Advance Auto Parts 2012 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2012 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10

Successful implementation of our business strategy also depends on factors specific to the retail automotive parts industry

and numerous other factors that may be beyond our control. In addition to the aforementioned risk factors, adverse changes in

the following factors could undermine our business strategy and have a material adverse affect on our business, financial

condition, results of operations and cash flow:

• the competitive environment in the automotive aftermarket parts and accessories retail sector that may force us to

reduce prices below our desired pricing level or increase promotional spending;

• our ability to anticipate changes in consumer preferences and to meet customers' needs for automotive products

(particularly parts availability) in a timely manner;

• our ability to maintain and eventually grow DIY market share; and

• our ability to continue our Commercial sales growth.

For that portion of our inventory manufactured and/or sourced outside the United States, geopolitical changes, changes in

trade regulations, currency fluctuations, shipping related issues, natural disasters, pandemics and other factors beyond our

control may increase the cost of items we purchase or create shortages which could have a material adverse effect on our sales

and profitability.

We will not be able to expand our business if our growth strategy is not successful, including the availability of suitable

locations for new store openings, the successful integration of any acquired businesses or the continued increase in

supply chain capacity and efficiency, which could adversely affect our business, financial condition, results of operations

and cash flows.

New Store Openings

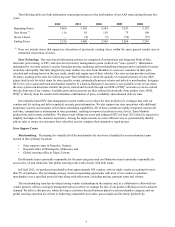

We have increased our store count significantly in the last ten years from 2,435 stores at the end of Fiscal 2002 to 3,794

stores at December 29, 2012. We intend to continue to increase the number of our stores and expand the markets we serve as

part of our growth strategy, primarily by opening new stores. We may also grow our business through strategic acquisitions. We

do not know whether the implementation of our growth strategy will be successful. As we open more stores it becomes more

critical that we have consistent execution across our entire store chain. The actual number of new stores to be opened and their

success will depend on a number of factors, including, among other things:

• the availability of desirable store locations;

• the negotiation of acceptable lease or purchase terms for new locations;

• the availability of financial resources, including access to capital at cost-effective interest rates; and

• our ability to manage the expansion and hire, train and retain qualified sales associates.

We are unsure whether we will be able to open and operate new stores on a timely or sufficiently profitable basis, or that

opening new stores in markets we already serve will not harm existing store profitability or comparable store sales. The newly

opened and existing stores' profitability will depend on the competition we face as well as our ability to properly merchandise,

market and price the products desired by customers in these markets.

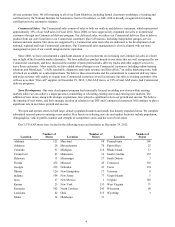

Acquisition Integration

On December 31, 2012, we acquired B.W.P. Distributors, Inc. Strategic acquisitions have been and may continue to be an

element of our growth strategy in the future. Acquisitions involve certain risks that could cause our actual growth and

profitability to differ from our expectations; examples of such risks include the following:

• we may not be able to continue to identify suitable acquisition targets or to acquire additional companies at favorable

prices or on other favorable terms;

• our management's attention may be distracted;

• we may fail to retain key personnel from acquired businesses;

• we may assume unanticipated legal liabilities and other problems;

• we may not be able to successfully integrate the operations of businesses we acquire to realize economic, operational

and other benefits; and

• we may fail or be unable to discover liabilities of businesses that we acquire for which we, as a successor owner or

operator, may be liable.