Advance Auto Parts 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-14

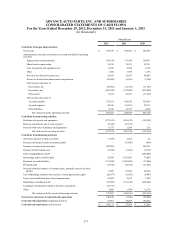

Lease Accounting

The Company leases certain store locations, distribution centers, office space, equipment and vehicles. Initial terms for

facility leases are typically 10 to 15 years, with renewal options at five year intervals, and may include rent escalation clauses.

The total amount of the minimum rent is expensed on a straight-line basis over the initial term of the lease unless external

economic factors exist or become existent such that renewals are reasonably assured, in which case the Company would

include the renewal period in its amortization period. In those instances, the renewal period would be included in the lease term

for purposes of establishing an amortization period and determining if such lease qualified as a capital or operating lease. In

addition to minimum fixed rental payments, some leases provide for contingent facility rentals. Contingent facility rentals are

determined on the basis of a percentage of sales in excess of stipulated minimums for certain store facilities as defined in the

individual lease agreements. Most of the leases provide that the Company pay taxes, maintenance, insurance and certain other

expenses applicable to the leased premises. Management expects that in the normal course of business leases that expire will be

renewed or replaced by other leases.

Property and Equipment

Property and equipment are stated at cost, less accumulated depreciation. Expenditures for maintenance and repairs are

charged directly to expense when incurred; major improvements are capitalized. When items are sold or retired, the related cost

and accumulated depreciation are removed from the account balances, with any gain or loss reflected in the consolidated

statements of operations.

Depreciation of land improvements, buildings, furniture, fixtures and equipment, and vehicles is provided over the

estimated useful lives, which range from 2 to 40 years, of the respective assets using the straight-line method. Depreciation of

building and leasehold improvements is provided over the shorter of the original useful lives of the respective assets or the term

of the lease using the straight-line method.

Closed Store Liabilities

The Company continually reviews the operating performance of its existing store locations and closes or relocates certain

stores identified as underperforming or delivering strategically or financially unacceptable results. Expenses pertaining to

closed store exit activities are included in the Company's closed store liabilities. Closed store liabilities include the present

value of the remaining lease obligations and management's estimate of future costs of insurance, property tax and common area

maintenance expenses (reduced by the present value of estimated revenues from subleases and lease buyouts) and new

provisions are established by a charge to SG&A in the accompanying consolidated statements of operations at the time the

facilities actually close.

From time to time closed store liability estimates require revisions, primarily due to changes in assumptions associated

with revenue from subleases. The effect of changes in estimates for our closed store liabilities impact both our income

statement and balance sheet: (i) they are included in SG&A in the accompanying consolidated statements of operations, and (ii)

they are recorded in Accrued expenses (current portion) and Other long-term liabilities (long-term portion) in the

accompanying consolidated balance sheets.

The Company also evaluates and determines if the results from the closure of store locations should be reported as

discontinued operations based on the elimination of the operations and associated cash flows from the Company's ongoing

operations. The Company does not include in its evaluation of discontinued operations those operations and associated cash

flows transferred to another store in the local market.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 29, 2012, December 31, 2011 and January 1, 2011

(in thousands, except per share data)