BMW 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

Group Financial Statements 50

Income Statements 51

Balance Sheets 52

Cash Flow Statements 54

Group Statement of

Changes in Equity 56

Notes 57

--Accounting Principles

and Policies 57

--Notes to the Income Statement 66

--Notes to the balance sheet 74

--Other Disclosures 93

--Segment Information 100

--Disclosures pursuant to

§292a HGB

104

Auditors’ Report 107

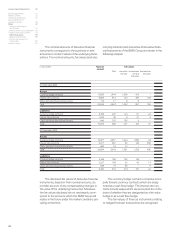

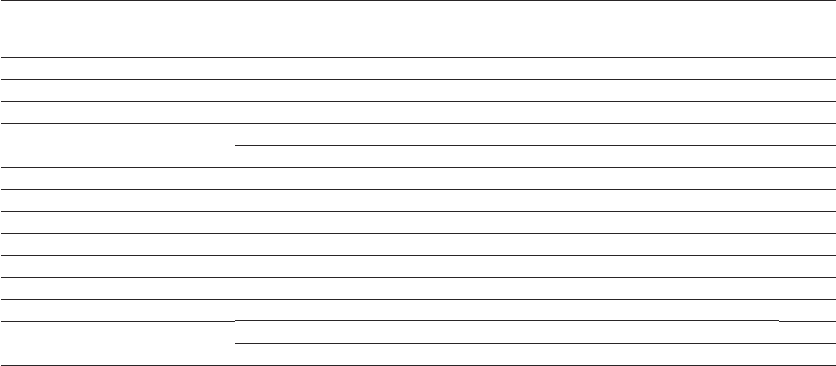

The defined benefit plans of the BMW Group

gave rise to an expense from pension obliga-

tions in the financial year 2004 of euro 433 million

The expense from reversing the discounting of

pension obligations and the income from the ex-

pected return on plan assets are reported as part of

the financial result. All other components of pension

expense are included in the relevant costs by func-

tion in the income statement.

The actual return from external pension funds

was euro 536 million (2003: euro 407 million).The

variance of the actual return to the expected return,

as in the previous year, was mainly due to the fact

that pension fund assets generated a higher return

than planned. This was principally as a result of

the recovery of the international capital markets,

particularly in the United Kingdom.The difference

between actual and expected return from external

(2003: euro 339 million), comprising the following

components:

pension funds leads to actuarial gains or losses.

Actuarial gains or losses, to the extent that they lie

outside a corridor of 10% of the present value of the

defined benefit obligations, are recognised as income

or expense over the expected remaining working

lives of the employees participating in the plans.

The level of the pension obligations differs de-

pending on the pension system applicable in each

country. Since the state pension system in the United

Kingdom only provides a basic fixed amount benefit,

retirement benefits are largely organised in the form

of company pensions and arrangements financed

by the individual. The pension benefits in the United

Kingdom therefore contain contributions made by

the employee.

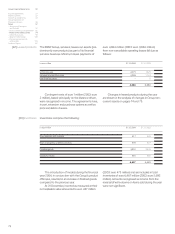

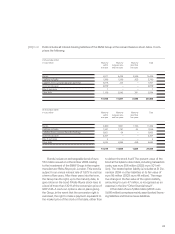

in euro million Germany UK Other countries Total

2004 2003 2004 2003 2004 2003 2004 2003

Current service cost 91 81 54 48 31 39 176 168

Expense from reversing the

discounting of pension obligations 132 122 303 273 15 15 450 410

Past service cost 49 ––––149 1

Expected return on plan assets (–) – –– 261 – 239 –10 –10 – 271 – 249

Actuarial gains (–) and losses (+) – –27 62329 9

Expense from pension

obligations 272 203 123 88 38 48 433 339