BMW 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

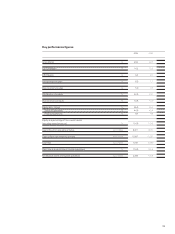

as result of the fact that certain legal proceedings

were completed during the year. The increase in in-

come from the reversal of write-downs was attribut-

able to the higher level of income from unwinding

the discounting effect on receivables. Other operating

expenses fell by 13.6% as a result of lower losses

on currency transactions and lower sundry operating

expenses. By contrast, there was an increase in the

expense for allocations to provisions, in particular for

new risks of litigation.

The net financial result (net expense) increased

by 29.1% compared to the previous year. This was

due to losses arising on the fair value market meas-

urement of derivative financial instruments and to

the fair value loss recognised on the exchangeable

bond option relating to the BMW Group investment

in Rolls-Royce plc, London. These, together, re-

duced other financial result by euro 143 million com-

pared to the previous year. The fair value loss on the

exchangeable bond option of euro 58 million was

re-

lated to the increase in the share price of Rolls-Royce

plc stock. The fair value gain on the BMW Group’s

investment in Rolls-Royce plc in 2004 was euro 154

million, which was recognised directly in equity

with-

in accumulated other equity and cannot be accounted

for by offsetting the fair value gain on the investment

against the fair value loss on the exchangeable bond

option. The deterioration of other financial result

was partly compensated by the net result on invest-

ments, which improved by euro 97 million to give a

positive net result of euro 94 million in 2004. Net

interest expense increased by euro 3 million, and

remained therefore approximately at the previous

year’s level. The net expense arising from the ex-

pense from reversing the discounting of pension

obligations and from the income from the expected

return on plan assets increased by 11.2% compared

to the previous year.

The Group profit from ordinary activities im-

proved by 10.9 %. It is stated after a one-off expense

of euro 49 million relating to the increase in pension

benefits. This expense has been allocated to the

relevant expense lines by function in the income

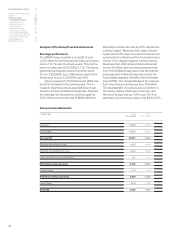

mainly as a result of currency factors. Revenues

generated in the markets of Africa, Asia and Oceania

fell overall by 0.4%, the decrease being largely at-

tributable to the reduction in sales volume in specific

Asian markets, in particular the Chinese market.

The increase in group cost of sales was 0.6 per-

centage points lower than that of revenues. The

gross profit rose by 8.9% and represented 23.2%

(2003: 22.7%) of revenues. The gross profit per-

centage for the industrial operations sub-group fell

by 0.2 percentage points and that of the financial

operations sub-group improved by 0.2 percentage

points. Further details of the entities consolidated

in each of the sub-groups are provided in Note [1].

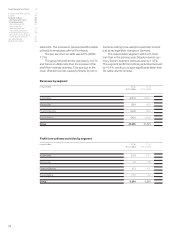

Sales and administrative costs increased by

4.7% as a result of the expansion of business vol-

umes; the rate of increase was, however, less than

that of revenues. Sales and administrative costs

represent 10.5% of revenues, 0.2 percentage points

lower than in the previous year.

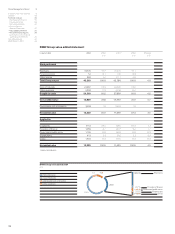

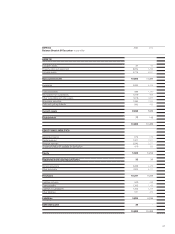

Research and development costs rose by 8.8%

compared to the previous year and represent 5.3%

(2003: 5.2%) of revenues. Research and develop-

ment costs include depreciation and disposals of

euro 637 million (2003: euro 583 million) on develop-

ment costs recognised as assets. Total research

and development costs (i.e. research costs, non-

capitalised development costs and investment in

capitalised development costs) amounted to euro

2,818 million (2003: euro 2,559 million). At this level,

the research and development ratio was 6.4%

(2003: 6.2%).

Depreciation and amortisation included in cost

of sales, sales and administrative costs and research

and development costs amounted to euro 2,672

million (2003: euro 2,370 million).

The positive net amount of other operating in-

come and expenses fell by 9.6% compared to the

previous year. Other operating income was down

by 11.8 % mainly as a result of the lower level of

exchange gains, gains on disposals of non-current

assets and sundry operating income. By contrast,

income from the release of provisions went up mainly