BMW 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Financial Statements 50

Income Statements 51

Balance Sheets 52

Cash Flow Statements 54

Group Statement of

Changes in Equity 56

Notes 57

--Accounting Principles

and Policies 57

--Notes to the Income Statement 66

--Notes to the balance sheet 74

--Other Disclosures 93

--Segment Information 100

--Disclosures pursuant to

§292a HGB

104

Auditors’ Report 107

62

For machinery used in multiple-shift operations,

depreciation rates are increased to account for the

additional utilisation.

The cost of internally constructed plant and

equipment comprises all costs which are directly

attributable to the manufacturing process and an

appropriate portion of production-related overheads.

This includes production-related depreciation and

an appropriate proportion of administrative and social

costs.

Financing costs are not included in acquisition

or manufacturing costs.

Non-current assets also include assets relating

to leases. The BMW Group uses property, plant

and equipment as lessee and also leases assets,

mainly vehicles manufactured by the Group, as les-

sor. IAS 17 (Leases) contains rules for determining,

on the basis of the risks and rewards of the lease,

the economic owner of the assets. In the case of

finance leases, the assets are attributed to the lessee

and in the case of operating leases, the assets are

attributed to the lessor.

In accordance with IAS 17, assets leased under

finance leases are measured at their fair value at the

Expenditure on low value non-current assets is

written off in full in the year of acquisition.

inception of the lease or at the present value of the

lease payments, if lower. The assets are depreciated

using the straight-line method over their estimated

useful lives or over the lease period, if shorter. The

obligations for future lease instalments are recog-

nised as liabilities within debt.

Where Group products are recognised by

BMW Group leasing companies as leased assets

under operating leases, they are measured at manu-

facturing cost. All other leased products are meas-

ured at acquisition cost. All leased products are

depreciated using the straight-line method over the

period of the lease to the lower of their imputed

residual value or estimated fair value.

The recoverability of the carrying amount of

intangible assets (including capitalised develop-

ment costs and goodwill) and property, plant and

equipment is tested regularly for impairment in

accordance with IAS 36 (Impairment of Assets) on

the basis of cash generating units. An impairment

loss is recognised when the recoverable amount

(defined as the higher of the asset’s net selling

price and its value in use) is lower than the carrying

amount. If the reason for the previously recognised

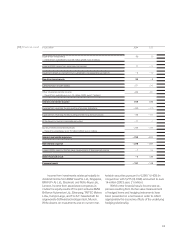

in years

Residential buildings 40 to 50

Office and factory buildings, including utility distribution buildings 10 to 40

Plant and machinery 5 to 10

Other facilities, factory and office equipment 3 to 10

Systematic depreciation is based on the fol-

lowing useful lives, applied throughout the Group: