BMW 2004 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

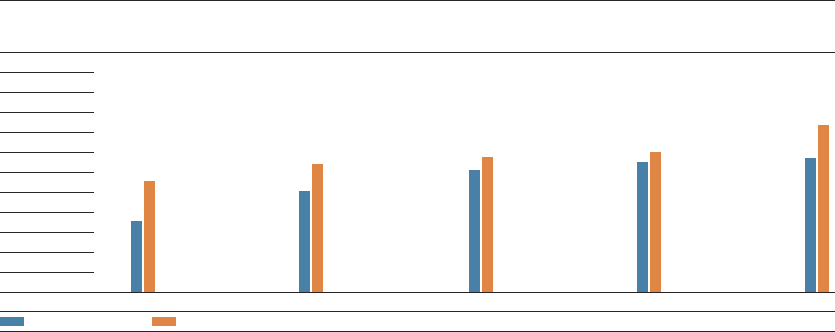

Capital expenditure remains at a high level

The BMW Group invested euro 3,226 million in

property, plant and equipment and intangible assets

in 2004. In addition, development expenditure of

euro1,121 million has been recognised as assets in

accordance with IAS 38, so that total capital expen-

diture for 2004 amounted to euro 4,347 million,

equivalent to an increase of 2.4% compared to the

previous year.

The main emphasis of capital expenditure in

2004 was the construction of the new BMW plant in

Leipzig and expansion of the sales network. In addi-

tion, extensive measures were taken and up-front

expenditure incurred to expand capacities for new

models going into production at existing plants.

At 39.8%, the proportion of development costs

recognised as assets is still relatively low for the in-

dustry (2003: 38.9%).

Including capitalised development costs, the

capital expenditure ratio (i.e. the ratio of capital

expenditure to group revenues) was 9.8% in 2004,

and was thus below the record ratio reported for the

previous year (10.2%).

Cash flow for the year, at euro 5,167 million, in-

creased sharply (15.1%) and, as in previous years,

exceeded capital expenditure.

BMW Group capital expenditure and cash flow

in euro million

6,500

6,000

5,500

5,000

4,500

4,000

3,500

3,000

2,500

2,000

1,500

00

Capital expenditure

01

2,781

3,779 3,516

4,202

02

4,042

4,374

03

4,245

4,490

04

4,347

5,167

Cash flow

Higher revenues despite currency impact

Group revenues in 2004, at euro 44,335 million, were

6.8% ahead of the previous year and hence a new

high for the BMW Group. The weakness of the US

dollar against the euro continued to have an adverse

impact on reported revenues; in the USA in particu-

lar, revenues in euro terms were well below the pre-

vious year despite the fact that a new sales volume

record was set. Worldwide, however, this effect was

more than compensated by the sharp increase in

the number of cars sold. Adjusted for changes in ex-

change rates, revenues of the BMW Group would

have risen by 9.2% compared to the previous year.

Revenues of the Automobiles segment in-

creased by 11.0% to euro 42,544 million and thus

even faster than the growth in sales volume. By con-

trast, revenues of the Motorcycles segment fell by

2.5% to euro 1,029 million as a result of the cur-

rency impact and lower volumes brought about by

prevailing market conditions and model life-cycles.

Revenues of the Financial Services segment for

2004 amounted to euro 8,226 million, an increase

of 8.5% compared to the previous year.