BMW 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

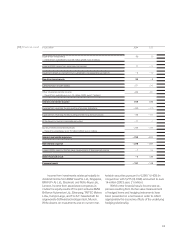

BMW Financial Services Korea Co., Ltd., Seoul,

BMW Leasing de Mexico S.A. de C.V., Mexico City,

axentiv AG, Darmstadt, arcensis GmbH, Stuttgart,

BMW España Finance S.L., Madrid, BMW Malta

Ltd., Valletta, and BMW Malta Finance Ltd., Valletta,

have all been consolidated for the first time.

Austin Rover International Services S.A.,

Lausanne, and Rover Service Center Corp., Tokyo,

are no longer included in the group reporting entity.

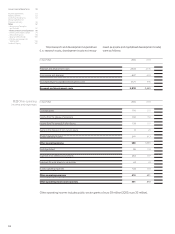

The equity of subsidiaries is consolidated in accor-

dance with IFRS 3 (Business Combinations), which

replaced IAS 22 with effect from 31 March 2004.

IFRS 3 requires that all business combinations are

accounted for using the purchase method, whereby

identifiable assets and liabilities acquired are meas-

ured initially at their fair value. The excess of the

Group’s interest in the net fair value of the identifiable

assets and liabilities acquired over cost is recognised

as goodwill and is subjected to a regular review for

possible impairment. Goodwill of euro 91million

which arose prior to 1 January 1995 remains netted

against reserves. In the event of impairment and

deconsolidation, goodwill that has been deducted

from equity is dealt with directly in equity in accor-

dance with the requirements of IFRS 3.80. Goodwill

arising between 1 January 1995 and the effective

date of IFRS 3 on 31 March 2004 and recognised

as an asset in the balance sheet was amortised up

The group reporting entity also changed by

comparison to the previous year as a result of the

first-time consolidation of seven special purpose

entities as well as the deconsolidation of two special

purpose entities and one trust.

The changes in the composition of the Group

do not have a material impact on the assets, lia-

bilities, financial position and earnings of the Group.

The financial statements of consolidated companies

which are drawn up in a foreign currency are trans-

lated using the functional currency concept (IAS 21:

The Effects of Changes in Foreign Exchange Rates)

and the foreign entity method. Since foreign sub-

sidiaries operate their businesses autonomously,

from a financial, economical and organisational point

of view, the functional currency of these companies

is identical to the local currency. Income and ex-

penses

of foreign subsidiaries are therefore translated

in the Group financial statements at the average ex-

change rate for the year, and assets and liabilities are

translated at the closing rate. Exchange differences

arising from the translation of shareholders’ equity

are offset directly against accumulated other equity.

Exchange differences arising from the use of different

to 31 December 2004; the amortisation expense in

2004 amounted to euro 5 million.

Receivables, liabilities, provisions, income and

expenses and profits between consolidated com-

panies (inter-group profits) are eliminated on con-

solidation.

Investments in other companies are accounted

for using the equity method, when significant influ-

ence can be exercised (IAS 28 Accounting for Invest-

ments in Associates). This is normally the case when

voting rights of between 20% and 50% are held

(associated companies). Under the equity method,

investments are measured at the group’s share of

equity taking account of fair value adjustments on

acquisition, based on the group’s shareholding. Any

difference between the cost of investment and the

group’s share of equity is accounted for in accordance

with the purchase method.

[4]Consolidation

principles

[3]Changes in the

reporting entity

[5]Foreign currency

translation