BMW 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Group Management Report 8

A review of the Financial Year 8

Outlook 29

Financial Analysis 30

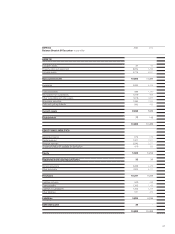

--Earnings performance 30

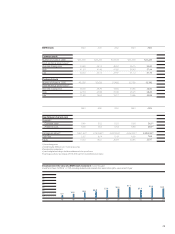

--Financial position 33

--Net assets position 34

--Events after the

Balance Sheet date 37

--Value added statement 37

--Key performance figures 39

--Comments on the financial

statements of BMW AG 40

Risk Management 44

BMW Stock in 2004 48

40

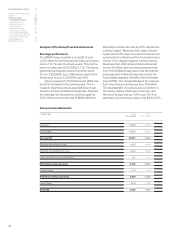

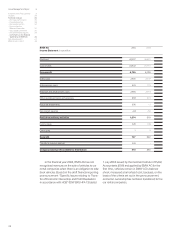

Comments on financial statements of BMW AG

Whereas the Group Financial statements are drawn

up in accordance with IFRSs issued by the IASB,

the financial statements of BMW AG are drawn up

in accordance with the provisions of the German

Commercial Code (HGB). Where it is permitted and

considered sensible, the principles and policies of

IFRSs are also applied in the individual company

financial statements. The pension provision in the

individual company financial statements, for exam-

ple, is also determined in accordance with IAS 19.

In numerous other cases, however, the accounting

principles and policies in the individual company

financial statements of BMW AG differ from those

applied in the Group financial statements. The main

differences relate to the recognition of intangible

assets, depreciation and amortisation methods, the

measurement of inventories and provisions as well

as the treatment of financial instruments.

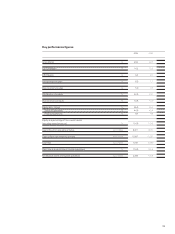

BMW AG develops, manufactures and sells

cars and motorcycles manufactured by itself and

foreign subsidiaries. These vehicles are sold through

the Company’s own branches, independent dealers,

subsidiaries and importers. The number of cars

manufactured at German and foreign plants in 2004

rose by 11.7% to 1,250,345 units. At 31 December

2004, BMW AG had 77,252 employees, an increase

of 1,283 compared to one year earlier. Wage-earners

account for approximately 59% of the workforce.

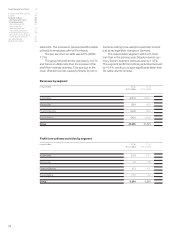

In 2004, revenues were 10.1% higher than in

the previous year. Sales to foreign group sales com-

panies accounted for euro 28.5 billion or approxi-

mately 70% of the total revenues of euro 40.6 billion.

Cost of sales increased by 9.7% and therefore by

slightly less than the increase in revenues. The gross

profit of euro 5.8 billion was 12.2% above the pre-

vious year’s figure.

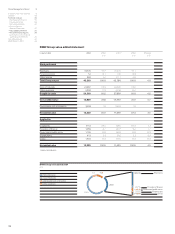

In the financial year 2004, capital expenditure on

intangible assets and property, plant and equipment

was euro 2,321 million (2003: euro 2,293 million).

This represents an increase of 1.2%. Capital

expen-

diture related primarily to investments in new products

as well as the expansion of the production network,

such as the new Leipzig plant. Depreciation and

amortisation amounted to euro 1,535 million.

The equity ratio rose from 27.0% to 28.3%.

Long-term external capital (pension provision, regis-

tered profit-sharing certificates, the liability to BMW

Unterstützungsvereins e.V. and liabilities due after

one year) increased by 35.8% to euro 3.8 billion.

This was due, amongst other factors, to the change

in the discount factor used to compute the pension

provision (reduced from 5.5% to 4.75%) and to an

increase in pension benefits granted to BMW AG

employees.