Advance Auto Parts 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-10

During Fiscal 2012, the Company in-sourced its commercial credit function. This initiative consisted of the transition from

using a third party financial institution to settle credit transactions with its Commercial customers to processing those

transactions internally, thus increasing the trade receivable balance during the current year. The Company's concentration of

credit risk with respect to trade receivables is limited because the Company's customer base consists of a large number of

customers with relatively small balances, which allows the credit risk to be spread across a broad base. The Company also

mitigates its exposure to credit risk through a credit approval process including, credit checks, pre-determined credit limits and

accounts receivable and credit monitoring procedures.

Inventory

Inventory amounts are stated at the lower of cost or market. The cost of the Company's merchandise inventory is

determined using the last-in, first-out ("LIFO") method. Under the LIFO method, the Company's cost of sales reflects the costs

of the most recently purchased inventories, while the inventory carrying balance represents the costs relating to prices paid in

prior years.

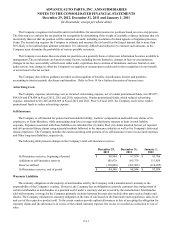

Vendor Incentives

The Company receives incentives in the form of reductions to amounts owed and/or payments from vendors related to

cooperative advertising allowances, volume rebates and other promotional considerations. Many of these incentives are under

long-term agreements (terms in excess of one year), while others are negotiated on an annual basis or less (short-term). Volume

rebates and cooperative advertising allowances not offsetting in selling, general and administrative expenses, or SG&A, are

earned based on inventory purchases and initially recorded as a reduction to inventory. These deferred amounts are included as

a reduction to cost of sales as the inventory is sold. Cooperative advertising allowances provided as a reimbursement of

specific, incremental and identifiable costs incurred to promote a vendor's products are included as an offset to SG&A when the

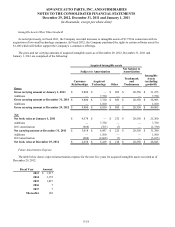

cost is incurred. Total deferred vendor incentives included as a reduction of Inventory was $102,975 and $82,660 at

December 29, 2012 and December 31, 2011, respectively.

Similarly, the Company recognizes other promotional incentives earned under long-term agreements as a reduction to cost

of sales. However, these incentives are recognized based on the cumulative net purchases as a percentage of total estimated net

purchases over the life of the agreement. Short-term incentives (terms less than one year) are generally recognized as a

reduction to cost of sales over the duration of any short-term agreements.

Amounts received or receivable from vendors that are not yet earned are reflected as deferred revenue in the accompanying

consolidated balance sheets. Management's estimate of the portion of deferred revenue that will be realized within one year of

the balance sheet date has been included in Other current liabilities in the accompanying consolidated balance sheets. Earned

amounts that are receivable from vendors are included in Receivables, net except for that portion expected to be received after

one year, which is included in Other assets, net on the accompanying consolidated balance sheets.

Preopening Expenses

Preopening expenses, which consist primarily of payroll and occupancy costs related to the opening of new stores, are

expensed as incurred.

Income Taxes

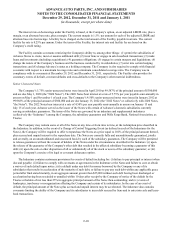

The Company accounts for income taxes under the asset and liability method which requires the recognition of deferred

tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements.

Under the asset and liability method, deferred tax assets and liabilities are determined based on the differences between the

financial statements and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences

are expected to reverse. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income in the

period of the enactment date.

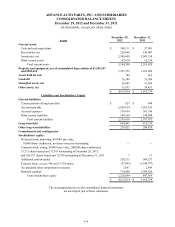

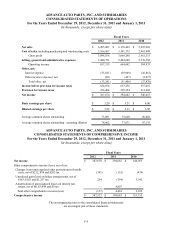

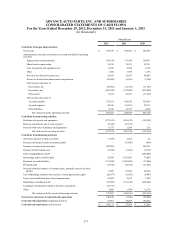

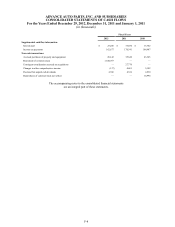

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 29, 2012, December 31, 2011 and January 1, 2011

(in thousands, except per share data)