BMW 2004 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200

|

|

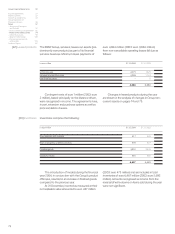

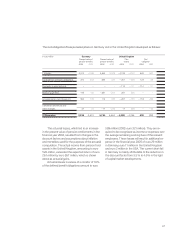

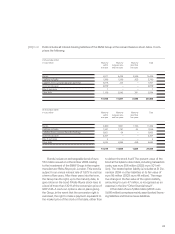

The net obligation from pension plans in Germany and in the United Kingdom developed as follows:

The actuarial losses, which led to an increase

in the present value of pension entitlements in the

financial year 2004, resulted from changes in the

discount factors and assumptions about inflation

and mortalities used for the purposes of the actuarial

computation. The actual income from pension fund

assets in the United Kingdom, amounting to euro

528 million, exceeded the expected return of euro

261 million by euro 267 million, which is shown

above as actuarial gains.

Actuarial losses in excess of a corridor of 10%

of the defined benefit obligations amount to euro

589 million (2003: euro 321 million). They are re-

quired to be recognised as income or expenses over

the average remaining working lives of the relevant

employees. These losses will result in additional ex-

pense in the financial year 2005 of euro 29 million

in Germany, euro 11 million in the United Kingdom

and euro 2 million in the USA. The current short-fall

in Germany is mainly attributable to the reduction in

the discount factor from 5.5% to 4.8% in the light

of capital market developments.

87

in euro million Germany United Kingdom

Present value of Present value of Plan Net

pension benefits pension benefits assets obligation

2004 2003 2004 2003 2004 2003 2004 2003

1 January 2,513 2,186 5,564 5,329 – 4,744 – 4,722 820 607

Expense from pensions obligations 272 203 384 327 – 261 – 239 123 88

Payments to external funds – –––– 112 – 111 – 112 – 111

Pension payments – 59 –56 – 281 – 255 281 255 ––

Actuarial gains (-) and losses (+) 563 139 114 435 – 267 – 155 – 153 280

Translation differences and

other changes 47 41 –17 – 272 17 228 ––44

31 December 3,336 2,513 5,764 5,564 – 5,086 – 4,744 678 820