BMW 2004 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

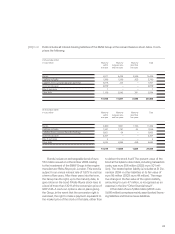

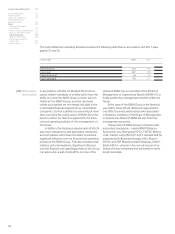

The fair values shown are computed using mar-

ket information available at the balance sheet date,

on the basis of prices quoted by the contract partners

or using appropriate measurement methods, e.g.

These interest rates were adjusted, where necessary, to take account of the credit quality and risk of the un-

derlying financial instrument.

discounted cash flow models. In the latter case,

amounts were discounted at 31 December 2004 on

the basis of the following interest rates:

95

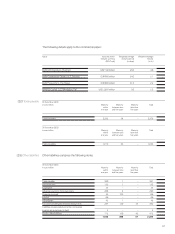

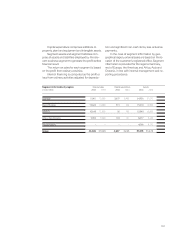

Use and control of financial instruments

As an enterprise with worldwide operations, business

is conducted in a variety of currencies, from which

exchange rate risks arise. The BMW Group’s opera-

tions are financed in various currencies, mainly by

the issue of bonds and medium term notes and

through bank loans. The BMW Group’s financial

management system involves the use of standard

types of financial instruments, e.g. short-term de-

posits, investments in variable and fixed-income se-

curities as well as securities funds. The BMW Group

is therefore exposed to risks resulting from changes

in interest rates, stock market prices and exchange

rates. Financial instruments are only used to hedge

underlying positions or forecasted transactions.

Protection against such risks is provided at first

instance though natural hedging which arises when

the values of non-derivative financial instruments

have matching maturities and amounts (netting).

Derivative financial instruments are used to reduce

the risk remaining after netting.

The scope of permitted transactions, responsi-

bilities, financial reporting procedures and control

mechanisms used for financial instruments are set

out in internal guidelines. This includes, above all, a

clear separation of duties between trading and pro-

cessing. Exchange rate, interest rate and liquidity

risks of the BMW Group are managed at a corporate

level. At 31 December 2004, derivative financial in-

struments were in place to hedge exchange rate

risks, in particular for the currencies US Dollar, British

Pound and Japanese Yen.

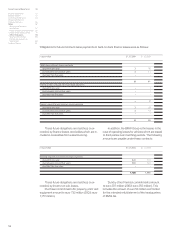

Quantitative disclosures on financial

instruments

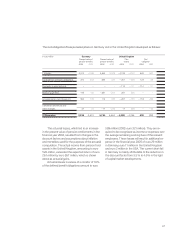

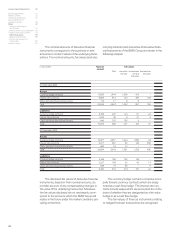

The carrying amount and the fair value of material

non-derivative financial instruments are set out in

the following table:

[36]Financial

instruments

in euro million 31.12. 2004 31.12. 2003

Carrying Fair value Carrying Fair value

amount amount

Receivables from sales financing 25,054 25,448 21,950 22,199

Debt 30,483 30,421 27,449 27,410

ISO Code EUR USD GBP JPY

in %

Interest rate for six months 2.2 2.8 4.9 0.1

Interest rate for one year 2.3 3.1 4.9 0.1

Interest rate for five years 3.2 4.1 4.9 0.7

Interest rate for ten years 3.8 4.7 4.9 1.5