Advance Auto Parts 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

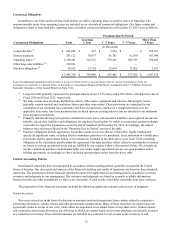

Partially offsetting the decrease in operating cash flow was:

• a $56.8 million increase in cash flows provided by an increase in accrued expenses related to timing of the payment of

certain expenses.

For Fiscal 2011, net cash provided by operating activities increased $162.7 million to $828.8 million. This net increase in

operating cash flow was primarily due to:

• a $87.6 million increase in cash flows from inventory, net of accounts payable, as a result of the continued increase in

our accounts payable ratio in Fiscal 2011 combined with the deceleration of inventory growth during the second half

of Fiscal 2011;

• an increase in net income of $48.6 million; and

• a $12.5 million increase in provision for deferred income taxes.

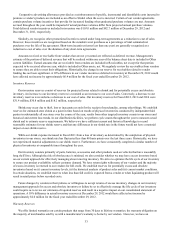

Investing Activities

For Fiscal 2012, net cash used in investing activities decreased by $17.0 million to $273.0 million. The decrease in cash

used was primarily driven by the decrease in cash used for business acquisitions.

For Fiscal 2011, net cash used in investing activities increased by $90.6 million to $290.0 million. The increase in cash

used was primarily driven by investments in our existing stores, supply chain and information technology as well as the

acquisition of two small technology companies in support of our e-commerce strategy. The majority of the increase in our

supply chain investments is related to the completion of our Remington distribution center.

Financing Activities

For Fiscal 2012, net cash provided by financing activities increased by $668.1 million to $127.9 million. This increase was

primarily a result of:

• a $604.0 million decrease in cash used for the repurchase of common stock under our stock repurchase program; and

• $299.9 million provided by the issuance of senior unsecured notes.

Partially offsetting these increases was a $230.0 million decrease in net borrowings on credit facilities.

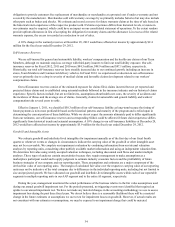

For Fiscal 2011, net cash used in financing activities increased by $32.6 million to $540.2 million. Cash used in financing

activities increased as a result of:

• a $31.2 million decrease in financed vendor accounts payable; and

• a $21.6 million decrease in proceeds from the issuance of common stock related to the exercise of share-based

compensation awards.

Partially offsetting these decreases was an increase of $16.2 million in net borrowings.

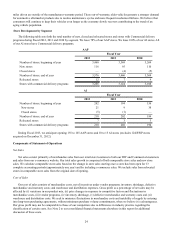

Long-Term Debt

Bank Debt

We have a $750.0 million unsecured five-year revolving credit facility with our wholly-owned subsidiary, Advance Stores

Company, Incorporated, or Stores, serving as the borrower. The revolving credit facility also provides for the issuance of

letters of credit with a sub-limit of $300.0 million, and swingline loans in an amount not to exceed $50.0 million. We may

request, subject to agreement by one or more lenders, that the total revolving commitment be increased by an amount not

exceeding $250.0 million (up to a total commitment of $1 billion) during the term of the revolving credit facility. Voluntary

prepayments and voluntary reductions of the revolving balance are permitted in whole or in part, at our option, in minimum

principal amounts as specified in the revolving credit facility. The revolving credit facility matures on May 27, 2016.