equity method.

The remaining Standards listed above (except

for IFRS 6 and Amendment to IAS 19) become

mandatory from 1 January 2005 onwards. IFRS 6

and Amendment to IAS 19 do not become manda-

tory until 1 January 2006.

With the exception of IFRS 3, the new, revised

and amended Standards were not applied before

their mandatory date in the Group financial state-

ments

at 31 December 2004.This also applies to the

Improvements to International Accounting Standards