BMW 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Group Management Report 8

A review of the Financial Year 8

Outlook 29

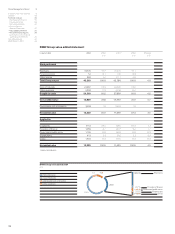

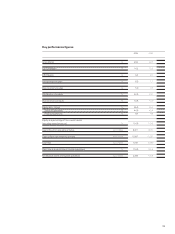

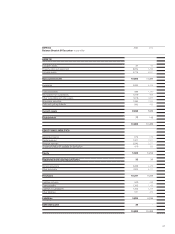

Financial Analysis 30

--Earnings performance 30

--Financial position 33

--Net assets position 34

--Events after the

Balance Sheet date 37

--Value added statement 37

--Key performance figures 39

--Comments on the financial

statements of BMW AG 40

Risk Management 44

BMW Stock in 2004 48

46

strikes or poor quality can lead to production stop-

pages and thus have a negative impact on profitability

.

The Group mitigates this risk by means of

extensive selection, monitoring and management

procedures in its dealings with suppliers. Before

selection, for example, the technical competence

and financial strength of potential suppliers are

appraised. A comprehensive Supplier Relationship

Management system also contributes to risk miti-

gation.

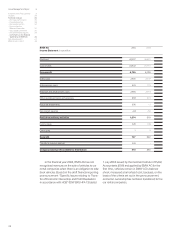

Risks relating to the provision of financial

services

– As a consequence of the growth of lease business,

the BMW Group faces an increased residual value

risk on the vehicles which are returned to the Group

at the end of lease contracts. Changes in the residual

values of vehicles of the BMW Group on the used

car markets are therefore constantly monitored and

forecast. The overall risk position is measured each

quarter by comparing forecasted market values and

contractual values per model and market. Provisions

or writedowns are recognised to cover all identified

risks. This risk is also reduced by measures such

as active life-cycle management and management

of used car markets at an international level, both of

which have a stabilising effect on residual values.

– Against the background of Basel II requirements,

the BMW Group is committed to the use of scoring

systems and rating methods to avoid bad debts,

as far as possible. The appropriate processes and

IT infrastructure are continually being developed.

Management tools, including ones based on a

value-at-risk approach, are used to minimise and

control potential losses.

– Operating risks relating to the provision of financial

services are managed by the BMW Group by means

of a process which records and measures risks and

incorporates specific measures to avoid risk. In this

way, the BMW Group minimises the risk of losses

which could arise as a result of the inappropriate-

ness or failure of internal procedures and systems,

human error or external factors.

– Liquidity and interest rate change risks to which

the BMW Groupis exposed are mitigated by matching

maturities and by the use of derivative financial in-

struments. Credit line facilities with various banks

ensure liquidity at all times. Interest rate change risks

are managed using a value-at-risk approach. In addi-

tion, sensitivity analyses are prepared on an on-going

basis to measure the potential impact of interest rate

changes on earnings.

– In order to avoid currency risks, financing and lease

business is refinanced, as a general rule, in the cur-

rency of the relevant market.

– A major part of financing and lease business

within the Financial Services segment is refinanced

on the capital markets. As a result of its good credit-

standing, reflected in the long-standing first-class

short-term ratings issued by Moody’s (P-1) and

Standard& Poor’s (A-1), the BMW Group is able to

obtain competitive conditions.

– A system of local, regional and centralised credit-

decision committees is in place across the BMW

Group, thus contributing to a reduction in the credit

risk inherent to financial services business. Major

loans/credits to dealers and fleet customers are

presented for decision to regional credit committees

or to the central credit committee, depending on

the amount involved. In another measure to reduce

risk, the BMW Group is also working towards stan-

dardised processes throughout Europe to make

credit-decisions and to measure standard risk costs.

These processes have been implemented in 2004

in all European markets where the BMW Group pro-

vides financial services.

The BMW Group uses scorecards to monitor

risk in the area of retail customer financing. Criteria

such as arrears and bad debt ratios are analysed

monthly to provide information about the quality of

the portfolio.