Advance Auto Parts 2012 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2012 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

We believe our current initiatives are key for our long-term sales growth and improvement in our gross profit rate.

Combined with our focus on balancing support and discretionary expenses with the additional cost of investments in our key

strategies, we are committed to achieving our longer-term growth and profitability goals. As we enter Fiscal 2013, the key

initiatives under our strategies include:

• Growing our Commercial business through improved delivery speed and reliability, increased customer retention and

increased volume with national and regional accounts;

• Improving localized parts availability through the continued increase in number of HUBs, strengthened focus on key

store availability and leveraging the advancement of our supply chain infrastructure;

• Accelerating our new store growth rate; and

• Continuing our focus on store execution through more effective scheduling, product on-hand accuracy, sales training

and customer engagement.

Acquisition

On December 31, 2012, we acquired B.W.P. Distributors, Inc. ("BWP"), a privately held company that supplies, markets

and distributes automotive aftermarket parts and products principally to Commercial customers. BWP operates or supplies 216

locations in the Northeastern United States. We believe this acquisition will enable us to continue our expansion in the

competitive Northeast, which is a strategic growth area for us due to the large population and overall size of the market, and to

gain valuable information to apply to our existing operations as a result of BWP's expertise in Commercial. As a result of this

transaction, we will operate 124 BWP company-owned stores and two distribution centers. We will begin integrating the BWP

locations in Fiscal 2013.

Automotive Aftermarket Industry

Operating within the automotive aftermarket industry, we are influenced by a number of general macroeconomic factors

similar to those affecting the overall retail industry. These factors include, but are not limited to, fuel costs, unemployment

rates, consumer confidence and competition. The ongoing uncertainty in the macroeconomic environment continues to impact

us and the retail industry in general. While we believe that the current macroeconomic environment continues to constrain

consumer spending, we remain confident that the long-term dynamics of the automotive aftermarket industry are positive.

Furthermore, we continue to believe we are well positioned to serve our customers by meeting their needs in a challenging

macroeconomic environment.

We believe that two key drivers of demand within the automotive aftermarket are (i) the number of miles driven in the U.S. and

(ii) the number and average age of vehicles on the road.

Miles Driven

We believe that the number of total miles driven in the U.S. heavily influences the demand for the repair and maintenance

of vehicles. As the number of miles driven increases, consumers' vehicles are more likely to need repair and maintenance,

resulting in an increase in the need for automotive parts and maintenance items. Historically, the long-term trend in miles

driven in the U.S. has steadily increased; however, according to the Department of Transportation, total miles driven in the U.S.

remained relatively flat from 2007 to 2011 as the U.S. experienced difficult macroeconomic conditions. Historically, rapid

increases in fuel prices have also negatively impacted total miles driven as consumers react to the increased expense by

reducing travel. Average gasoline prices increased approximately 25% during this same time frame. While gas prices remain

somewhat volatile and are not predicted to return to pre-recessionary levels, gas prices were relatively flat when comparing the

average price of gas in 2012 to 2011 and the number of miles driven in 2012 increased approximately 0.6% as measured

through October. We believe that as the U.S. economy continues to recover, and gasoline prices stabilize further, annual miles

driven will return to historical growth rates and continue to drive demand in the automotive aftermarket industry.

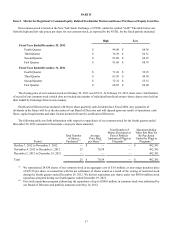

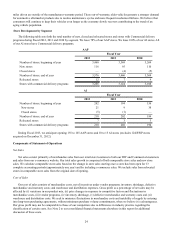

Number of Registered Vehicles and Increase in Average Vehicle Age

We believe that the total number of vehicles (excluding medium and heavy duty trucks) on the road and the average age of

vehicles on the road also heavily influence the demand for products sold within the automotive aftermarket industry. There

were 241 million vehicles on the road in 2011 which is 15% higher than in 2001. While recent industry data reported by the

Automotive Aftermarket Industry Association (“AAIA”) indicates that the growth in number of vehicles on the road has

decelerated and new vehicle registrations are increasing, the average age of vehicle continues to increase. The average age of

vehicles has gradually increased over the last five years from 10.3 years in 2008 to 11.3 years in 2012. We believe that the

average age of vehicles continues to increase due to relatively constant scrappage rates, a rate of new car sales well under the

10-year trend and an increase in overall quality of vehicles. As the average age of a vehicle increases, a larger percentage of the