BMW 2004 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

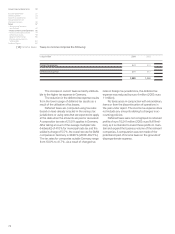

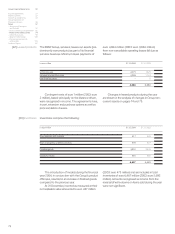

The minority interest in profit totalling euro 0.238 mil-

lion (2003: euro 0.235 million) comprises euro

0.246 million (2003: euro 0.223 million) relating

to the minority shareholder Euro Lloyd Reisebüro

The net amount shown on the line tax reduc-

tions/tax increases is attributable in 2004 primarily to

the higher level of tax-exempt income.The increase

in the line tax expense/benefits for prior periods is

attributable primarily to tax payments for previous

years.

GmbH& Co.KG, Cologne, and euro 0.008 million

(2003: euro 0.012 million) relating to the minority

shareholder Norddeutsche Landesbank Girozentrale,

Braunschweig.

Group Financial Statements 50

Income Statements 51

Balance Sheets 52

Cash Flow Statements 54

Group Statement of

Changes in Equity 56

Notes 57

--Accounting Principles

and Policies 57

--Notes to the Income Statement 66

--Notes to the balance sheet 74

--Other Disclosures 93

--Segment Information 100

--Disclosures pursuant to

§292a HGB

104

Auditors’ Report 107

72

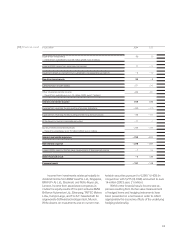

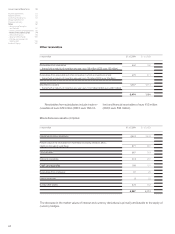

on deferred tax assets relating to capital allowances

in the United Kingdom which is shown above in

property, plant and equipment. The valuation al-

lowance decreased in total by euro 220 million in

2004 (2003: euro 204 million). A deferred tax ex-

pense of euro127 million (2003: euro 75 million)

arose in the United Kingdom from the utilisation of

tax losses and capital allowances.

Interest and currency derivatives recognised

directly in equity were euro 1,034 million (gross)

lower at the end of 2004 than one year earlier as

a result of reduced volumes and lower fair values.

Deferred tax liabilities recognised directly in equity

fell correspondingly by euro 406 million.

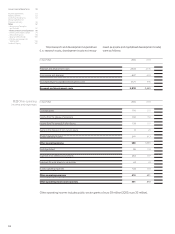

The actual tax expense for the financial year

2004 of euro 1,332 million (2003: euro 1,258 mil-

lion) is euro 51 million (2003: euro 31 million) lower

than the expected tax expense of euro 1,383 mil-

lion (2003: euro 1,289 million) which would theoreti-

cally arise if the tax rate of 38.90% (2003: 40.21%),

applicable for German companies, was applied

across the Group. The difference between the ex-

pected and actual tax expense is attributable to the

following:

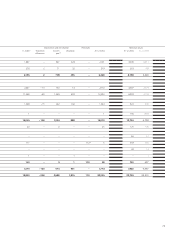

in euro million 2004 2003

Expected tax expense 1,383 1,289

Variances due to different tax rates – 115 – 101

Tax reductions (–)/tax increases (+) as a result of non-taxable income and

non-deductible expenses –77 36

Tax expense (+)/benefits (–) for prior periods 198 102

Other variances –57 –68

Actual tax expense 1,332 1,258

[15]Minority interest