BMW 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200

|

|

Group Financial Statements 50

Income Statements 51

Balance Sheets 52

Cash Flow Statements 54

Group Statement of

Changes in Equity 56

Notes 57

--Accounting Principles

and Policies 57

--Notes to the Income Statement 66

--Notes to the balance sheet 74

--Other Disclosures 93

--Segment Information 100

--Disclosures pursuant to

§292a HGB

104

Auditors’ Report 107

70

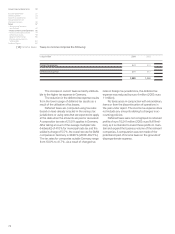

The increase in current taxes is mainly attributa-

ble to the higher tax expense in Germany.

The reduction in the deferred tax expense results

from the lower usage of deferred tax assets as a

result of the utilisation of tax losses.

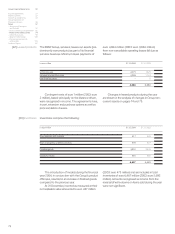

Deferred taxes are computed using tax rates

based on laws already enacted in the various tax

jurisdictions or using rates that are expected to apply

at the date when the amounts are paid or recovered.

A corporation tax rate of 25.0% applies in Germany.

After taking account of the average multiplier rate

(Hebesatz) of 410% for municipal trade tax and the

solidarity charge of 5.5%, the overall tax rate for BMW

companies in Germany is 38.90% (2003: 40.21%).

The tax rates for companies outside Germany range

from 10.0% to 41.7%. As a result of changed tax

rates in foreign tax jurisdictions, the deferred tax

expense was reduced by euro 4 million (2003: euro

11 million).

No taxes arose in conjunction with extraordinary

items or from the discontinuation of operations in

the year under report. The income tax expense does

not include any amounts relating to changes in ac-

counting policies.

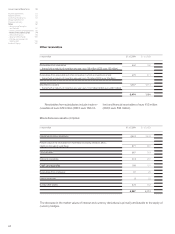

Deferred taxes were not recognised on retained

profits of euro 10,541 million (2003: euro 9,419 mil-

lion), as it is intended to invest these profits to main-

tain and expand the business volume of the relevant

companies. A computation was not made of the

potential impact of income taxes on the grounds of

disproportionate expense.

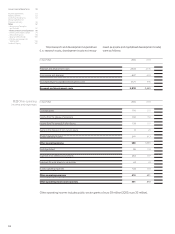

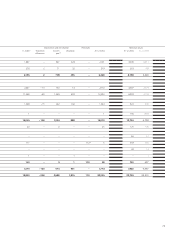

Taxes on income comprise the following:

[14]Income taxes

in euro million 2004 2003

Current tax expense 841 441

Deferred tax expense 491 817

1,332 1,258