BMW 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Management Report 8

A review of the Financial Year 8

Outlook 29

Financial Analysis 30

--Earnings performance 30

--Financial position 33

--Net assets position 34

--Events after the

Balance Sheet date 37

--Value added statement 37

--Key performance figures 39

--Comments on the financial

statements of BMW AG 40

Risk Management 44

BMW Stock in 2004 48

16

General economic conditions relating to

financial services business

Financial services business in 2004 benefited from

the improvement in the global economy and the

resulting tighter monetary policies imposed by some

central banks. The US Federal Reserve Bank in-

creased key lending rates in moderate steps from

1% to 2.25%; interest rates were also increased,

for example, in the United Kingdom and Switzerland.

By contrast, the European Central Bank and the

Japanese Reserve Bank did not change key interest

rates in 2004. Interest yield curves (in particular the

US dollar yield curve), which were steep at the be-

ginning of the year, became much flatter by the year-

end, extremely so in the case of the United Kingdom.

With money market interest rates increasing in the

USA, albeit at a much slower pace, five-year capital

market interest rates rose, whereas those for ten and

thirty year periods remained virtually at the levels of

one year earlier.

The financial services sector reacted to the re-

sulting pressure on margins by further measures to

optimise processes and improve efficiency. The

availability of funds on the money and capital mar-

kets further exacerbated the intensely competitive

situation.

Continuing growth for the Financial Services

segment

The Financial Services segment was again able to

expand business successfully for another year in

suc-

cession. The business volume of the segment in

balance sheet terms rose by 13.6% to euro 32,556

million.The proportion of new cars of the BMW Group

leased or financed by the Financial Services segment

increased by 3.7 percentage points to 42.0%.

At the year-end, a total of 1,843,399 credit or

lease contracts were in place with dealers or retail

customers, 13.5% more than one year earlier.

Regional expansion continued

The Financial Services segment pushed ahead with

its regional expansion. In the course of the year, for

example, eight new ventures, based on cooperation

agreements, started their operations in Europe,

Asia and America. The Financial Services segment

now sells its products through 24 group entities

and 24 cooperation arrangements, and is therefore

represented in 48 countries.

Sharp increase in retail customer business

In total, 817,597 new contracts were signed with

retail customers in 2004, 15.1% more than in 2003.

The number of new contracts significantly surpassed

the previous year’s figure, both in the area of lease

contracts (+29.6%) and credit contracts (+8.5%).

As a result of the faster growth of lease business,

mainly relating to the higher number of contracts for

new vehicles manufactured by the BMW Group, lease

business now accounts for 35.4% of all customer

retail business. The Financial Services segment also

registered a 15.8% increase in the financing of used

cars, with the majority of new contracts relating to

used BMW brand cars.

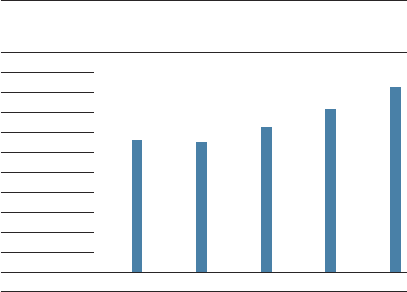

Contract portfolio of BMW Financial Services

in 1,000 units

2,000

1,800

1,600

1,400

1,200

1,000

800

600

400

200

00 01

1,317 1,298

02

1,443

03

1,623

04

1,843