BMW 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

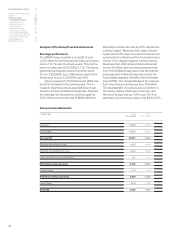

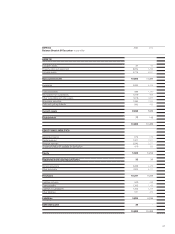

Revenues of the Motorcycles segment fell by

2.5% as a result of volume and currency factors.

The segment profit from ordinary activities was

down by 38.0% as a result of one-time expenditure

relating to the start of new model series and delays

in the production start of the K1200 S.

The Financial Services segment was again

able to expand business successfully in 2004.

The segment profit from ordinary activities im-

proved by 13.9% compared to the previous year.

This very positive performance was attributable

once again to higher business volumes and lower

costs.

As in the previous year, reconciliations to the

Group profit from ordinary activities were negative

overall; the net expense increased by euro 93 million

in 2004. This was due partly to the higher level of

eliminations of inter-segment profit on leased as-

sets relating to financial services and partly to the

change in the fair value of the exchangeable bond

option relating to the BMW Group investment in

Rolls-Royce plc.

Financial Position

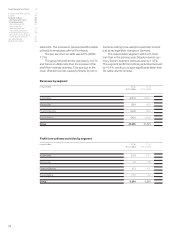

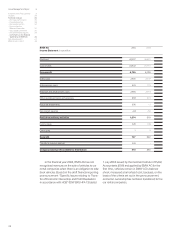

The cash flow statements of the BMW Group and

its sub-groups show the sources and applications

of cash flows for the financial years 2004 and 2003,

classified into cash flows from operating, investing

and financing activities.

Beginning with the net profit for the year, the

cash flows from operating activities are computed

using the indirect method. Cash flows from investing

and financing activities are based on actual cash

payments and receipts. Cash and cash equivalents

in the cash flow statement correspond to those dis-

closed in the balance sheet.

Operating activities of the BMW Group during

the financial year 2004 generated a positive cash

flow of euro 9,311 million, an increase of euro 1,440

million or 18.3% over the previous year. Changes in

net current assets gave rise to a net cash inflow of

euro 222 million in 2004, compared to a net cash

outflow of euro 899 million in 2003. Inventories

resulted in a net cash outflow, whereas receivables

generated a net cash inflow due to the reduction in

trade receivables, as did liabilities, mainly as a result

of the increase in trade payables.

The cash outflow from investing activities

amounted to euro 11,957 million, an increase of

euro 726 million or 6.5% compared to the previous

year. The higher cash outflow was attributable once

again largely to the sharp increase in the net invest-

ment in financial services business. On a net basis,

this was euro 1,396 million higher than in the pre-

vious year.

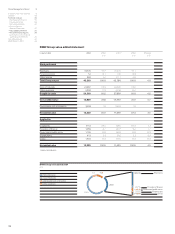

Capital expenditure on intangible assets

and property,

plant and equipment resulted in an

additional cash outflow of euro128 million. 77.9%

(2003: 70.1%) of the cash outflow from investing

activities was covered by the cash inflow from oper-

ating activities.

The cash flow statement for industrial opera-

tions shows that the cash inflow from operating

activities exceeded the cash outflow from investing

activities by 49.6% (2003: 2.6%). By contrast, the

cash flow statement for financial operations shows

that the cash inflow from operating activities fell

short of the cash outflow from investing activities by

59.8 % (2003: 54.6%).

The cash flow from financing activities of the

BMW Group gave rise to a cash inflow of euro

3,137 million which was earmarked to refinance

sales financing activities. The dividend payment in

2004 increased by 11.7% to euro 392 million.

After adjustment for the effects of exchange-

rate fluctuations and changes in the composition of

the BMW Group amounting in total to a net negative

amount of euro 22 million (2003: euro – 82 million)

the various cash flows resulted in an increase in cash

and cash equivalents of euro 469 million (2003: de-

crease of euro 674 million).