Advance Auto Parts 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-21

Debt Guarantees

Certain 100% wholly-owned domestic subsidiaries of Stores, including its Material Subsidiaries (as defined in the Facility)

serve as guarantors of the Notes and Facility with Advance also serving as a guarantor of the Facility. The subsidiary

guarantees related to the Company’s Notes and Facility are full and unconditional and joint and several, and there are no

restrictions on the ability of Advance to obtain funds from its subsidiaries. Also, Advance has no independent assets or

operations, and the subsidiaries not guaranteeing the Notes and Facility are minor as defined by SEC regulations.

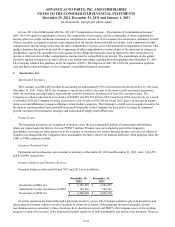

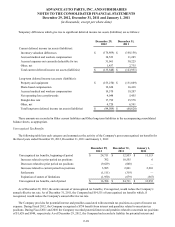

Future Payments

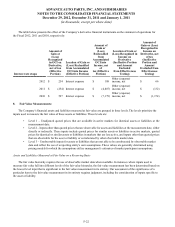

At December 29, 2012, the aggregate future annual maturities of long-term debt instruments are as follows:

Fiscal

Year Amount

2013 $ 627

2014 524

2015 5,000

2016 —

2017 —

Thereafter 598,937

$ 605,088

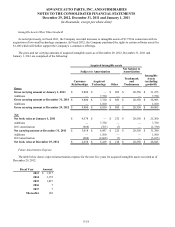

7. Derivative Instruments and Hedging Activities:

From September 2011 through January 2012, the Company executed a series of forward treasury rate locks in anticipation

of the issuance of the 2022 Notes. The treasury rate locks, which were derivative instruments, were designated as cash flow

hedges to offset the Company's exposure to increases in the underlying U.S. Treasury benchmark rate. This rate was used to

establish the fixed interest rate for 2022 Notes which was comprised of the underlying U.S. Treasury benchmark rate, plus a

credit spread premium. Upon issuance of the 2022 Notes, the cumulative change in fair market value of the treasury rate locks

was not significant due to the narrow margin between the lock rate and the underlying treasury rate.

The Company's previously outstanding interest rate swaps matured on October 5, 2011. The Company had entered into

these interest rate swaps as a hedge to the variable rate interest payments on its bank debt. Effective April 24, 2010, the

Company’s outstanding interest rate swaps no longer qualified for hedge accounting as a result of the Company’s intent to pay

off its bank debt with the proceeds from the offering of the 2020 Notes. Accordingly, the Company recorded all subsequent

changes in the fair value of the interest rate swaps through earnings and amortized to interest expense the remaining balance of

previously recorded unrecognized loss in accumulated other comprehensive income over the remaining life of the swaps.

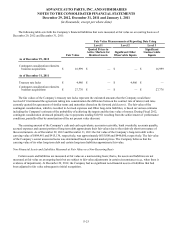

The table below presents the fair value of the Company’s derivative financial instruments as well as their classification on

the condensed consolidated balance sheet as of December 29, 2012 and December 31, 2011:

Balance Sheet

Location

Fair Value as of

December 29, 2012

Fair Value as of

December 31, 2011

Derivatives designated as hedging

instruments:

Treasury rate locks Accrued expenses $ — $ 4,986

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 29, 2012, December 31, 2011 and January 1, 2011

(in thousands, except per share data)