Advance Auto Parts 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-19

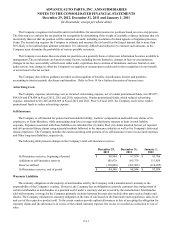

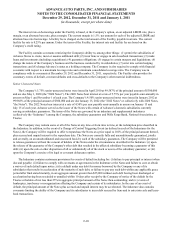

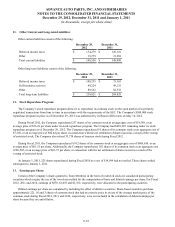

5. Receivables, net:

Receivables consist of the following:

December 29,

2012

December 31,

2011

Trade $ 110,153 $ 19,079

Vendor 119,770 118,309

Other 5,862 6,675

Total receivables 235,785 144,063

Less: Allowance for doubtful accounts (5,919)(4,056)

Receivables, net $ 229,866 $ 140,007

The increase in trade receivables is primarily due to the in-sourcing of the Company's commercial credit function in

Fiscal 2012.

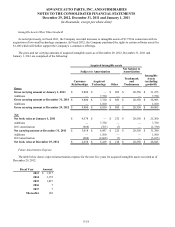

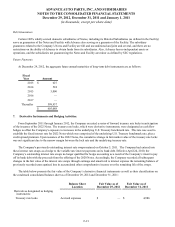

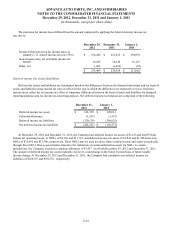

6. Long-term Debt:

Long-term debt consists of the following:

December 29,

2012

December 31,

2011

Revolving facility at variable interest rates (1.74% and 1.78% at

December 29, 2012 and December 31, 2011, respectively) due May 27,

2016 $ — $ 115,000

5.75% Senior Unsecured Notes (net of unamortized discount of $975 and

$1,078 at December 29, 2012 and December 31, 2011, respectively) due

May 1, 2020 299,025 298,922

4.50% Senior Unsecured Notes (net of unamortized discount of $88 at

December 29, 2012) due January 15, 2022 299,912 —

Other 6,151 2,062

605,088 415,984

Less: Current portion of long-term debt (627)(848)

Long-term debt, excluding current portion $ 604,461 $ 415,136

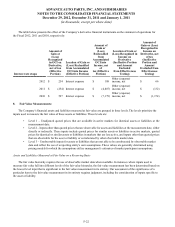

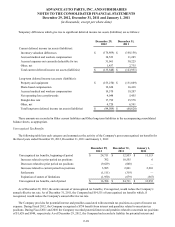

Bank Debt

On May 27, 2011, the Company entered into a $750,000 unsecured five-year revolving credit facility (the "Facility") with

Stores serving as the borrower. Proceeds from the Facility were used to repay $165,000 of principal outstanding on the

Company’s previous revolving credit facility. In conjunction with this refinancing, the Company incurred $3,656 of financing

costs which it will amortize over the term of the Facility. The Facility also provides for the issuance of letters of credit with a

sub-limit of $300,000, and swingline loans in an amount not to exceed $50,000. The Company may request, subject to

agreement by one or more lenders, that the total revolving commitment be increased by an amount not exceeding $250,000 (up

to a total commitment of $1,000,000) during the term of the credit agreement. Voluntary prepayments and voluntary reductions

of the revolving balance are permitted in whole or in part, at the Company’s option, in minimum principal amounts as specified

in the revolving credit facility. The Facility matures on May 27, 2016.

As of December 29, 2012, the Company had no borrowings outstanding under the Facility, and had letters of credit

outstanding of $78,774, which reduced the availability under the Facility to $671,226. The letters of credit generally have a

term of one year or less and primarily serve as collateral for the Company's self-insurance policies.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 29, 2012, December 31, 2011 and January 1, 2011

(in thousands, except per share data)