BMW 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200

|

|

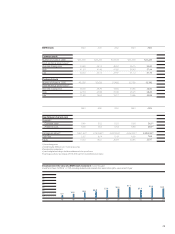

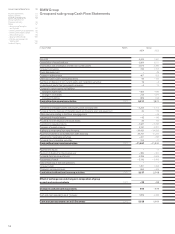

55

Industrial operations Financial operations

2004 2003 2004 2003

1,981 1,695 449 427 Net profit

562,390 2,146 Depreciation of leased products

2,660 2,369 15 21 Depreciation and amortisation of other non-current assets

653 1,157 98 –Increase in provisions

–49 ––Rover disengagement

482 787 111 167 Change in deferred taxes

63 –59 32 –85 Other non-cash income and expense items

19 –6 –2Gain/loss on disposal of non-current assets and marketable securities

–4 13 ––Undistributed results from associated companies

Changes in current assets and liabilities

– 864 – 651 –1 11 Change in inventories

472 –1,084 – 344 – 662 Change in receivables

690 694 404 874 Increase in liabilities

6,157 4,970 3,154 2,901 Cash inflow from operating activities

– 4,225 – 4,094 –18 –21 Investment in intangible assets and property, plant and equipment

40 114 25

Proceeds from the disposal of intangible assets and property, plant and equipment

––49 ––Other payments relating to the Rover disengagement

–34 –153 –9 –6 Investment in financial assets

31 52 38Proceeds from the disposal of financial assets

– 337 – 283 – 6,990 – 5,502 Investment in leased products

336 240 2,861 2,467 Disposals of leased products

––– 38,432 – 34,593 Additions to receivables from sales financing

––34,741 31,246 Payments received on receivables from sales financing

– 241 – 700 ––Investment in marketable securities

315 27 ––Proceeds from marketable securities

– 4,115 – 4,846 – 7,842 – 6,396 Cash outflow from investing activities

–17 –11 Payment into equity

– 392 – 351 ––Payment of dividend for the previous year

––4,339 5,669 Proceeds from the issue of bonds

––– 3,126 – 3,483 Repayment of bonds

– 1,074 – 425 1,074 425 Internal financing of financial operations

175 116 1,276 1,248 Increase in debt

–– 494 865 46 Change in commercial paper

– 1,291 – 1,137 4,428 3,916 Cash inflow/outflow from financing activities

Effect of exchange rate and changes in composition of group

–1 4–21 –86 on cash and cash equivalents

750 – 1,009 – 281 335 Change in cash and cash equivalents

1,247 2,256 412 77 Cash and cash equivalents as at 1 January

1,997 1,247 131 412 Cash and cash equivalents as at 31 December