BMW 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Management Report 8

A review of the Financial Year 8

Outlook 29

Financial Analysis 30

--Earnings performance 30

--Financial position 33

--Net assets position 34

--Events after the

Balance Sheet date 37

--Value added statement 37

--Key performance figures 39

--Comments on the financial

statements of BMW AG 40

Risk Management 44

BMW Stock in 2004 48

26

two percentage points each to 53% and 19%

respectively. The volume purchased in South

America, Africa, Central Europe and Eastern Europe

increased in proportion to the overall increase in

purchases and therefore remains constant in per-

centage terms.

As a consequence of the weaker US dollar and

the reduction in production volume for the Z4, the

proportion of purchases made in the NAFTA region

fell by three percentage points to 13%. In US dollar

terms, purchases from NAFTA countries by the

BMW Group fell by only 3%. Purchases in Asia and

Australia rose in absolute terms as a result of the

BMW Group’s activities in China, but fell in percent-

age terms by one percentage point to 2% because

of the above-average rise in purchases in Germany

and Western Europe.

Raw material markets under strain

Price increases and the supply of raw materials were

particularly important factors for the BMW Group in

2004, whereby market developments affecting steel

and crude oil were at the forefront. Steel prices rose

sharply, especially in the final quarter of 2004. For

example, the average price of cold-rolled steel plate

in 2004 was approximately 15% higher than in 2003.

The overall industrial commodity index rose by 15%

in US dollar terms and by 7% in euro terms. The

price of non-ferrous metals rose by 20 % in US

dollar terms and by 12% in euro terms. Thanks to

the strong euro, EU countries were not as affected

as much other economies by the increase in raw

material prices on the world’s markets.

To a large extent, long-term contracts were in

place in 2004 to hedge the price of the main raw

materials (steel,plastic) purchased bythe BMW Group.

In the case of precious metals (rhodium, palladium,

platinum), prices were managed with the aid of price

hedging arrangements.

Management of partner networks

The “Management of Partner Networks” (MoPN)

project has been initiated to take better advantage

of procurement market opportunities. This project

is intended to take effect at the early stage of a

product’s development and is meant to optimise

BMW Group’s exploitation of procurement market

opportunities in terms of innovation, system expertise

and non-automotive sector know-how. The focus of

MoPN in 2004 was to integrate system and module

suppliers for complex product groups (e.g. in the

area of chassis and doors) into the early stages of

the Product Evolution Process (PEP). This allows

solutions to procurement issues to be identified at

an early stage and provides a basis for measuring the

benefits of integrating the various partner networks

into the PEP concept.

Sustainability fixed in cooperation with new

partners

In 2003, the BMW Group formally integrated the

principles of sustainability into its procurement

terms and conditions. In this way, the BMW Group

encourages and supports its business partners and

suppliers to introduce and implement standards of

a similar high level, in particular those pertaining to

environmental care and social issues. Sustainability

principles have been applied in 2004 in a whole range

of processes, from supplier selection through to the

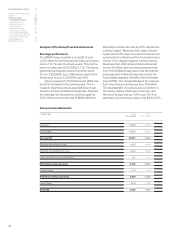

Regional mix of BMW Group purchase volumes 2004

in %, basis: production material

Germany

Rest of Western Europe

NAFTA

Central and Eastern Europe

Africa

Asia/Australia

South America 8

13

3

2

2

19

53