BMW 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200

|

|

80

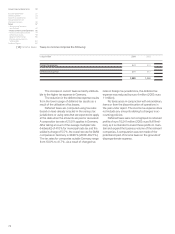

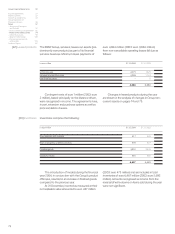

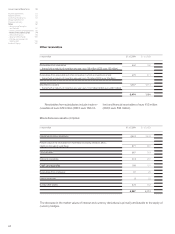

Other receivables

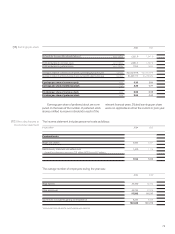

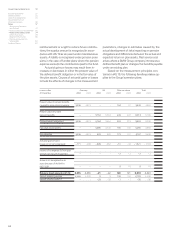

The decrease in the market values of interest and currency derivatives is primarily attributable to the expiry of

currency hedges.

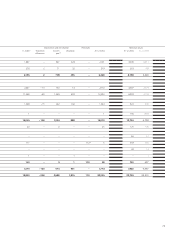

Receivables from subsidiaries include trade re-

ceivables of euro 229 million (2003: euro 166 mil-

Miscellaneous assets comprise:

lion) and financial receivables of euro 613 million

(2003: euro 594 million).

Group Financial Statements 50

Income Statements 51

Balance Sheets 52

Cash Flow Statements 54

Group Statement of

Changes in Equity 56

Notes 57

--Accounting Principles

and Policies 57

--Notes to the Income Statement 66

--Notes to the balance sheet 74

--Other Disclosures 93

--Segment Information 100

--Disclosures pursuant to

§292a HGB

104

Auditors’ Report 107

in euro million 31.12.2004 31.12. 2003

Receivables from subsidiaries 842 760

– thereof with a maturity of more than one year: euro 168 million (2003: euro193 million)

Receivables from associated and other companies in which an investment is held 275 311

– thereof with a maturity of more than one year: euro 10 million (2003: euro10 million)

Miscellaneous assets 5,357 6,113

– thereof with a maturity of more than one year: euro 1,512 million (2003: euro 2,887 million)

6,474 7,184

in euro million 31.12.2004 31.12. 2003

Interest and currency derivatives 2,674 3,543

Present value of the receivable from Ford Motor Company, Dearborn, Mich.,

relating to the sale of Land Rover 971 867

Tax receivables 667 763

Collateral receivables 313 257

Credit card receivables 168 151

Receivables from employees 31 28

Interest receivable 9 22

Sundry other assets 524 482

5,357 6,113