Advance Auto Parts 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-11

The Company recognizes tax benefits and/or tax liabilities for uncertain income tax positions based on a two-step process.

The first step is to evaluate the tax position for recognition by determining if the weight of available evidence indicates that it is

more likely than not that the position will be sustained on audit, including resolution of related appeals or litigation processes,

if any. The second step requires the Company to estimate and measure the tax benefit as the largest amount that is more than

50% likely to be realized upon ultimate settlement. It is inherently difficult and subjective to estimate such amounts, as the

Company must determine the probability of various possible outcomes.

The Company reevaluates these uncertain tax positions on a quarterly basis or when new information becomes available to

management. The reevaluations are based on many factors, including but not limited to, changes in facts or circumstances,

changes in tax law, successfully settled issues under audit, expirations due to statutes of limitations, and new federal or state

audit activity. Any change in either the Company's recognition or measurement could result in the recognition of a tax benefit

or an increase to the tax accrual.

The Company also follows guidance provided on derecognition of benefits, classification, interest and penalties,

accounting in interim periods, disclosure and transition. Refer to Note 14 for a further discussion of income taxes.

Advertising Costs

The Company expenses advertising costs as incurred. Advertising expense, net of vendor promotional funds, was $83,871,

$84,656 and $78,809 in Fiscal 2012, 2011 and 2010, respectively. Vendor promotional funds, which reduced advertising

expense, amounted to $11,445 and $4,609 in Fiscal 2012 and 2011. Prior to Fiscal 2011, the Company received no vendor

promotional funds to reduce advertising expense.

Self-Insurance

The Company is self-insured for general and automobile liability, workers' compensation and health care claims of its

employees, or Team Members, while maintaining stop-loss coverage with third-party insurers to limit its total liability

exposure. Expenses associated with these liabilities are calculated for (i) claims filed, (ii) claims incurred but not yet reported

and (iii) projected future claims using actuarial methods followed in the insurance industry as well as the Company's historical

claims experience. The Company includes the current and long-term portions of its self-insurance reserve in Accrued expenses

and Other long-term liabilities, respectively.

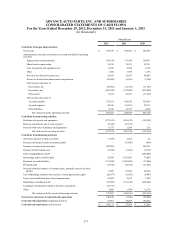

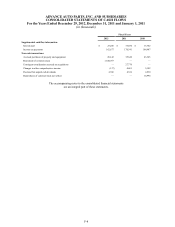

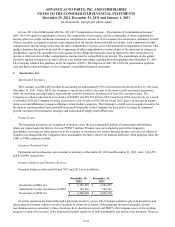

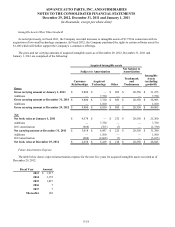

The following table presents changes in the Company's total self-insurance reserves:

December 29,

2012

December 31,

2011

January 1,

2011

Self-insurance reserves, beginning of period $ 98,944 $ 97,070 $ 93,706

Additions to self-insurance reserves 105,670 105,379 113,859

Reserves utilized (110,066)(103,505)(110,495)

Self-insurance reserves, end of period $ 94,548 $ 98,944 $ 97,070

Warranty Liabilities

The warranty obligation on the majority of merchandise sold by the Company with a manufacturer's warranty is the

responsibility of the Company's vendors. However, the Company has an obligation to provide customers free replacement of

certain merchandise or merchandise at a prorated cost if under a warranty and not covered by the manufacturer. Merchandise

sold with warranty coverage by the Company primarily includes batteries but may also include other parts such as brakes and

shocks. The Company estimates its warranty obligation at the time of sale based on the historical return experience, sales level

and cost of the respective product sold. To the extent vendors provide upfront allowances in lieu of accepting the obligation for

warranty claims and the allowance is in excess of the related warranty expense, the excess is recorded as a reduction to cost of

sales.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 29, 2012, December 31, 2011 and January 1, 2011

(in thousands, except per share data)