BMW 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

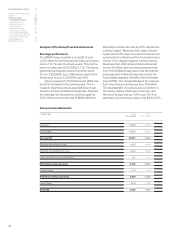

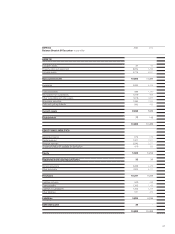

to euro 2,063 million (–0.2%). Balances brought

forward for subsidiaries being consolidated for the

first time amounted to euro 31 million. Capital expen-

diture on intangible assets and property, plant and

equipment totalled euro 4,347million (+2.4%), which,

as in the previous years, was financed fully out of

cash flow. Capital expenditure as a percentage of

revenues was 9.8% (2003: 10.2%).

Financial assets increased by 26.7% to euro

769 million. This was attributable mainly to the fair

value measurement of the investment in the engine

manufacturer Rolls-Royce plc, London. The market

price of this investment rose by euro 154 million

compared to the previous year-end and is now euro

42 million above its historical cost. This increase

in value of the investment was recognised directly

in accumulated other equity.

The total carrying amount of leased products in-

creased sharply (+12.0%) in 2004 to euro 7,502 mil-

lion, despite the adverse currency impact, due to

the positive development of business. Adjusted for

changes in exchange rates, leased products would

have risen by 19.6%.

Inventories rose by 13.6% to euro 6,467 mil-

lion. Above all, the introduction of new models in

conjunction with the Group’s product offensive fur-

ther increased the level of inventories necessary for

operations.

Trade receivables decreased by 17.2% to euro

1,868 million.

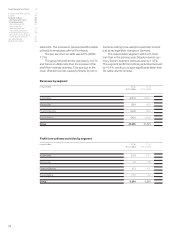

Receivables from sales financing increased by

14.1% to euro 25,054 million as a result of the ex-

pansion of business. Of this amount, customer and

dealer financing accounted for euro 18,782 million

(+14.4%) and finance leases accounted for euro

6,272 million (+13.5%).

Other receivables and assets decreased by

9.9% to euro 6,474 million, mainly as a result of the

lower volume, and fair values, of derivative financial

instruments.

Liquid funds increased by 12.6% to euro 3,960

million. The make-up of liquid funds shifted in favour

of cash and cash equivalents which rose by 28.3%

compared to one year earlier.

Deferred tax assets, at euro 296 million, increased

mainly as a result of the fact that the valuation al-

lowance was euro 121 million lower than at the end

of the previous year.

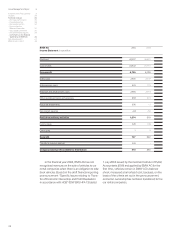

On the equity and liabilities side of the balance

sheet, group equity grew by 8.5% to euro 17,517

million. The group net profit for the year increased

equity by euro 2,222 million, whereas the payment

of the dividend for the financial year 2003, trans-

lation differences and fair value losses on financial

instruments reduced equity by euro 855 million.

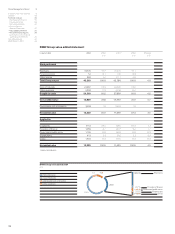

The equity ratio of the BMW Group fell overall by

0.3 percentage points to 26.0%. The equity ratio

for industrial operations was 44.9% compared to

45.4% at the end of the previous year. The equity

ratio for financial operations fell by 0.1 percentage

points to 9.7%.

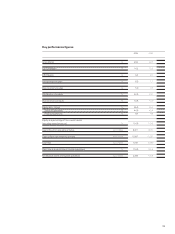

Provisions recognised in the balance sheet in-

creased by 8.2% to euro 9,472 million. The higher

level of additions to provisions related mainly to

other provisions and was attributable to the increase

in the volume of business as well as higher employee-

related and tax obligations. The provision for pension

obligations was up by 11.2% to euro 2,703 million.

Total obligations for pension and similar plans of the

BMW Group amount to euro 9,453 million (2003:

euro 8,390 million), of which euro 7,939 million

(2003: euro 7,294 million) are covered by provisions

and fund assets. In the case of defined benefit plans,

net obligations which exceed 10% of the defined

benefit obligations must be recognised in the income

statement over the expected average remaining