Advance Auto Parts 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-24

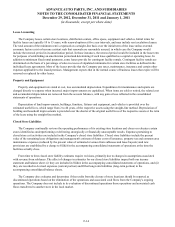

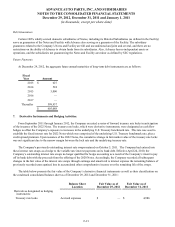

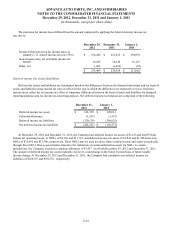

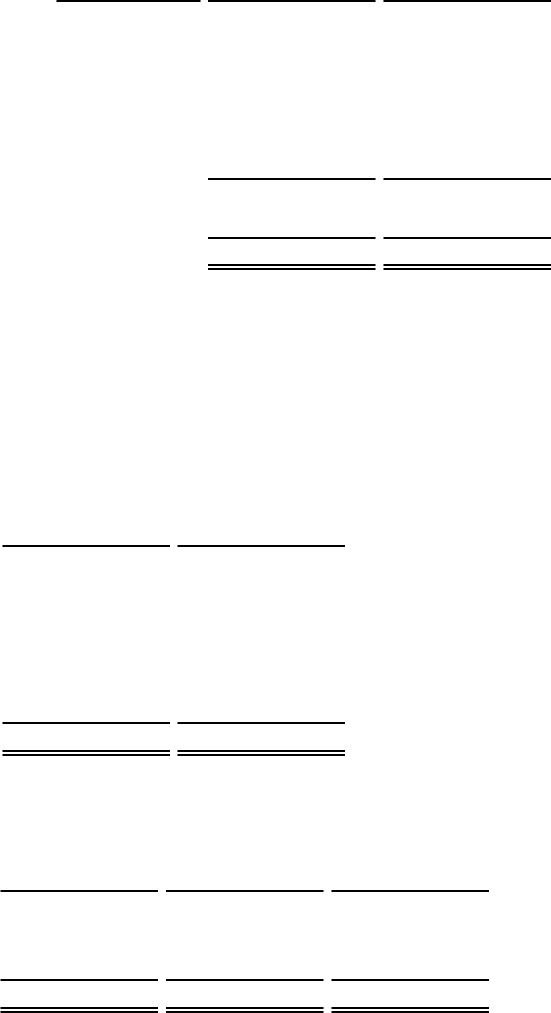

9. Property and Equipment:

Property and equipment consists of the following:

Original

Useful Lives

December 29,

2012

December 31,

2011

Land and land improvements 0 - 10 years $ 403,401 $ 359,916

Buildings 30 - 40 years 432,274 392,564

Building and leasehold improvements 3 - 30 years 309,194 290,354

Furniture, fixtures and equipment 3 - 20 years 1,152,778 1,012,116

Vehicles 2 - 5 years 19,490 22,657

Construction in progress 76,769 129,114

2,393,906 2,206,721

Less - Accumulated depreciation (1,102,147)(983,622)

Property and equipment, net $ 1,291,759 $ 1,223,099

Depreciation expense was $185,909, $174,219 and $163,378 for Fiscal 2012, 2011 and 2010, respectively. The Company

capitalized approximately $10,026, $6,258 and $4,875 incurred for the development of internal use computer software during

Fiscal 2012, 2011 and 2010, respectively. These costs are included in the furniture, fixtures and equipment category above and

are depreciated on the straight-line method over three to five years.

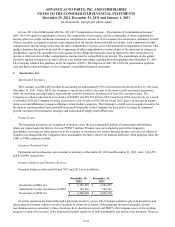

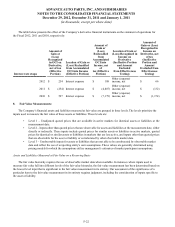

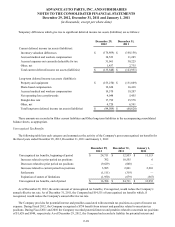

10. Accrued Expenses:

Accrued expenses consist of the following:

December 29,

2012

December 31,

2011

Payroll and related benefits $ 79,756 $ 89,676

Warranty reserves 38,425 38,847

Capital expenditures 26,142 35,648

Self-insurance reserves 45,324 49,812

Taxes payable 73,158 52,480

Other 116,834 119,283

Total accrued expenses $ 379,639 $ 385,746

The following table presents changes in the Company's warranty reserves:

December 29,

2012

December 31,

2011

January 1,

2011

Warranty reserves, beginning of period $ 38,847 $ 36,352 $ 30,387

Additions to warranty reserves 40,766 43,013 45,741

Reserves utilized (41,188)(40,518)(39,776)

Warranty reserves, end of period $ 38,425 $ 38,847 $ 36,352

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 29, 2012, December 31, 2011 and January 1, 2011

(in thousands, except per share data)